The convergence of AI agents and blockchain can create a decentralized infrastructure for secure autonomous systems. Autonomous worlds are ecosystems where AI agents perform tasks independently, interacting with each other and the environment without direct human oversight.

Think of it as an AI agent solely operating on a centralized network as a virtual assistant designed for personalized financial advice. AI agents will be able to quickly analyze user data, market trends and patterns, and financial goals to recommend investments or saving strategies.

But when this same AI agent is deployed onto a decentralized blockchain network, it ensures financial data is stored securely and transparently on an immutable ledger. This setup ensures verifiable decision-making, building trust while protecting user data from tampering and breaches.

In this blog, we’ll explore the concept of AI agents and their integration with blockchain technology. We’ll also list the top-performing blockchains for deploying AI agents based on key evaluation criteria. Finally, we’ll discuss the challenges and future opportunities in this rapidly evolving space.

What are crypto AI agents?

Understanding the core concept behind crypto AI agents is vital before we delve into the use cases and elect suitable blockchains to deploy AI agents.

AI Agents are systems powered by LLMs (Large Language Models), AI/ML algorithms, and specific programs that execute independent tasks by processing vast datasets. These agents streamline workflows, improve productivity, and automate decision-making processes.

In the cryptocurrency world, AI agents act as automated solutions for performing key blockchain-based tasks, such as portfolio management, trading, staking, bridging, and on-chain analytics.

By leveraging blockchain’s decentralized infrastructure, AI agents can deliver secure, transparent, and rapid processing of transactions, reducing the reliance on human intervention.

Blockchain + AI Agent Integration: Key Benefits

1- Autonomy

AI agents perform tasks independently, advancing beyond basic command-response systems. Their decision-making mirrors human behavior, enabling complex operations and reducing chances of error.

2- Enhanced On-Chain Operations

AI agents optimize critical blockchain functions like automated trading, portfolio management, swapping and bridging, and on-chain analytics.

3- Enterprise Automation

Leading crypto firms leverage AI agents to automate repetitive, high-volume tasks like market analysis, trade execution, and operational scaling.

4- Transparency and Security

Operating on blockchain protocols, AI agents ensure:

- Immutability: Actions are stored as tamper-proof, verifiable records.

- Trustless Execution: Reduced reliance on centralized intermediaries for secure operations.

- MEV Optimization: Minimized front-running and transaction inefficiencies for better performance.

Use cases of AI agents in crypto

1- Market Monitoring & Analysis

AI agents analyze real-time market trends, price fluctuations, and trading sentiment to identify opportunities and optimize decision-making.

Examples:

- Glassnode: AI-powered advanced analysis

- Nansen: AI-powered crypto wallet and transaction tracking.

2- Automated Trading

AI agents autonomously execute trades based on preprogrammed or adaptive AI-driven strategies, reducing manual intervention and human error.

Example: 3Commas and Ku coin both have AI-assisted trading bots

3- On-Chain Availability

Operating 24/7 without downtime, AI agents ensure continuous execution of tasks like transaction monitoring, ensuring efficiency and reliability in decentralized systems.

Examples:

- Chainalysis: Uses AI for blockchain forensics and transaction tracking

- Dune Analytics: AI-assisted blockchain data querying and visualization

4- DeFi and CEX Integration

AI agents manage liquidity, automate staking, and facilitate smooth swaps across decentralized finance (DeFi) platforms and centralized exchanges (CEXs).

For instance, Yearn Finance is automated yield optimization with intelligent asset allocation

5- Portfolio Management

AI agents monitor asset performance, rebalance portfolios, and recommend strategies based on market conditions to maximize returns.

Balancer is a good example of smart portfolio management and liquidity provision

6- Bots in Games

Bots in blockchain-powered games are just getting started. Crypto games can construct AI-powered avatars that have their wallets and interact with each other, creating a living and breathing ecosystem.

The Sandbox and Decentraland allow programmable bots to engage in player-driven economies.

7- Bots in Social Apps

These bots can chat with real people, performing on-chain actions and transactions, making the experience more interactive.

Some blockchain communities use Telegram bots for real-time trading or tracking wallets.

Bridging the Gap: The Trillion-Dollar Opportunity

As AI agents take center stage in digital interactions, they will require robust financial systems to facilitate payments between agents, purchase services, and even pay humans. Traditional financial infrastructures are struggling to meet these demands.

Here’s why:

- Credit card fees range from 2-3%.

- Settlement times can take days.

- Anti-fraud systems are designed to block, not enable, automated transactions.

- 2FA (Two-Factor Authentication) disrupts seamless, autonomous operations.

These limitations in traditional payment systems present a massive opportunity for crypto to fill the gap in an agent-powered economy.

