Over the years, DeFi lending platforms emerged as pillars of the decentralized finance ecosystem changing the way people and organizations raise credit without intermediaries. With the development of these platforms, unprecedented opportunities are offered along with the issues in the fast-changing landscapes of finance. This article will discuss the top ten DeFi lending projects that are shaping the future of finance in the areas of innovation, market impact, and contribution to the larger crypto economy.

Decentralized Finance (DeFi) is redefining traditional financial services by removing intermediaries and empowering users with greater control over their assets.

Brief Overview of DeFi Lending:

- DeFi lending enables users to borrow and lend digital assets without the need for intermediaries like banks.

- DeFi lending platforms are powered by smart contracts that offer open and permissionless access to financial services, allowing users to collateralize their assets and earn interest or obtain loans.

- Its benefits such as transparency, lower costs, global accessibility, and opportunities for passive income through yield farming and staking allow such platforms to attract users.

- DeFi lending is democratizing access to credit and becoming a cornerstone of the decentralized finance landscape.

2025 Market Context:

- DeFi lending has experienced phenomenal growth over the years due to its technological advancements and evolving market dynamics.

- DeFi lending has become more accessible to a wider audience due to its integration of Layer 2 solutions and cross-chain interoperability which has enhanced scalability and reduced transaction costs.

- Regulatory frameworks have also begun to take shape since governments worldwide are seeking to balance innovation with consumer protection.

- The security and reliability of DeFi lending platforms have also been further solidified with the recent introduction of decentralized identity solutions and more improved Oracle systems.

Selection Criteria Used:

Using the specific DeFi lending platform based on one’s requirements is crucial. The criteria we have used to determine the top DeFi lending platforms are given below:

-

Security

Solid security measures and regular audits are crucial in evaluating the trustworthiness of the platform.

-

APY (Annual Percentage Yield)

APY is the interest rate offered on different cryptocurrencies, including variations based on lock-in periods and staking.

-

User Experience

The platform should be easy to use with an attractive user interface and availability of features for both beginners and advanced users.

-

Flexibility

Whether the platform offers flexible or fixed-term lending options, and how these impact APY and user convenience.

-

Supported Cryptocurrencies

The variety and quality of cryptocurrencies supported, including major tokens like Bitcoin and Ethereum, as well as stablecoins.

-

Liquidity

The platform’s ability to handle large amounts of transactions without slippage ensures that users can lend and borrow efficiently.

-

Regulatory Compliance

Adherence to legal and regulatory standards, including KYC (Know Your Customer) protocols, enhances platform credibility.

-

Innovative Features

Additional features such as uncollateralized loans, perpetual lending pools, staking options, and integration with other DeFi services provide users with more utility and control.

Top 10 DeFi Lending Platforms in 2025

Following are the top 10 DeFi lending platforms in 2025 based on the selection criteria described above:

