Decentralized Finance (DeFi) was introduced in 2020 and has gained massive public attention over the past few years. DeFi introduces a different approach to financial services by removing intermediaries like banks and brokers. By providing financial services over blockchain to manage transactions, DeFi has emerged as one of the best innovations in the cryptocurrency space. It offers services such as lending, trading, and investments in a peer-to-peer, open, and transparent manner.

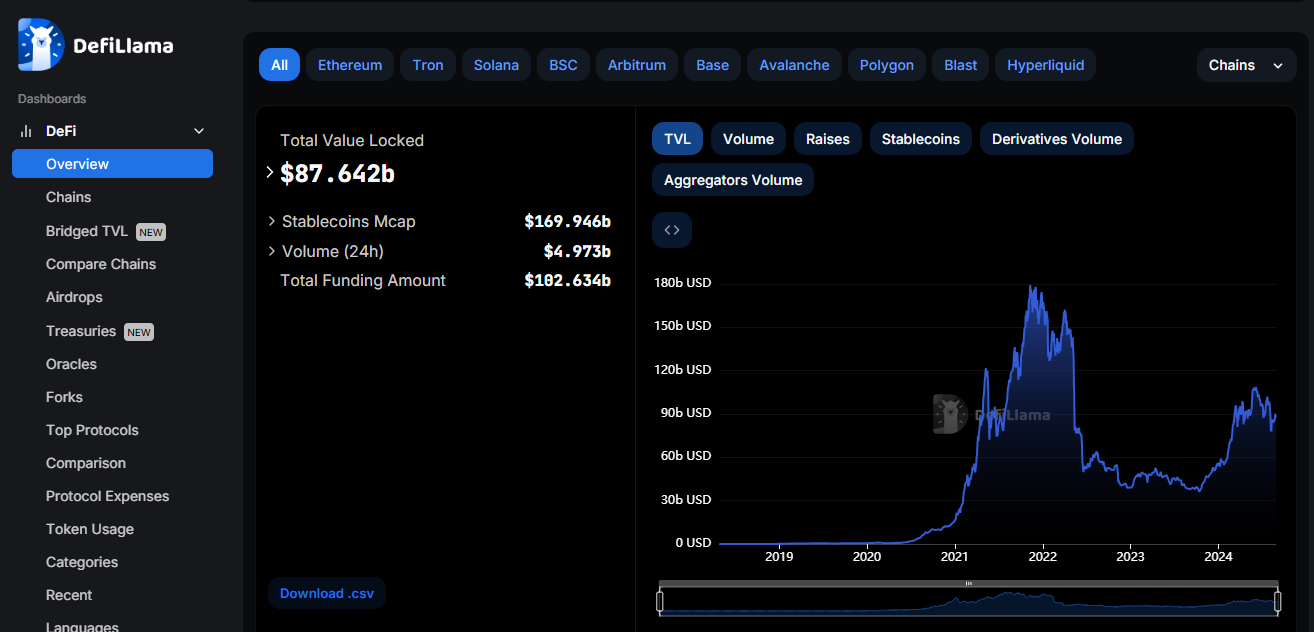

In November 2021, DeFi’s total value locked (TVL) peaked at $175.6 billion but dropped by almost 50% over time. However, by 2025, it began to regain momentum, with TVL rising 2.5 times from $36.08 billion in October 2023, signaling a strong market recovery. The decentralized finance market size is expected to reach USD 51.73 billion in 2025.

The DeFi ecosystem is evolving rapidly with many innovations and opportunities that did not seem possible a few years ago. This article will explain the trends that will capture the market initially in 2025.

1- Tokenization of Real-World Assets (RWAs):

Tokenization of Real-World Assets (RWAs) represents one of the most transformative trends within the decentralized finance (DeFi) ecosystem. The conversion of tangible, real-world assets like real estate, stocks, bonds, and commodities into digital tokens that can be traded on blockchain platforms is called Tokenization of RWAs. This innovation bridges the gap between traditional financial systems (TradFi) and decentralized finance, opening up investment opportunities for a much broader audience.

