*/de-fi>

Industries We Serve

With

DeFi Consultation

Staking

Participate in secure network staking without receiving tradable tokens, ensuring network integrity.

Liquid Staking

Stake assets and receive tradeable tokens in return, enabling liquidity and flexible asset management.

Restaking

Reuse staked ETH to participate in additional staking opportunities, maximizing returns.

Liquid Restaking

Combine the benefits of liquid staking and restaking for enhanced rewards and liquidity options.

Slashing Risk Assessment

Mitigate risks of token loss by evaluating potential network slashing events and designing secure mechanisms.

Governance Controls

Implement governance frameworks to ensure transparency, fairness, and decentralized decision-making in staking ecosystems.

Lending

Access decentralized borrowing and lending solutions to maximize asset efficiency.

CDP (Collateralized Debt Position)

Use digital assets as collateral to mint stablecoins, unlocking liquidity while retaining asset ownership.

Token Locker

Well-designed triggers and auction processes prevent under-collateralization and protect system solvency.

Collateral Health Monitoring

Ensures the protocol can handle rapid market downturns and preserve collateral value.

Liquidation Mechanisms

Securely lock digital assets with restricted access, ideal for vesting or ensuring protocol compliance.

Insurance & Reserve Funds

Buffer the protocol against unexpected losses or black swan events.

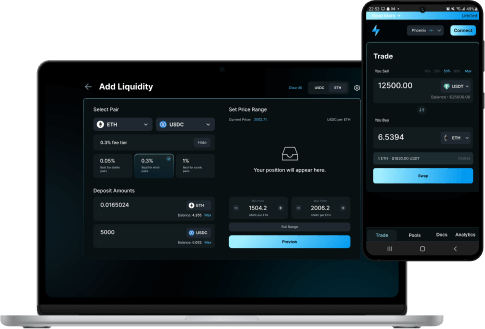

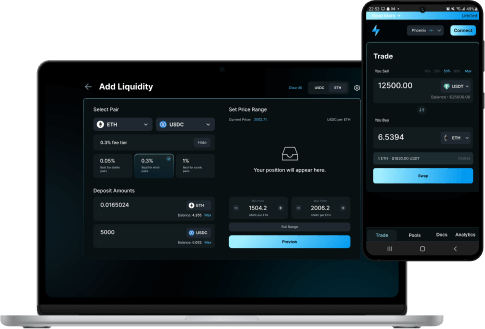

Decentralized Exchanges (DEXs)

Seamlessly swap and trade cryptocurrencies without intermediaries.

Derivatives

Access leverage-based protocols for risk management and strategic trading.

Basis Trading

Capitalize on price discrepancies between spot and futures markets to generate profit.

Cross-Chain Swapping

Swap assets across different blockchain networks, facilitating liquidity and broader market access.

Liquidity Incentive Design & Ongoing Optimization

Offer data-driven analysis, token distribution modeling, and dynamic rewards for liquidity providers. This ensures stable liquidity, minimal slippage, and optimized capital usage for the protocol.

Risk & Market Behavior Analysis

Incorporate stress testing, and scenario modeling to assess potential liquidity risks and guide strategic adjustments. This includes managing impermanent loss, volatility, and other market factors critical to a sustainable economic model.

Liquidity Provision

Provide liquidity to decentralized exchanges (DEXs) and earn trading fees as rewards.

Yield Aggregator

Consolidate and optimize yield strategies across multiple DeFi platforms for higher returns.

Farming

Lock assets in protocols to earn governance or utility tokens as rewards.

Aggregation Algorithms

Develop or customize strategies that automatically rebalance and compound yields.

Pool Deployment & Management

Deploy liquidity pools on DEXs and manage parameters (slippage, fees, etc.).

Reward Distribution Mechanisms

Implement smart contracts to distribute LP rewards in governance or utility tokens.

Rewards & Incentive Engineering

Define how farmers earn governance/utility tokens for providing liquidity.

Real-World Assets (RWA)

Tokenize tangible assets such as real estate or commodities, enabling fractional ownership and liquidity.

Fractional Ownership

Tokenization allows for fractional ownership of high-value assets, making it easier for users to invest in traditionally illiquid markets.

Indexes

Create and track performance benchmarks for diversified asset groups, simplifying portfolio management.

Technical Guidelines

Clear frameworks and processes for tokenizing real estate, commodities, or other tangible assets.

Feasibility Analysis

Conduct both technical and economic assessments to evaluate the viability of tokenization initiatives, ensuring business objectives align with capabilities and benefits.

Governance

Enable community-driven decision-making through transparent and participatory frameworks.

