Real-world asset (RWA) tokenization is an exciting shift that is taking place in the financial world. They have a huge impact on the financial market growth and therefore gain a lot of attention from real-world applications. In general, they bridge the gap between traditional assets, such as currencies, physical commodities, real estate, and digital arts to digital tokens. It utilizes the process of converting physical assets or digital assets into digital tokens that can be traded, sold, or transferred in the blockchain ecosystem.

The main motivation for implementing tokenization was to make the assets more liquid, accessible, and transparent. By breaking the tokens into small pieces, we could allow more people to participate and invest in the network with low capital.

Why are RWAs trending?

The growth of RWAs has been incredibly amazing. One important factor for RWA’s popularity is to connect traditional finance with the decentralized world. Hence to perform critical financial transactions we don’t need any middleman or centralized entity. Financial giants like JP Morgan and BlackRock have already launched their tokens for their collateral networks. This move shows the world’s strong commitment to innovation and the growing trend toward Real World Assets (RWA) tokenization. The adoption of tokenization by these companies has stirred the market activity, and in May 2024 we have witnessed that the U.S. treasuries reached a new high of around $1.5 billion on-chain.

In this article, we’ll discuss the top 5 crypto projects that are at the forefront of tokenizing RWAs. The protocols below were chosen in order of TVL, popularity, and other social and financial metrics.

Top 5 RWA Protocols in 2025

There are multiple types of Real-World Asset (RWA) protocols, each targeting a specific asset class. To name a few, we have capital markets, physical commodities, Real estate, gold, and other emerging markets such as Oracle and data feeds. Here we will discuss a few of the top use cases implemented by protocols.

1- Ondo Finance

Nathan Allman founded Ondo Finance in 2021 and it is one of the biggest blockchain protocols in the blockchain world. The protocol provides institutional-based financial products and services. It is also one of the most trending in the RWA movement.

Ondo finance is mainly a platform to convert real-world assets into digital tokens, making them accessible and liquid on blockchain networks. It is specialized for tokenizing yield-generating assets from traditional finance such as T-bills and stocks. The most important products of Ondo Finance are T-bills and Flux Finance. Ondo Finance is integrated into various blockchain platforms including Ethereum and Solana for better market share.

Offerings:

Ondo Finance offers many utilities and services. Recently they have expanded their offerings within RWA, such as Ondo Global Markets. This platform provides its users the option of accepting orders via both traditional methods and smart contract calls. Apart from this Ondo offers many services such as:

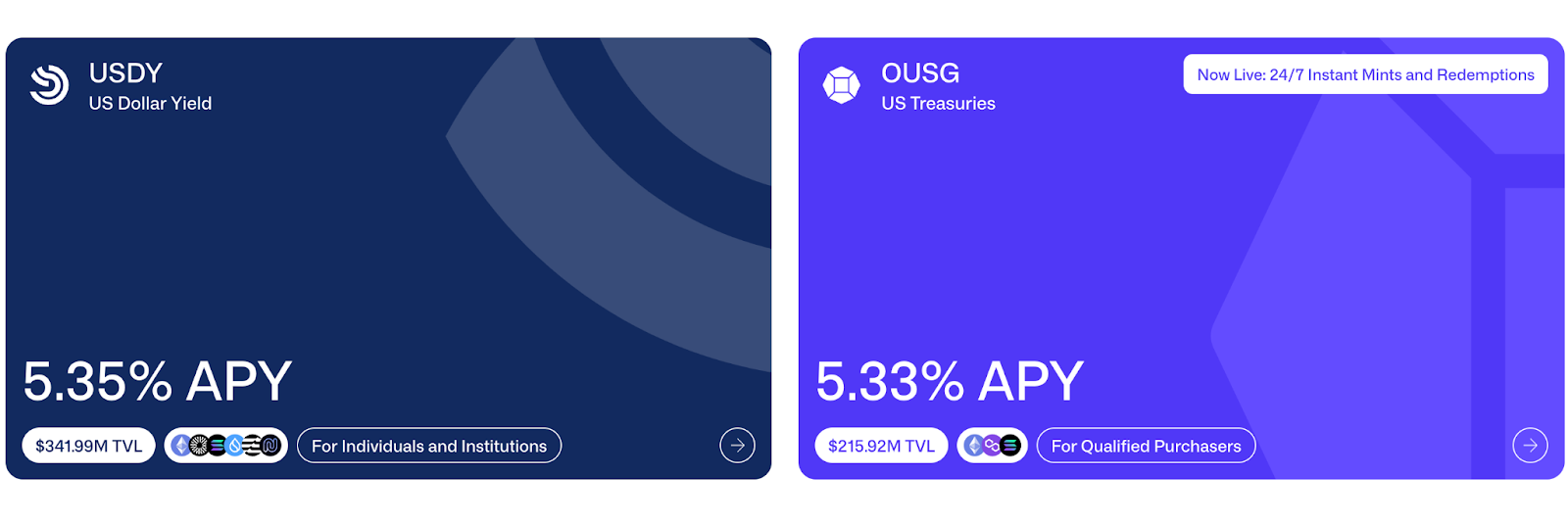

- Asset tokenization: Ondo offers OUSG which is a tokenized version of a BlackRock short-term US Treasuries ETF that makes the traditional finance more seamless for its investors.

- Yield-Bearing Stablecoin: Another offering of Ondo is USDY which is a yield-bearing stable coin. The purpose of this coin is to ensure stability with the potential for earning yield.

- Risk-Isolated Vaults: Ondo is a platform that has introduced the concept of risk-isolated vaults. These vaults can allow lenders to specify conditions for collateral, fund usage, and loan-to-value thresholds.

Apart from the above few tokenization services offered by Ondo Finance, It also allows its users to govern the platform. For this purpose, Ondo Finance has launched an ONDO token that is used for governance. It allows its holders to vote on proposals regarding the proposed plans, development, and resource allocation.

