tokenomics

Industries We Serve With

Tokenomics Consultation

Tokenized Securities

Financial products like stocks, bonds, and derivatives are being tokenized to provide more liquidity and fractional ownership. This allows investors to trade these assets in a decentralized manner.

DeFi

Tokenization is fundamental to DeFi protocols, where tokens represent various financial assets (e.g., stablecoins, LP tokens, or staking tokens), enabling decentralized lending, borrowing, and trading.

Property Tokenization

Real estate assets can be tokenized, enabling fractional ownership and easier access to property investments.

Tokenization of Physical Assets

Other high-value assets, such as fine art, precious metals, or commodities, can also be tokenized, unlocking liquidity and broadening access to traditionally illiquid markets.

Rental Income

Tokens can represent future rental income on blockchain, making it easier to transfer ownership and increase liquidity in real estate markets.

Product Authentication

Tokenization is used to authenticate and track the movement of goods in the supply chain. Each product or batch can be assigned a unique token, which tracks its journey from manufacturer to end consumer, ensuring transparency and reducing fraud.

Tokenized Assets

Physical goods or commodities (e.g., diamonds, luxury goods) can be tokenized, allowing fractional ownership and easier transfer of assets.

Medical Records

Tokenization can be used to represent and secure sensitive patient data. This ensures privacy and control for patients while also allowing healthcare providers secure access to the data they need.

Tokenized Health Services

Healthcare services or health-related benefits can be tokenized to streamline the management and exchange of medical insurance, patient rewards, or access to services.

In-Game Assets

Tokenization gives players true ownership of digital assets like items, skins, and characters, enabling cross-platform trading.

Play-to-Earn Models

Tokenized rewards are earned by players through in-game

SocialFi

Tokenization allows content creators and social media platforms to reward engagement, with tokens representing ownership or access to digital content.

Equity Tokenization

Startups and businesses can issue tokenized equity, allowing investors to buy fractional ownership in a company through tokens. This opens up investment opportunities for a larger group of investors, democratizing access to venture capital.

Tokenized Crowdfunding

Tokens can be used in crowdfunding models, where backers receive tokens that represent future value, equity, or access to exclusive services or products.

Decentralized Governance

Tokens can represent voting power in decentralized autonomous organizations (DAOs), allowing members to vote on decisions and proposals based on the number of tokens they hold.

Voting Systems

Tokens are increasingly used in digital voting systems, where votes are represented by tokens on a blockchain to ensure transparency, security, and tamper-proof records.

Distributed Ownership

Tokenize physical infrastructure like energy grids, telecommunications, or transportation networks, allowing decentralized control and access to these assets.

Revenue Sharing

Tokenization enables transparent and automated revenue-sharing models from the infrastructure, ensuring fair compensation for stakeholders.

Incentivized Participation

Reward participants with tokens for contributing to the development, maintenance, and operation of physical infrastructure, fostering innovation and community-driven growth.

Our

Tokenomics

Consulting

Services

Why Do You Need

Tokenomics Consulting Services?

Expert Guidance

The cryptocurrency world can be complex, but our consultants provide expert advice tailored to your specific project requirements. We help you stay ahead with insights into blockchain technology, market trends, and innovative solutions.

Strategic Planning

The cryptocurrency world can be complex, but our consultants provide expert advice tailored to your specific project requirements. We help you stay ahead with insights into blockchain technology, market trends, and innovative solutions.

Risk Mitigation

Every blockchain project comes with its own set of risks, from regulatory challenges to market volatility. We help you identify these risks early and develop strategies to minimize them, ensuring the long-term resilience of your project.

Market Analysis

Understanding the competitive landscape is crucial to standing out in the blockchain ecosystem. Our team provides deep market insights, analyzing trends and user behavior to position your project for success and align it with market demands.

Tokenomics and Blockchain Projects

Tokenomics is at the heart of blockchain projects, driving user adoption and ecosystem growth. We help design and implement token models that incentivize participation, ensure fair distribution, and foster trust among your community, setting your project on a path to success.