Proposal Creation and Voting Systems

Users can propose new features, adjustments to protocol mechanisms, or even the addition of new assets.

Governance Delegation

Token holders can delegate their voting power to trusted representatives or other users.

DAO Structure & Setup

Decide on on-chain vs. off-chain voting, token governance models, and quorum thresholds.

Proposal Lifecycle

Define the process for proposing changes, discussion periods, and final voting.

Peer-to-Peer Payments

DeFi allows users to send and receive fast, low-cost, and borderless payments directly between one another.

Decentralized Payment Gateways

DeFi-based payment gateways offer businesses and individuals a decentralized alternative to traditional payment systems.

Fee structuring and management

Blockchain enables dynamics and transparent fee structures allowing users and businesses to optimize payment processes based on transaction size and priority.

Dispute Resolution Mechanisms

DeFi adds fairness and trust to peer to peer payment systems by integrating decentralized, smart contract based dispute resolution mechanisms.

Digital Art

Empower artists by creating and selling verifiable ownership of their work on the blockchain, ensuring scarcity and authenticity.

Collectibles

Enable users to collect rare, digital items with proven provenance, transforming the collectibles market.

Utility-Focused NFTs

Use NFTs beyond art and collectibles, integrating them into real-world applications like memberships, event tickets, or access passes for exclusive content.

Marketplace Features

Auction formats, royalty distribution, user bidding systems, and profile pages.

Use Case Analysis

Integrate NFT-based memberships, tickets, or loyalty programs.

Integration & Customization

Embed NFT logic into existing products, providing additional value to token holders.

Royalty & Revenue Tracking

Implement on-chain royalty mechanisms for perpetual artist/creator revenues.

Market Monitoring & Analysis

Analyze real-time market trends, price fluctuations, and trading sentiment to identify opportunities and optimize decision-making.

Automated Trading

Autonomously execute trades based on preprogrammed or adaptive strategies, reducing manual intervention and human error.

On-Chain Availability

Operating 24/7 without downtime

Portfolio Management

Monitor asset performance, rebalance portfolios, and recommend strategies based on market conditions to maximize returns.

Bots in Games

AI-powered bots interact with players, hold wallets, and participate in decentralized game economies, creating immersive, dynamic ecosystems.

Bots in Social Apps

Bots enable real-time interaction with blockchain communities by executing on-chain actions, enhancing user engagement and experience.

Strategy Creation & Optimization

Design trading strategies (arbitrage, scalping, grid trading) managed by AI agents.

Portfolio Balancing & Rebalancing

Automated allocation adjustments based on market conditions or user-defined risk profiles.

User Engagement Features

Automated responses, reward distribution, or community management in social platforms.

Play-to-Earn Models

Enable players to earn tokens or assets through gameplay, making gaming a legitimate source of income through decentralized finance mechanisms.

Tokenized In-Game Assets

Use blockchain to create verifiable, tradable assets like characters, skins, and items, allowing players to buy, sell, and trade within a decentralized marketplace.

Decentralized Game Economies

Build economies where in-game currencies and assets have real-world value, powered by DeFi protocols that support liquidity, lending, and staking.

User Engagement Features

Our

DeFi

Consulting Approach

In-depth

Assessment

We conduct a thorough assessment of your business objectives and identify the DeFi solutions that best align with your goals.

We help you select the most suitable blockchain protocols, DeFi platforms, strategies, tools, and other requirements for your project.

Protocol

Selection

Smart Contract

Development

Our team of experienced developers can create custom smart contracts to power your DeFi applications.

We conduct rigorous security audits to ensure the safety and integrity of your DeFi protocols.

Security

Audits

We can help you set up and manage liquidity pools to provide liquidity to your DeFi applications.

Liquidity Pool

Management

Building

Strategies

We assist in developing and implementing effective strategies based on what the project and its goal is.

In-depth Assessment

We conduct a thorough assessment of your business objectives and identify the DeFi solutions that best align with your goals.

Protocol Selection

Smart Contract Development

Our team of experienced developers can create custom smart contracts to power your DeFi applications.

We conduct rigorous security audits to ensure the safety and integrity of your DeFi protocols.

Security

Audits

Liquidity Pool Management

Building Strategies

DeFi

Solutions

We

Offer

Why Choose Us for

DeFi Consulting?

Expertise in

DeFi

As a leading DeFi consulting company, we bring extensive expertise in the decentralized finance space, helping you navigate its complexities with confidence.

Customized

Solutions

We offer tailored DeFi consultation services that align with your business needs, ensuring effective and relevant solutions.

Comprehensive

Support

From strategy development to implementation and optimization, we provide end-to-end support for your DeFi projects, ensuring their success.