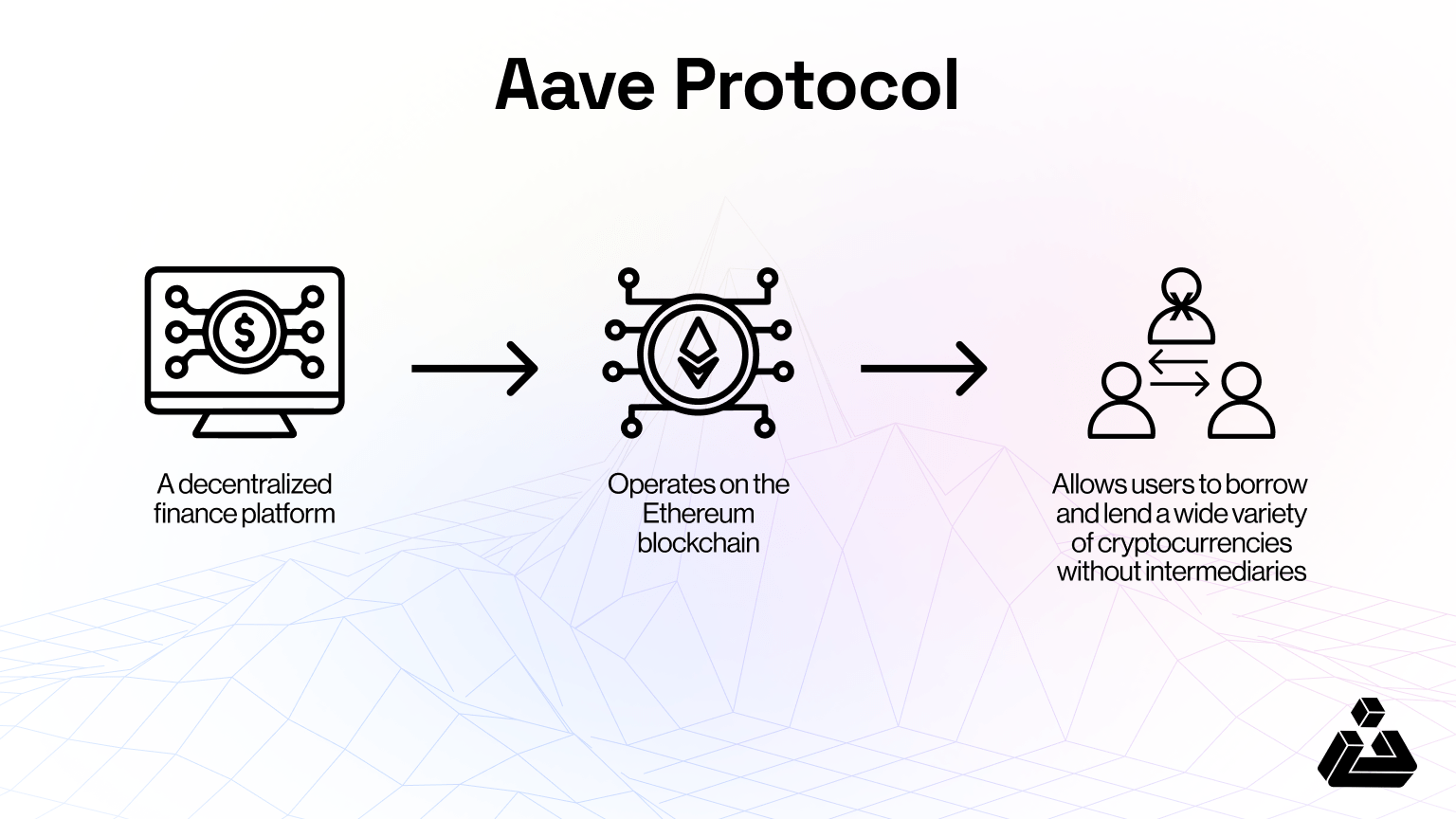

1- Aave

- Overview: Aave is widely known as one of the pioneers of DeFi Lending. It is a decentralized liquidity protocol where users can lend or borrow assets. It introduced features such as flash loans which allow users to borrow assets without collateral but they need to return the borrowed fund within a single transaction block. Its multi-chain support and governance model aligns well with the security and decentralization criteria.

- APY: Up to 15% on Ethereum but varies depending on the asset and market conditions.

- Key Features: Aave offers features such as uncollateralized flash loans, liquidity pools, multi-collateral support, and solid governance with the AAVE token.

- Blockchain Used: It uses Ethereum but also offers multi-chain support.

- Pros: High security, a wide range of assets, no KYC and flash loans.

- Cons: Quite complex for beginners and gas fees can be high on the Ethereum network.