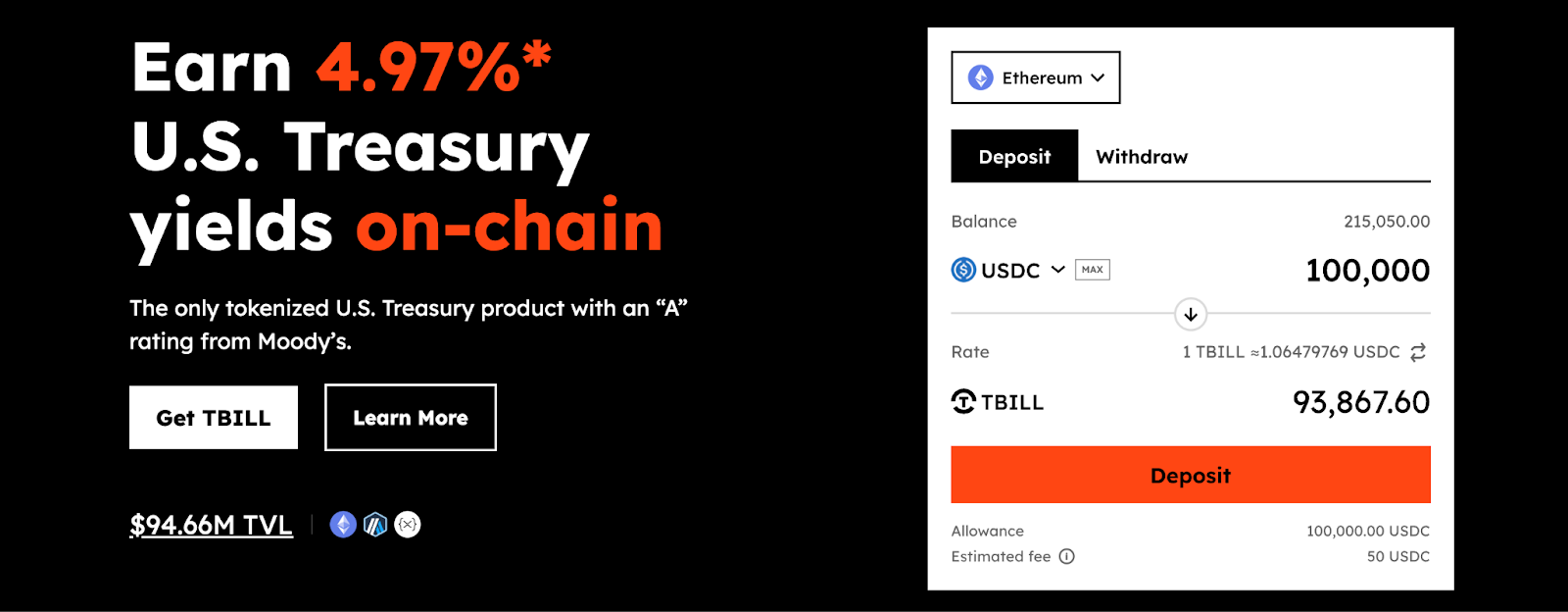

2- OpenEden

OpenEden was founded in December 2021 by Jeremy Ng and Eugene Ng. The project has also raised a $5M investment from UXD Protocol. The major product launched by OpenEden is its TBILL Vault, which allows its users to mint T BILL tokens. These TBILL tokens represent the direct ownership of short-dated US treasury bills.

OpenEden has also obtained regulatory approval from the BVI Financial Services Commission, to operate as a professional fund providing services. Therefore, the users of OpenEden are required to undergo strict KYC and AML screening processes for minting and compliance-related operations. For safety and security, the protocol also offers monthly reports and attestations to ensure transparency.

Offerings:

- Compliance First: The issuer of TBILL tokens is a professional fund regulated by a Financial Services Commission. Therefore, we could say that OpenEden operates under a compliance-first approach.

- Direct T-Bills: TBILL tokens are backed by U.S. Treasury Bills held in segregated accounts by licensed custodians.

- Fast Settlement: The protocol offers superior liquidity compared to traditional finance. It operates 24/7 to provide instant minting and redemption of TBILL tokens on-chain.

3-Centrifuge

Centrifuge is also another top protocol in the RWA world. The main purpose of the protocol is to lower the cost of capital for small and mid-size enterprises (SMEs) while providing investors with a stable income source. Centrifuge was co-founded by Lucas Vogelsang and has raised over $30M in a Series A funding round led by the founders of the Gnosis blockchain and angel investors, Wintermute and Stefan George. Apart from this centrifuge has also signed many large deals with top protocols such as MakerDao of about $220M.

Centrifuge provides asset liquidity by converting pretty much all sorts of physical assets from the real world such as bonds, invoices, real estate, revenues, and more. Centrifuge has also collaborated with various DeFi protocols, such as MakerDAO, to launch projects like “Proof of Portfolio,” which enhances the collateral transparency for businesses and individuals’ portfolios.

Offerings:

- Asset tokenization: Centrifuge allows its user businesses to tokenize all sorts of physical and digital commodities such as invoices, real estate, and bonds which could also be used as collateral for financing on Centrifuge’s pools.

- Regulatory Compliance and Governance: Centrifuge uses KYC, extensive screenings, and technical audits to secure compliance. The protocol is also governed by its on-chain DAO called Centrifuge DAO, where all parties can issue/vote on proposals.

- Liquidity Pools and Yield Generation: Centrifuge’s liquidity pools allow investors to provide liquidity to tokenized assets and earn yield. It also provides access to stable yields backed by real-world assets, including finance and compliance options for invoices, real estate, and bonds.

4- Tangible

Tangible is one RWA that focuses on tokenizing physical world assets like real estate and converts them into digital tokens known as Tangible NFTs (TNFTs). Tangible was founded by Jag Singh, a UK-based tech entrepreneur, and has tokenized over 218 properties, producing a TVL of over $40M.

Tangible also offers a stablecoin called Real USD (USDR), which is backed by tokenized real estate, providing its holders with a daily rebasing yield of about 10-15% APY.

Offerings:

- Stable Coin: The protocol has also launched its own stablecoin namely USDR. The stablecoin is backed by tokenized real estate, with rental income distributed to holders.

- Tokenized Real Estate: Tangible converts the real estate into a tokenized form that allows fractional ownership and easy transfer.

- Yield Generation: Any yield generated from these tokenized real estate, is distributed to its holders on a daily rebase mechanism.