Innovative Approach

Our approach to DeFi consulting services leverages the latest trends and technologies to keep your projects ahead of the curve and competitive in the evolving DeFi landscape.

Our Sucess

Stories

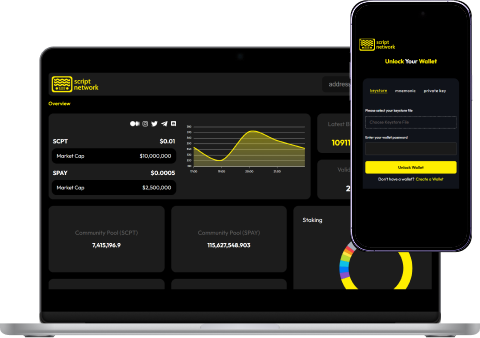

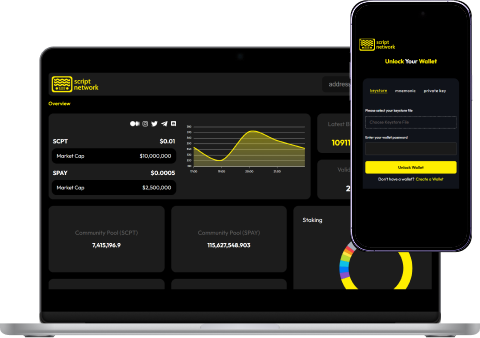

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Market design

Mechanism design

Game design

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Market design

Mechanism design

Game design

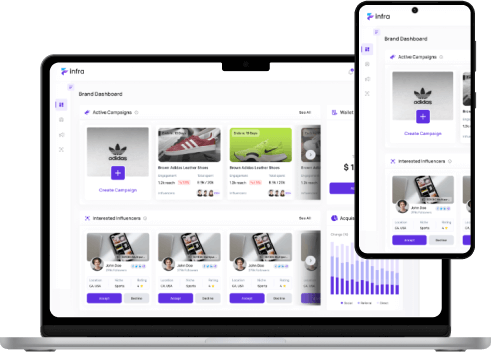

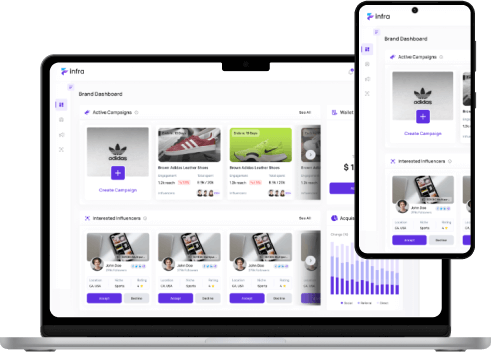

To create a peer-to-peer influencer promotion marketplace that empowers users to create and manage campaigns, seamlessly connecting them with influencers to effectively promote their projects.

Services

Market design

Mechanism design

Protocol Engineering

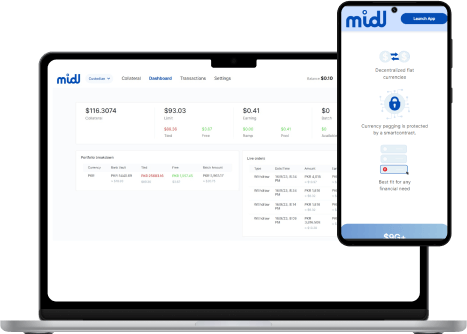

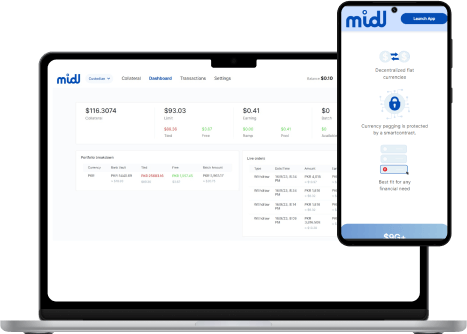

To develop a globally accessible, collateral-backed cross-border payment platform that seamlessly integrates secure crypto-to-fiat on/off ramps, empowering users to transact anytime, anywhere.

Services

Market design

Mechanism design

Protocol Engineering

Nero allows users to pay for blockchain transaction fees in any token using account abstraction through Paymasters. We are currently researching a multidimensional gas fee model tailored to optimize this flexibility and exploring mechanics for the $NERO token to act as a representative of all underlying dApp tokens.