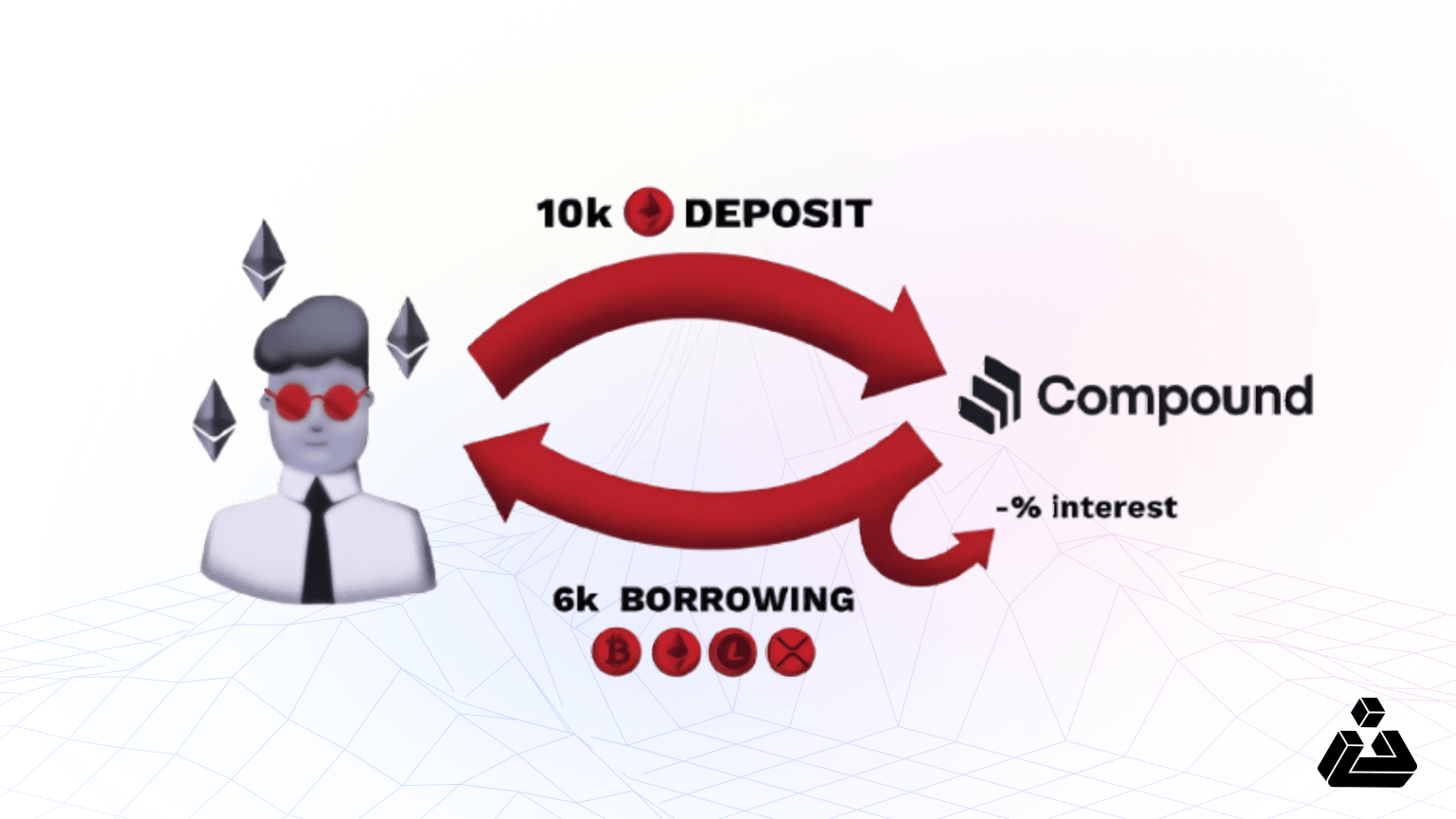

2- Compound

- Overview: Compound’s user-friendly interface and strong governance using COMP tokens made it a clear choice. It allows users to earn interest or borrow assets by supplying collateral to liquidity pools. The decentralized structure of the Compound allows users the surety that they have full control over their assets.