Three Key Trends Emerging in AI and Blockchain Integration

At the intersection of AI agents and blockchain, several new trends are beginning to emerge:

- Accessibility Agents: These agents simplify complex blockchain tasks, streamlining everything from DeFi strategies to NFT trading.

- Social Agents with Tokens: New models for community engagement are being created through social agents, fueling speculation and creating value-driven ecosystems.

- Agent-Native Financial Rails: Development of financial systems tailored for API-first, autonomous transactions, providing a seamless and efficient way for agents to operate.

These trends are setting the stage for a revolutionary shift in how agents and digital economies function, making crypto a crucial element in the future of financial transactions.

Top-performing blockchains for deploying AI agents

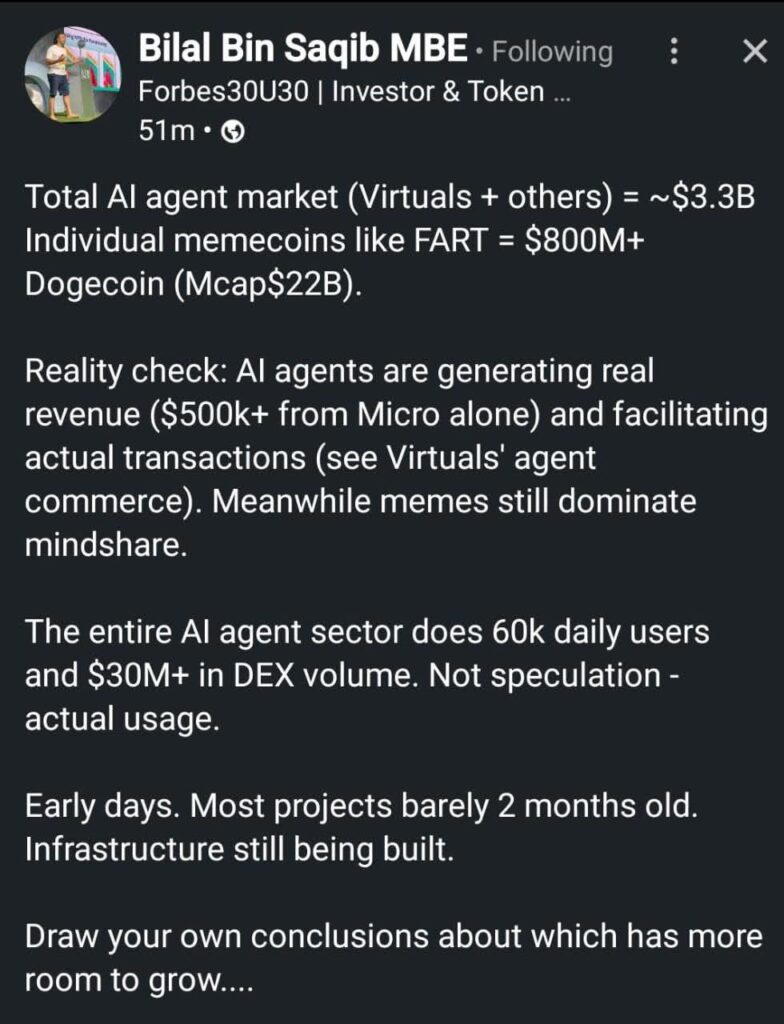

The role of AI agents in blockchain space is continually growing and generating real revenue. As stated in the LinkedIn post below, AI agents currently serve 60k daily users and process $30M+ in decentralized exchange (DEX) volume, reflecting their active role in automated trading and on-chain activities.

Most projects are less than two months old, indicating this integration is in its infancy but holds massive potential as the infrastructure continues to develop. Blockchain protocols provide the ideal foundation (e.g., security, transparency, automation) to enable and scale AI agent autonomy.

Before we explore a few top blockchains to deploy AI agents, we need to thoroughly study the key evaluation metrics as blockchain ecosystems with higher liquidity, bandwidth, and security are likely to see the most efficient AI agent deployment.

Key Metrics:

- Liquidity: The ease with which assets can be exchanged without significantly affecting their price. High liquidity ensures that AI agents can execute large transactions efficiently, which is vital for real-time operations like automated trading.

- Bandwidth: The network’s capacity to process transactions within a given time frame. Higher bandwidth allows AI agents to handle substantial data flows and execute numerous transactions swiftly, which is essential for tasks like market analysis and portfolio management.

- Security: Measures the network’s ability to protect against attacks and ensure data integrity. Robust security is critical for AI agents to operate without risk of data breaches or tampering, maintaining trust in automated processes.

- Maximal Extractable Value (MEV): The maximum value that can be extracted by reordering, including, or excluding transactions within blockchain blocks. High MEV can lead to unfair advantages and inefficiencies, so minimizing MEV is important for the fair operation of AI agents

1) Solana

Solana is positioning itself to be a key player in the agent-powered blockchain ecosystem, leveraging its unique infrastructure to support AI agents. Here’s how its features help deploy AI agents:

- Liquidity: Solana’s high throughput attracts significant trading activity, enhancing liquidity and making it an ideal platform for financial transactions by AI agents.