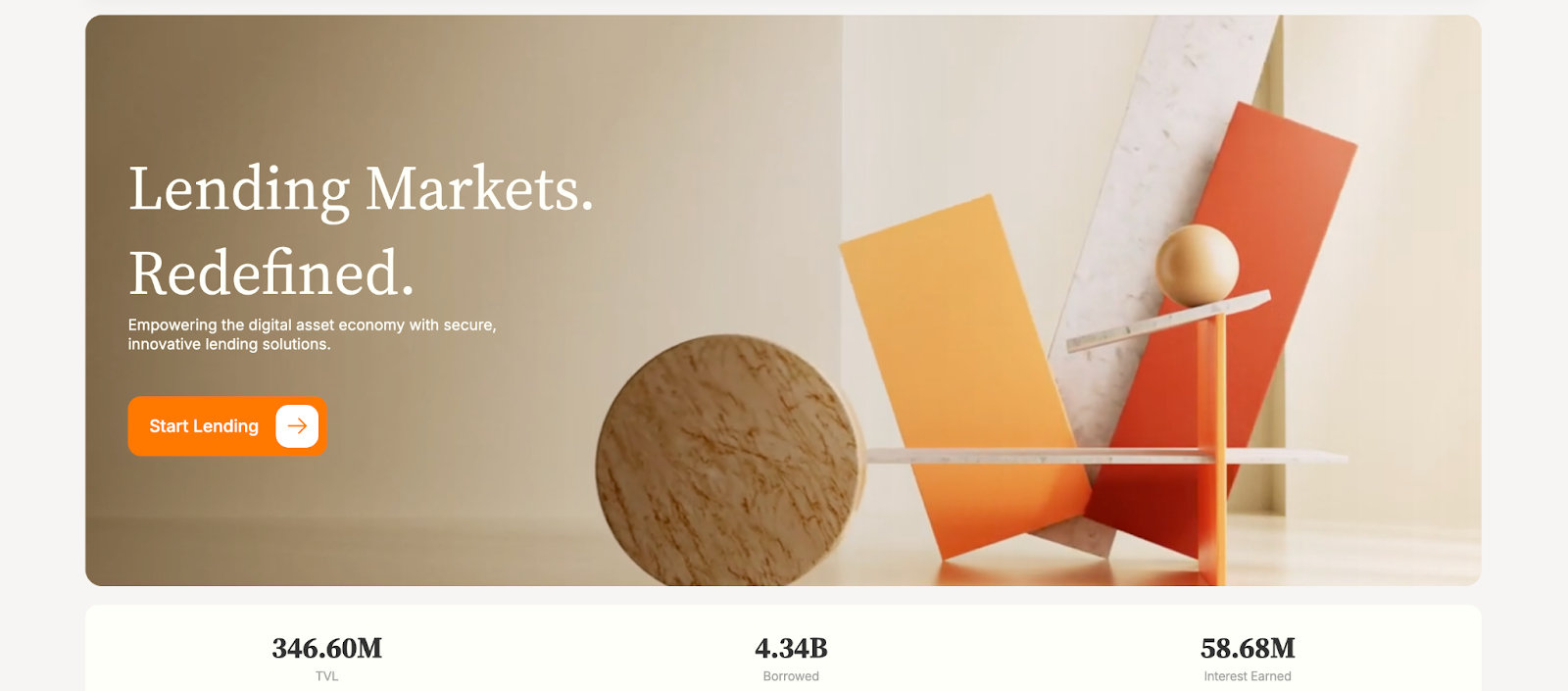

5- Maple Finance

Maple Finance was co-founded by Sid Powell and Joe Flanagan in 2021. It is one of the top DeFi protocols that focuses on offering lending opportunities to institutional and individual investors. The protocol also lets its users get over-collateralized loans based on borrower profile. The protocol undergoes thorough inspection for its users to ensure efficient capital gains and yield.

Offerings:

- Direct Lending: Maple lends directly to top institutional borrowers in the blockchain ecosystem to ensure high yields and transparency.

- Cash Management: Maple offers an on-chain cash management system allowing users to access US Treasury yields with daily liquidity and high transparency.

- High Yield: The platform also offers high APY across various lending opportunities, such as USDC lending, with a target APY of around 10-11%.

The Conclusion and Future of RWAs

The tokenization is now driving the crypto industry at the forefront of technology. It has created infinite possibilities for financial services and products. Experts have predicted that Tokenization could reach the highest of $3.5 trillion in the least market activity.

RWAs have the potential to bridge the gap between Defi and traditional markets. With the increased traction of crypto markets, the future of tokenization looks promising with improved market liquidity and better regulatory frameworks.