- APY: Typically between 2-7%, varying by asset.

- Key Features: Compound offers important features such as automated interest rate adjustments, governance through COMP token, and deep integration with other DeFi platforms.

- Blockchain Used: Ethereum is used in Compound.

- Pros: It is an established platform with a strong track record, and allows decentralized governance and a wide range of assets.

- Cons: Interest rates can be volatile on Compound and high gas fees are also a major drawback.

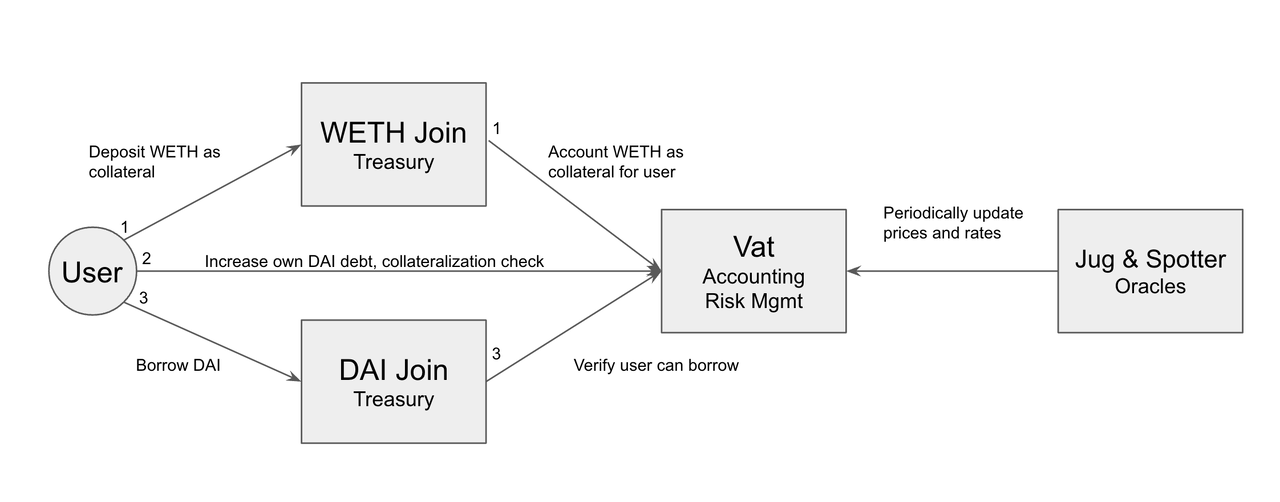

3- MakerDAO

- Overview: MakerDAO is one of the major players in DeFi lending and is well known for its stablecoin, DAI. MakerDAO was selected for its stability and governance features. Users can lock up collateral to mint DAI, which can be used across the DeFi ecosystem. MakerDAO’s decentralized governance model enables all MKR token holders to participate in decision-making processes.

- APY: Relatively low APY offered because the higher focus is on stability.

- Key Features: MakerDAO has a stability-focused design, it offers DAI minting and decentralized governance via MKR token.

- Blockchain Used: Based on Ethereum blockchain.

- Pros: It provides high security and is backed by a strong governance mechanism.

- Cons: Drawbacks include lower APY as compared to other platforms and higher complexity in managing collateral.