Use Cases For

Cryptocurrency Consulting Services?

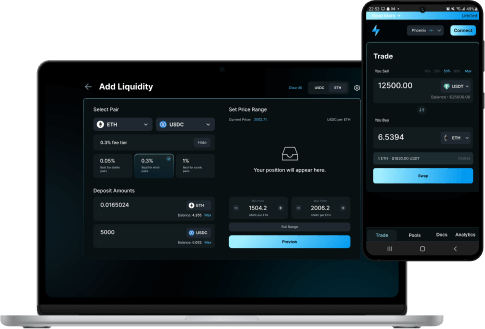

DeFi Platforms

DeFi Platforms

NFT Marketplaces

NFT Marketplaces

Custom Token Launch

Custom Token Launch

Crypto Wallet Development

Crypto Wallet Development

P2P Payment Solutions

P2P Payment Solutions

Our

Blockchain

Consultation Process

Initial Design

and Planning

Token Design

Economic Modeling

Governance Framework

Market Making

DEX Listing

Pre-Launch

Preparation

Launch

Execution

Token Distribution

Liquidity Provision

Staking and Farming Mechanisms

Governance Adjustments

Continuous Economic

Analysis

Post-Launch Optimization

Maturity And

Stability

Long-term Incentive Strategies

Token Price Stability

Liquidity Simulations

Initial Design

and Planning

Token Design

Economic Modeling

Feasibility Study & Business Processes Analysis

Launch

Execution

Token Distribution

Liquidity Provision

Continuous Economic Analysis

Community Engagement

Post-Launch

Optimization

Maturity and Stability

Why Choose

Tokenomics Consultation Services?

Deep Expertise

With their deep understanding of the nuances and complexities of blockchain systems including custom blockchains, our consultants address even the most challenging aspects of your project with precision.

Customized

Solutions

By understanding your specific goals and challenges, we provide customized blockchain recommendations and design strategies that align perfectly with your objectives.