A real-world example of tokenization of real-world assets (RWAs) can be seen with platforms like RealT, which tokenizes real estate properties. RealT issues tokenized ownership stakes in properties, allowing users to invest in fractional shares of real estate by purchasing digital tokens on the blockchain.

Why do RWAs Matter?

Tokenization comes with several benefits such as fractional ownership, increased liquidity, faster transactions, and reduced costs. To illustrate this, fractional ownership enables investors to buy small portions of expensive assets like real estate or art. These tokenized assets are then traded on blockchain-based marketplaces, making them more accessible to retail investors globally.

RWAs also introduce liquidity to traditionally illiquid markets, allowing assets like commercial real estate or fine art to be traded quickly and with lower fees. Also, blockchain technology ensures that transactions are transparent and immutable, hence, enhancing security and transparency between the buyers and sellers.

2- Market Potential:

The future of RWAs is bright. The total addressable market (TAM) for tokenized real-world assets is projected to reach $16 trillion by 2030. Tokenization not only appeals to retail investors but also attracts institutional players looking to diversify their portfolios with liquid, tokenized assets. MakerDAO, which is one of the leading decentralized lending platforms, has invested $1.2 billion in U.S. Treasury bonds.

DeFi platforms are integrating RWAs to stabilize yields and reduce volatility associated with crypto assets.

In summary, the tokenization of RWAs could redefine global finance. Tokenization enables illiquid assets tradable which opens up significant investment opportunities and strengthens the DeFi ecosystem.

3- Liquid Staking Tokens (LSTs):

Traditionally, staking requires locking up cryptocurrency assets, and after they are locked up as stakes, they cannot be used anywhere else. Liquid Staking Tokens (LSTs) helped solve this problem, LSTs allow users to stake their assets while still retaining liquidity. When users stake their assets on a network like Ethereum or Solana, they receive derivative tokens (LSTs), such as stETH or stSOL, these represent their staked assets. These tokens can then be used for other DeFi activities like lending, borrowing, or yield farming.

LST Market Growth:

As of August 2023, Lido Finance is the most prominent liquid staking platform and it holds over $14 billion TVL across multiple networks such as Ethereum, Solana, and Polygon. The protocol offers an APY ranging from 4.4% to 6.7%, depending on the network. Users can earn staking rewards while using their liquid tokens to participate in DeFi markets.

Benefits of LSTs:

Let’s understand these benefits with an example of Alice and Bob:

- LSTs (Liquid Staking Tokens) offer a significant advantage over traditional staking by allowing users to retain flexibility. For example, Alice stakes 10 ETH on Lido and receives 10 stETH. She can now use these stETH tokens as collateral to borrow funds or participate in liquidity pools, effectively earning rewards from both staking and DeFi activities. This dual income potential increases her overall returns.

- In traditional staking, if a validator misbehaves, users like Bob face the risk of slashing, where part of his staked ETH is forfeited. However, with Lido, the risk is mitigated by distributing stakes across multiple validators, ensuring better security and performance, and making liquid staking a safer and more profitable choice.

In 2025, the liquid staking market is expected to expand as more protocols adopt LSTs, and new use cases emerge for liquid tokens in DeFi. As Ethereum transitions further into Proof of Stake (PoS), the demand for liquid staking services is expected to rise, making LSTs a vital part of the DeFi ecosystem.

4- Crypto Bridges:

Crypto bridges have become an integral part of the blockchain space. These bridges assist in the transfer of assets and data into different blockchain ecosystems. With the rise of multiple layer 1 and layer 2 blockchains, including Ethereum, Solana, Avalanche, and Polygon, there’s a growing need for seamless asset transfers across networks. Crypto bridges enable this interoperability, creating a more connected and liquid DeFi ecosystem.

Functionality and Importance:

Without the advent of cross-chain interoperability, users were limited to transacting within a single blockchain’s ecosystem which restricts liquidity and opportunities for arbitrage. Bridges allow assets to be moved between different blockchain seamlessly. This facilitates cross-chain liquidity and improves DeFi’s capital efficiency.

Polygon’s bridge allows users to transfer ERC-20 tokens from Ethereum to Polygon. The Ethereum network often has high gas fees due to network congestion but by moving assets to Polygon, transaction costs are cut and users can retain access to Ethereum-based DeFi applications.