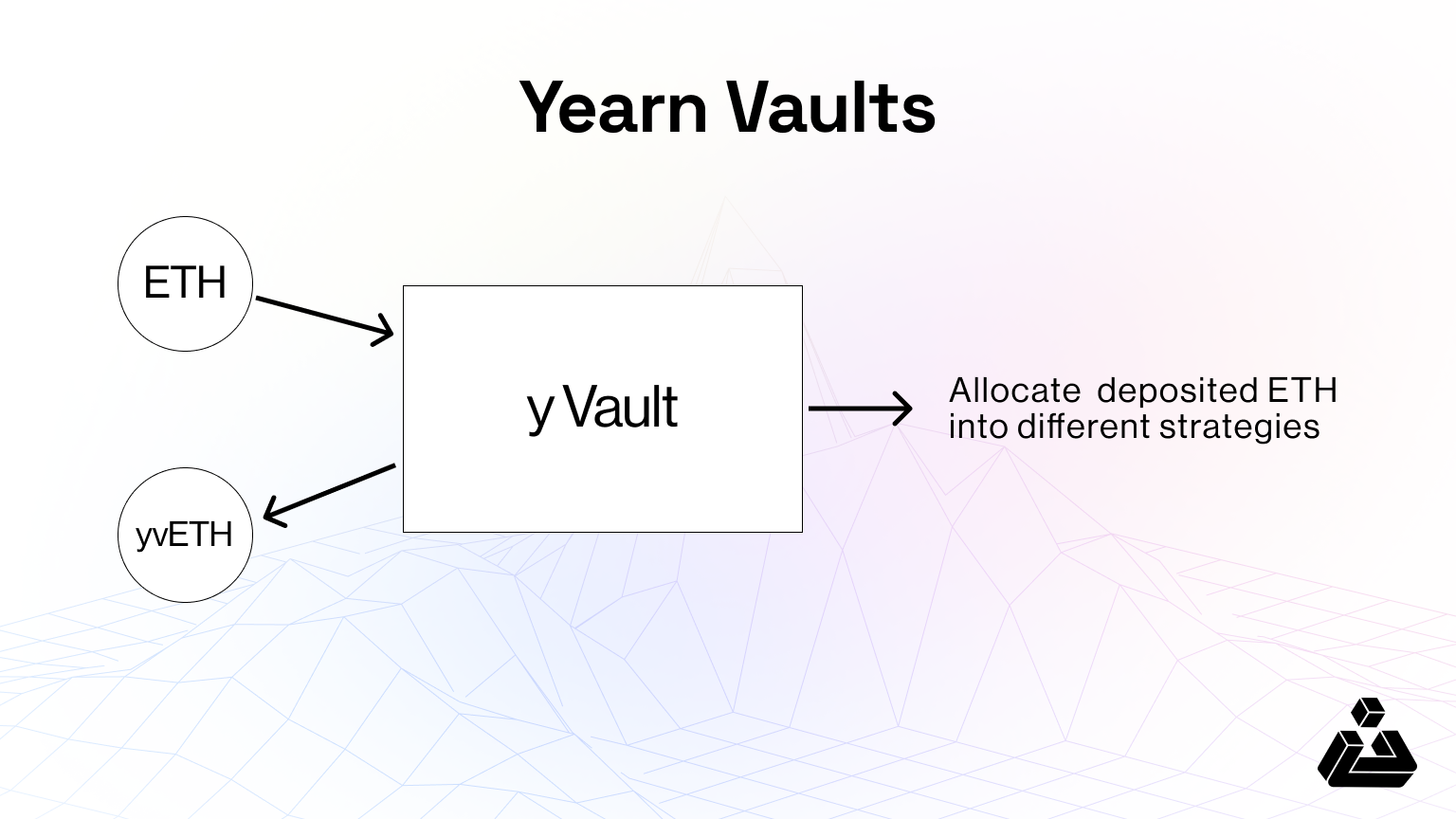

4- YearnFinance

- Overview: YearnFinance’s ability to automate yield farming and optimize returns across DeFi protocols helped it score high on automation and return maximization.

- APY: Its APY varies as it depends on the strategy being used.

- Key Features: It offers features such as automated yield optimization, easy-to-use vaults, and complex strategies for maximizing returns.

- Blockchain Used: Ethereum is used but it also supports other chains like Fantom.

- Pros: It attracts a large user base with its high potential returns, automation which reduces the need for constant management, and its strong democratic platform.

- Cons: The strategies included are quite complex for beginners and it has a higher gas fee.