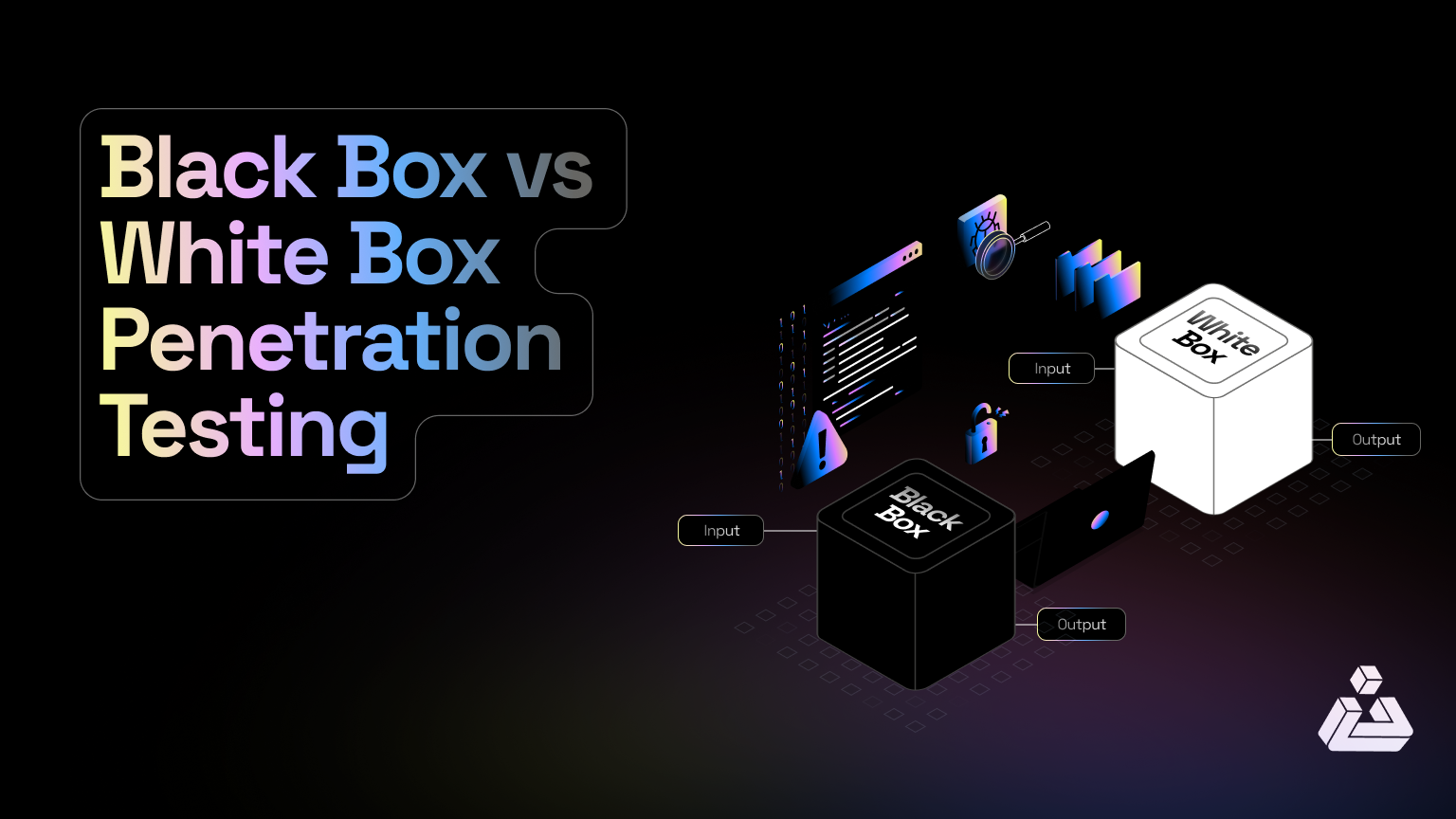

Comprehensive Protocol Analysis

We thoroughly evaluate various blockchains to ensure they meet your performance, scalability, and interoperability needs, providing a comprehensive blockchain protocol consulting experience.

Seamless Support

We work closely with your team to ensure a smooth transition from planning to deployment, addressing any challenges and ensuring the successful integration of the chosen blockchain.