Statistics:

As of 2025, cross-chain bridges are facilitating billions of dollars in transactions daily. Bridges are being used more and more, particularly between Ethereum and its layer 2 solutions like Arbitrum and Optimism. This has been a key driver of DeFi’s growth. These bridges improve capital efficiency by allowing users to tap into the liquidity of multiple blockchains.

The continued growth of bridges will be critical for the development of DeFi. With the passage of time, more sophisticated interoperable systems will be made which would mean more robust markets, greater liquidity, and enhanced user experiences.

5- Intent-based Systems:

Intent-based systems are a huge step in improving user experience within DeFi. Users usually enter the transaction parameters manually, but with intent-based systems, users just need to specify the outcomes. So, in layman terms, these systems focus on the ‘what’ part, not the ‘how’.

For example, a user could state that they want to trade a specific amount of ETH for the best possible price across multiple exchanges, and the system will execute the transaction automatically without needing further input.

AI agents play an important role in intent based systems as they function as autonomous programs designed to execute predefined instructions within blockchain networks.

They analyze real-time data to detect optimal trading opportunities, execute trades with precision, and optimize lending and borrowing strategies. This automation reduces slippage, enhances profitability, and improves overall market efficiency.

How it Works:

Intent-based systems are designed to decrease the complexity in DeFi transactions. Instead of requiring users to input every parameter such as slippage tolerance, gas fees, and platform choice, intent-based systems simplify the process. The system will automatically determine the best routes, platforms, and times to execute the transaction based on the user’s specific intent.

UniswapX is one such system that enhances liquidity routing across fragmented pools by allowing users to define their desired outcome (e.g., the best price) without setting individual parameters.

Market Potential:

These systems are gaining widespread acceptance. With the ability to simplify DeFi for the average user, intent-based systems have the potential to drive mass adoption since they make DeFi more accessible to those who are unfamiliar with complex blockchain mechanisms.

6- Decentralized Stablecoins:

Decentralized stablecoins are a very important part of DeFi. They work as a stable medium of exchange that is not dependent on traditional banking systems. When compared to centralized stablecoins like USDT and USDC, the decentralized approach in stablecoins usually means that the coins are collaterally bound to crypto assets and issued through a decentralized protocol.

Growth and Importance:

The world’s most popular decentralized stablecoin, DAI, reaches a value of over $6.2 billion in assets. Other projects like Frax and Liquity are experimenting with new models that blend algorithmic mechanisms with over-collateralization, ensuring greater stability.

With the rise of regulatory scrutiny of centralized stablecoins, decentralized stablecoins are gaining more popularity, especially in jurisdictions where these centralized versions are set to experience legal challenges. This gives them more resilience against censorship and aligns much better with the nature of DeFi.

Decentralized stablecoins will play an even larger role, especially in light of the increased regulatory challenges faced by their centralized counterparts. Yield-bearing stablecoins are expected to see a surge in demand as users seek both stability and passive income.

Key Takeaways:

- Tokenization of RWAs plays an important role in connecting traditional finance with DeFi. They offer fractional ownership and increased liquidity.

- Liquid Staking Tokens (LSTs) offer staking flexibility, allowing users to participate in DeFi while earning staking rewards.

- Crypto Bridges facilitate cross-chain interoperability, improving liquidity and transaction efficiency across multiple blockchains.

- Intent-based Systems simplify complex DeFi transactions, focusing on user-specified outcomes rather than technical parameters.

- Decentralized Stablecoins offer a censorship-resistant and resilient alternative to centralized stablecoins, growing in importance amid regulatory scrutiny.

Conclusion:

The DeFi landscape in 2025 is evolving with groundbreaking trends that expand the ecosystem’s accessibility, liquidity, and user-friendliness. DeFi is gaining popularity and acceptance and is constantly breaking its limit to reshape the future of the financial landscape. DeFi faces certain challenges such as composability, user experience, and liquidity fragmentations but as the DeFi market continues to grow, new solutions are expected to rise.

By integrating cutting-edge DeFi technology and providing robust security for decentralized platforms, BlockApex can play a pivotal role in shaping the future of decentralized finance.