5- Nexo

- Overview: Nexo’s high APY and user-friendly features scored well on ease of use and interest rates. The platform’s insurance on assets also ensures strong security. Its token, NEXO, offers users additional benefits and rewards.

- APY: Up to 16% but varies depending on the loyalty tier and asset.

- Key Features: Provides a wide range of features such as insured assets, flexible lock-in periods, and a comprehensive loyalty program.

- Blockchain Used: Nexo supports a variety of blockchains such as Ethereum and Bitcoin.

- Pros: It provides instant access to funds, high interest rates, and insurance on assets.

- Cons: It is a centralized platform which often comes with security and regulatory risks.

6- Binance

- Overview: Binance is often recognized as one of the biggest cryptocurrency exchanges. Binance’s integration with its exchange, high liquidity, and user-friendly features were the main reasons for its inclusion. The platform’s broad blockchain support, use cases, academic material, and reputation also align well with security and usability criteria.

- APY: APY varies with higher rates for longer lock-in periods.

- Key Features: It offers high liquidity, staking options, and integration with a broad ecosystem.

- Blockchain Used: The platform uses Binance Smart Chain (BSC) along with support for multiple other chains.

- Pros: Availability of a wider range of cryptocurrencies, high liquidity, solid security, and more user-friendly features make it stand out.

- Cons: Binance is not a completely decentralized platform and it has certain regulatory risks.

7- Celsius Network

- Overview: Celsius was chosen for its strong user trust, high interest rates, and wide selection of supported cryptocurrencies. Despite being centralized, its high-security focus and no-fee structure empowered it to enter this list.

- APY: The platform offers up to 17% on stablecoins.

- Key Features: It offers weekly interest payments, zero fees, and insured assets.

- Blockchain Used: It supports multiple blockchains including Bitcoin and Ethereum.

- Pros: Its main attractions are high interest rates, user-friendliness, and insurance on deposits.

- Cons: Its recent regulatory struggles and centralized nature may be less appealing for some users.

8- CoinRabbit

- Overview: CoinRabbit’s simplicity, security, and daily interest model fit well within the selection criteria for user-friendliness and security. CoinRabbit allows users to earn daily interest on their crypto assets, making it a convenient choice for those looking to generate passive income without dealing with complex processes.

- APY: It offers 5% APY on all supported assets.

- Key Features: It includes cold storage security, a simple user interface, and minimum KYC requirements.

- Blockchain Used: It supports a variety of blockchains including Ethereum and Binance Smart Chain.

- Pros: Its user-friendliness, strong security background,d, and consistent APY allow it to excel.

- Cons: It has a relatively lower number of features as compared to other platforms and a lesser overall APY.

9- Aqru

- Overview: Aqru’s focus on security and ease of use, combined with its no-lock-in policy, helped it score well on security and user-friendliness. Its multi-layered insurance and no-lock period offer flexibility.

- APY: It offers up to 10% APY on stablecoins.

- Key Features: Some of its features include no lock-in period, multi-layered deposit insurance, and an intuitive onboarding process.

- Blockchain Used: It supports multiple blockchains including Ethereum.

- Pros: It has high-security features, an interface that is easy to use, and no lock-in periods.

- Cons: It has lower APY on non-stablecoins when compared to other platforms and a limited asset variety.