Our Sucess

Stories

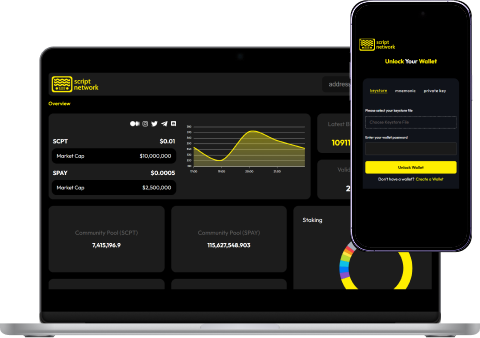

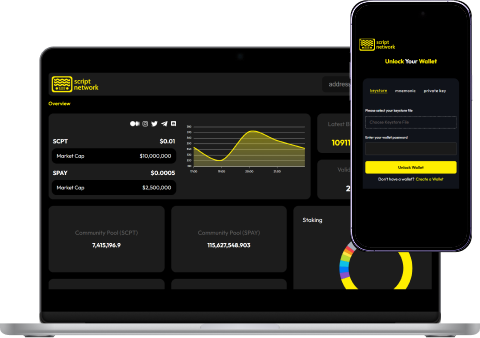

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Market design

Mechanism design

Game design

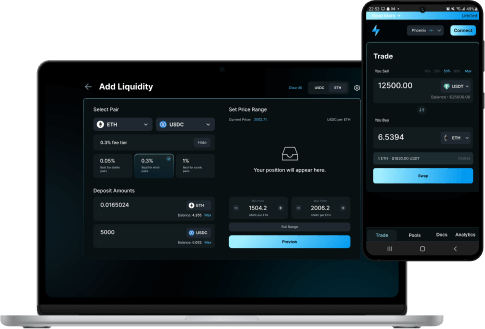

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Market design

Mechanism design

Game design

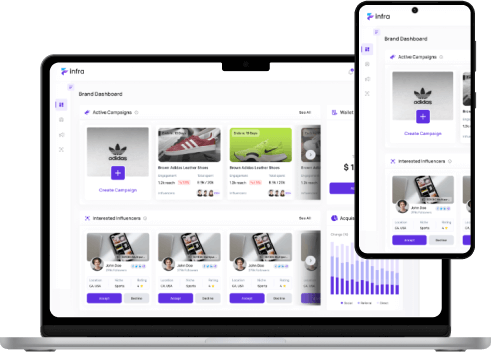

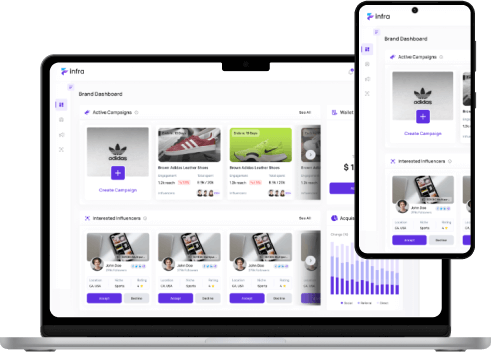

To create a peer-to-peer influencer promotion marketplace that empowers users to create and manage campaigns, seamlessly connecting them with influencers to effectively promote their projects.

Services

Market design

Mechanism design

Protocol Engineering

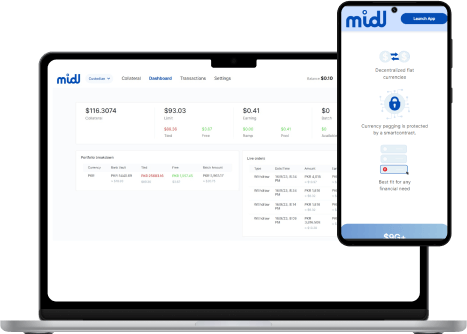

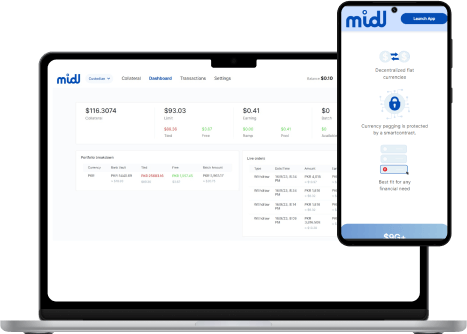

To develop a globally accessible, collateral-backed cross-border payment platform that seamlessly integrates secure crypto-to-fiat on/off ramps, empowering users to transact anytime, anywhere.

Services

Market design

Mechanism design

Protocol Engineering

Nero allows users to pay for blockchain transaction fees in any token using account abstraction through Paymasters. We are currently researching a multidimensional gas fee model tailored to optimize this flexibility and exploring mechanics for the $NERO token to act as a representative of all underlying dApp tokens.

Services

Protocol Engineering

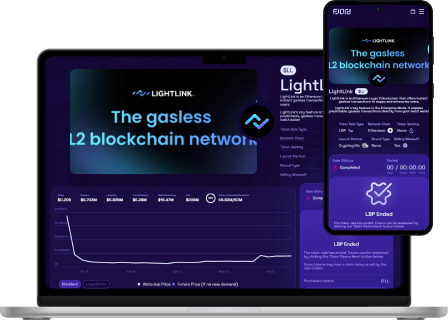

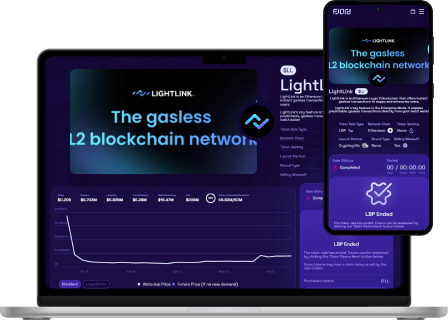

Token Economy Design

Designed tokenomics for Lightlink, an enterprise Layer-2 blockchain enabling gasless transactions, including token allocation, distribution, and emission models. Crafted a fair token sale strategy using a Liquidity Bootstrapping Pool (LBP) with optimized parameters and safeguards against grievers through market makers, raising $5.28M. Developed a targeted airdrop strategy to align with project goals and incentivize user onboarding to the network.