Services

Protocol Engineering

Token Economy Design

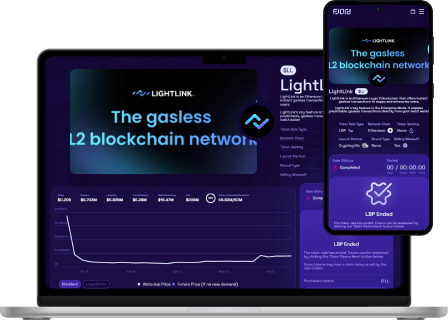

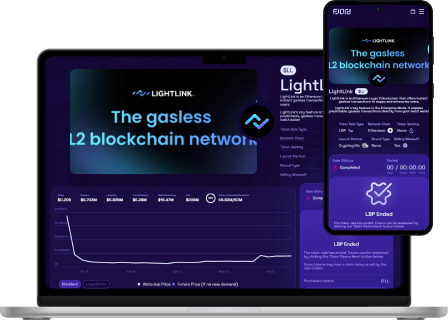

Designed tokenomics for Lightlink, an enterprise Layer-2 blockchain enabling gasless transactions, including token allocation, distribution, and emission models. Crafted a fair token sale strategy using a Liquidity Bootstrapping Pool (LBP) with optimized parameters and safeguards against grievers through market makers, raising $5.28M. Developed a targeted airdrop strategy to align with project goals and incentivize user onboarding to the network.

Services

Market Design

Protocol Design

Mechanism Design

Our Sucess

Stories

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Mechanism design

Market design

Game design

To create a fully decentralized, blockchain-enabled ecosystem for video content delivery and engagement. Designed a dual token economy with a network token tied to the underlying growth of the platform and a reward token to incentivize actions and drive engagement on the platform.

Services

Mechanism design

Market design

Game design

To create a peer-to-peer influencer promotion marketplace that empowers users to create and manage campaigns, seamlessly connecting them with influencers to effectively promote their projects.

Services

Mechanism design

Market design

Protocol Engineering

To develop a globally accessible, collateral-backed cross-border payment platform that seamlessly integrates secure crypto-to-fiat on/off ramps, empowering users to transact anytime, anywhere.

Services

Mechanism design

Market design

Protocol Engineering

Nero allows users to pay for blockchain transaction fees in any token using account abstraction through Paymasters. We are currently researching a multidimensional gas fee model tailored to optimize this flexibility and exploring mechanics for the $NERO token to act as a representative of all underlying dApp tokens.

Services

Token Economy

Protocol Engineering

Designed tokenomics for Lightlink, an enterprise Layer-2 blockchain with gasless transactions. Developed a fair token sale strategy using a Liquidity Bootstrapping Pool (LBP), raising $5.28M with safeguards against grievers. Created a targeted airdrop strategy to drive user onboarding and align with project goals.

Services

Protocol Design

Mechanism Design

Market Design

Related

Resources

Frequently

Asked

Questions

What is DeFi, and how can it benefit my business?

DeFi, or Decentralized Finance, encompasses blockchain-based financial services that operate without traditional intermediaries. It can benefit your business by enhancing financial transparency, reducing transaction costs, and providing innovative financial solutions.

How do you approach DeFi protocol development and smart contract auditing?

We approach DeFi protocol development by first understanding your business needs and then designing customized solutions. For smart contract auditing, we conduct thorough security assessments to ensure functionality, safety, and compliance.

What is the process for setting up liquidity pools and managing yield farming strategies?

Our process involves designing liquidity pools that meet your goals, deploying them, and then implementing strategies for yield farming to optimize returns. We continuously monitor and adjust these strategies to ensure they perform effectively.

What are the typical costs and timelines for implementing DeFi solutions?

Costs and timelines vary depending on the complexity of the project and the specific solutions required. Contact us to get detailed estimates and timelines based on your project’s scope and requirements

Can you help with the formation and governance of Decentralized Autonomous Organizations (DAOs)?

Yes, we assist with the formation and governance of DAOs, helping you set up effective management structures and decision-making processes to support your DeFi ecosystem.

Testimonials

Lets Talk

100+

Clients & Partners

Explore Our Other

Consultation

Web3

Consulting

From architecture to deployment, our security engineering solutions integrate best security practices throughout your project’s lifecycle, building a resilient foundation for your blockchain applications.

Cryptocurrency

Consulting

We identify vulnerabilities, ensure code efficiency and provide actionable recommendations for secure, reliable, and sturdy smart contract deployment across various platforms.

Tokenomics

Consulting

We offer a deep analysis of your blockchain’s infrastructure, examine consensus algorithms data integrity, and node security. Our blockchain audits guarantee robustness and trust in your decentralized ecosystem.

Simplify Blockchain

Challenges—

Contact Our

Experts Today!

MOST TRUSTED BLOCKCHAIN

CONSULTING COMPANY