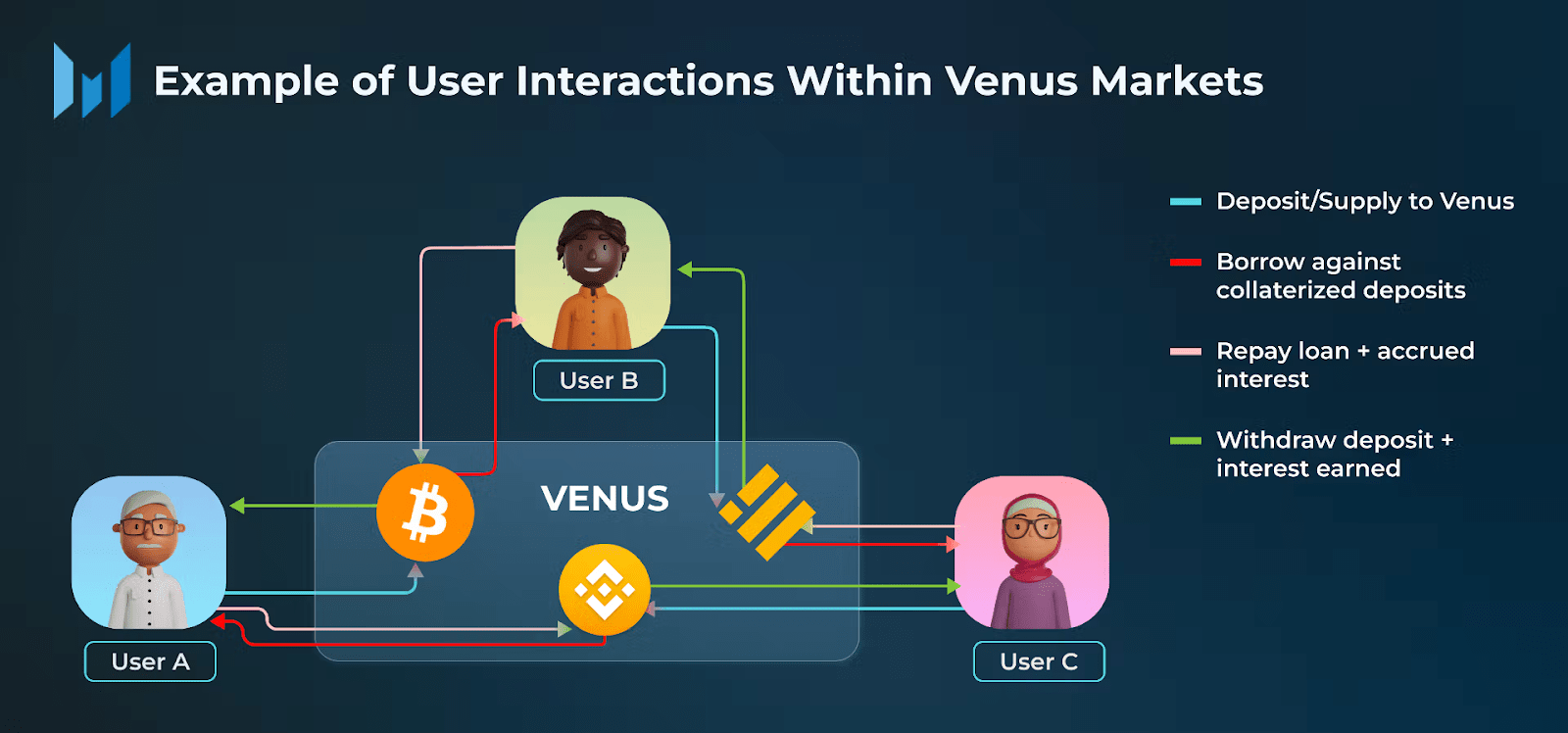

10- Venus

- Overview: Venus was selected for its decentralized nature, synthetic stablecoin minting, and high APY potential. Its use of the Binance Smart Chain allows for fast transactions and low fees, meeting the criteria for efficiency and scalability.

- APY: The APY depends on the market conditions and tokens.

- Key Features: It allows fast transactions with low fees and synthetic stablecoin minting.

- Blockchain Used: It uses Binance Smart Chain (BSC).

- Pros: It attracts users with its fast transactions, low fees, and high APY potential on certain assets.

- Cons: It is limited to BSC, which means there are limited asset choices and it is relatively new as compared to other platforms.

Challenges and Risks:

Even with its rapid growth and potential, DeFi lending platforms come with several challenges and risks. Some are below:

-

Security Hurdles

DeFi platforms rely on smart contracts, which, while efficient, can contain vulnerabilities or be exploited due to bugs or weaknesses in their code, leading to significant security risks. As the ecosystem grows, bigger risks come with it.