Services

Market Design

Protocol Design

Mechanism Design

Our Sucess

Stories

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Mechanism design

Market design

Game design

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Mechanism design

Market design

Game design

To create a peer-to-peer influencer promotion marketplace that empowers users to create and manage campaigns, seamlessly connecting them with influencers to effectively promote their projects.

Services

Mechanism design

Market design

Protocol Engineering

To develop a globally accessible, collateral-backed cross-border payment platform that seamlessly integrates secure crypto-to-fiat on/off ramps, empowering users to transact anytime, anywhere.

Services

Mechanism design

Market design

Protocol Engineering

Nero allows users to pay for blockchain transaction fees in any token using account abstraction through Paymasters. We are currently researching a multidimensional gas fee model tailored to optimize this flexibility and exploring mechanics for the $NERO token to act as a representative of all underlying dApp tokens.

Services

Token Economy

Protocol Engineering

Designed tokenomics for Lightlink, an enterprise Layer-2 blockchain with gasless transactions. Developed a fair token sale strategy using a Liquidity Bootstrapping Pool (LBP), raising $5.28M with safeguards against grievers. Created a targeted airdrop strategy to drive user onboarding and align with project goals.

Services

Protocol Design

Mechanism Design

Market Design

Related

Resources

Frequently

Asked

Questions

What is tokenomics consulting, and why is it important for my project?

Tokenomics consulting focuses on designing and optimizing your project’s token economy, ensuring its sustainability and alignment with your business objectives. It’s critical for creating a balanced ecosystem that drives user engagement, incentivizes participation, and supports long-term growth.

How do you design a tokenomics model tailored to our project?

We begin by understanding your project goals, target audience, and value proposition. Based on this, we design a tokenomics model that addresses token utility, supply and distribution mechanisms, governance structures, and incentive systems, ensuring alignment with your objectives.

How do you ensure the tokenomics model is sustainable?

Our consultants use financial modeling, risk assessment, and scenario analysis to design sustainable tokenomics. We also ensure the token’s utility and incentives create long-term value for the ecosystem while mitigating risks like inflation or volatility.

Can you help us integrate governance mechanisms into our tokenomics?

Yes, we specialize in designing governance structures that allow community participation and decentralized decision-making, fostering trust and transparency within your ecosystem.

How long does the tokenomics consultation process take?

The timeline depends on the complexity of your project. Simple models can be developed in a few weeks, while more advanced ecosystems may take several months. We provide a tailored timeline during our initial consultation.

Do you assist with token launch and post-launch analysis?

Absolutely. We support token launches by helping with community engagement, distribution strategies, and market positioning. Post-launch, we analyze token performance and suggest optimizations to maximize its impact.

Can you help us pivot or redesign our existing tokenomics?

Yes, we offer audits and redesign services for projects looking to pivot or optimize their existing tokenomics models to address challenges or adapt to changing market conditions.

Testimonials

Lets Talk

100+

Clients & Partners

Explore Our Other

Consultation

Web3

Consulting

From architecture to deployment, our security engineering solutions integrate best security practices throughout your project’s lifecycle, building a resilient foundation for your blockchain applications.

Cryptocurrency

Consulting

We identify vulnerabilities, ensure code efficiency and provide actionable recommendations for secure, reliable, and sturdy smart contract deployment across various platforms.

Tokenomics

Consulting

We offer a deep analysis of your blockchain’s infrastructure, examine consensus algorithms data integrity, and node security. Our blockchain audits guarantee robustness and trust in your decentralized ecosystem.

Simplify Blockchain

Challenges—

Contact Our

Experts Today!

MOST TRUSTED BLOCKCHAIN

CONSULTING COMPANY