-

Regulatory Uncertainty

The legal framework for DeFi is still evolving as governments around the world take different approaches to regulation. This uncertainty can lead to potential legal risks for platforms and users, including restrictions on certain activities or assets.

In response to these challenges, hybrid platforms are emerging, striking a balance between decentralization and compliance. These platforms integrate decentralized identity (DID) protocols and decentralized KYC (Know Your Customer) frameworks to meet evolving regulatory demands while maintaining the core values of DeFi.

-

Liquidity Risks

Liquidity makes DeFi lending platforms operate effectively. However, when a sudden market shift or large transaction is executed, liquidity concerns are raised which impacts the ability to borrow or lend assets at favorable rates.

-

User Experience Challenges

DeFi platforms offer crucial advantages but they can be difficult for new users to work with, hence limiting wider adoption.

Future Trends

The emerging trends and future developments in the DeFi lending ecosystem are given below:

-

Layer 2 Solutions

Scalability issues and reduction of transaction costs can be addressed using layer 2 solutions such as Optimistic Rollups and zk-Rollups. Such solutions could make DeFi more accessible and efficient.

-

Cross-Chain Interoperability

As time passes and DeFi evolves, the ability to move assets easily across different chains will become more and more significant. This will lead to the rise of cross-chain protocols and bridges.

-

Decentralized Identity (DID) Solutions

Maintaining user privacy is crucial in today’s age and the integration of DID solutions will enhance security and preserve user privacy. This will attract more users to DeFi platforms.

-

Enhanced Governance Models

With the passage of time, governance models are expected to become more sophisticated, allowing for more community involvement and better decision-making processes.

-

AI-Driven Credit Scoring

Artificial intelligence enhances credit underwriting by analyzing diverse data sources, including transaction history and digital footprints, to assess borrower creditworthiness more accurately. This approach enables real-time decision-making and personalized credit assessments, reducing reliance on traditional credit checks.

-

Multi-Chain Yield Optimization

Platforms like Beefy Finance aggregate yields across multiple blockchains, allowing users to maximize returns by automating the compounding process. This multi-chain approach enhances liquidity and offers diversified investment opportunities.

-

Self-Repaying Loans

Self-repaying loans utilize DeFi protocols to generate returns that cover loan repayments. By leveraging yield farming and staking, borrowers can use the generated income to repay their loans, reducing the financial burden and promoting responsible borrowing

Key Takeaways

- DeFi platforms have become a significant part of the crypto ecosystem. They offer innovative solutions that do not require traditional financial intermediaries.

- Users have a variety of platforms to choose from, each with unique features, APYs, and risks, making it important to carefully evaluate options based on personal needs and risk tolerance.

- DeFi comes with its challenges as well which cannot be overlooked. These include security risks, regulatory uncertainty, and liquidity risks.

- With the advancements in technology, the future of DeFi lending looks promising. Layer 2 solutions and better governance are the driving forces for further growth and adoption.

Conclusion

Financial services have been revolutionized by DeFi lending platforms, offering decentralized, transparent, and accessible alternatives to traditional banking. These platforms are transforming the financial landscape by introducing innovative solutions like AI-driven credit scoring, multi-chain yield optimization, and self-repaying loans.

Despite challenges such as scalability, security, and regulatory uncertainty, the continuous evolution of technology promises to reshape the future of DeFi. BlockApex stands at the forefront of this revolution, providing specialized services like smart contract audits tailored for DeFi lending, tokenomics support with custom strategies for governance and sustainability, and DeFi 2.0 expertise focused on optimizing composability and integrating Real-World Assets (RWAs).

With our expertise, we ensure the security, efficiency, and growth of your DeFi projects. Contact BlockApex today to consult and secure your future in the decentralized financial ecosystem.