- Bandwidth: With the ability to process 4,800 transactions per second and handle 125 MB of data, Solana supports data-intensive AI operations, critical for real-time decision-making and autonomous actions by agents.

- Security: The Proof of Stake (PoS) mechanism ensures a secure environment for AI agents to operate without centralized control, ensuring safe transactions and data integrity.

- MEV Mitigation: Solana’s focus on reducing Maximal Extractable Value (MEV) issues through transaction reordering and front-running strategies improves fairness for AI agents and ensures secure, transparent operations.

Solana’s Push into the AI Agent Market:

Solana’s early AI agent activity focused on autonomous trading bots and complex on-chain transactions but has since shifted to meme agents and speculative tokens like $GOAT, driving viral engagement on crypto platforms. Solana’s infrastructure is well-positioned to provide the foundation for agent-native finance:

- Standardized Blinks API: Provides a unified interface for AI agents to interact with the blockchain, offering capabilities for trading, lending, and more.

- Developer Focus: Solana’s recent hackathons and collaboration with developer communities are creating a vibrant ecosystem for building AI agents.

- Transaction Speed: The sub-second transaction finality, with negligible fees, makes Solana a highly efficient platform for deploying AI agents in real-time applications.

Also Read: Is Solana Ready For TradFi?

2) Ethereum: Pioneering Smart Contract Capabilities for AI Agents

Ethereum remains a cornerstone in the blockchain space, providing robust support for the deployment of AI agents, especially through its smart contract capabilities.

- Liquidity: Ethereum’s vast ecosystem and high liquidity attract AI agents, facilitating efficient token exchanges and asset management.

- Bandwidth: Ethereum’s long-term goal is to reach approximately 100,000+ transactions per second (TPS) across both the mainnet and all Layer 2 solutions as part of the “Surge” phase of its roadmap, with the aim to support AI-intensive operations.

Currently, Ethereum processes only 12-15 TPS, which is relatively low, and handles just 0.08 MB of data per second.

- Security: Ethereum’s battle-tested Proof of Work (PoW) and transitioning Proof of Stake (PoS) consensus mechanism offer a secure environment for AI agents to execute decentralized tasks.

- MEV Mitigation: Ethereum’s ongoing updates, including EIP-1559, aim to reduce MEV and ensure fairness in AI-driven transactions.

Also Read: Ethereum’s Growing Pains

Ethereum’s Push into the AI Agent Market:

Ethereum’s AI agent ecosystem began with decentralized finance (DeFi) integrations, later expanding into AI-powered applications through smart contracts.

With Layer 2 scaling solutions like Optimism and Arbitrum, Ethereum is optimizing for AI-driven financial transactions. Ethereum’s vibrant ecosystem continues to attract developers to experiment with AI agents in DeFi, NFTs, and beyond.

- Smart Contracts: Ethereum’s extensive support for programmable contracts powers AI agents to interact autonomously with decentralized applications.

- Developer Focus: Ethereum’s large developer community and tools like Solidity have fostered rapid development of agent-based applications.

- Layer 2 Scaling: Layer 2 solutions enable Ethereum to handle more complex AI workloads with lower fees and higher throughput.

3) Polygon: Scaling AI Agent Ecosystems with Lower Costs

Polygon has positioned itself as the go-to platform for developers seeking to scale AI agent operations without Ethereum’s high transaction fees.

- Liquidity: Polygon’s integration with Ethereum’s liquidity pools makes it ideal for AI agents needing to tap into vast financial resources.

- Bandwidth: Polygon’s enhanced scalability allows for 65,000 transactions per second, providing the necessary speed for AI agents to act on data instantly.

- Security: Polygon benefits from Ethereum’s security model, utilizing PoS for a secure platform where AI agents can function with integrity.

- MEV Mitigation: Polygon’s reduced transaction times and layer 2 scalability enhance fairness and mitigate issues like front-running for AI agents.

Polygon’s Push into the AI Agent Market:

Polygon has been at the forefront of enhancing blockchain ecosystems for AI agents, with a focus on affordability and scalability.

As the platform continues to expand its ecosystem with DeFi, NFTs, and other decentralized applications, Polygon’s low-cost transactions make it an appealing choice for AI-driven agents.

- Polygon SDK: Polygon’s Software Development Kit (SDK) allows for the easy creation of custom blockchains tailored for AI applications.

- Developer Focus: Polygon’s grants and collaborations with AI-focused communities are accelerating the adoption of AI agents within decentralized ecosystems.

- Transaction Speed: Polygon’s high throughput, low fees, and fast finality enable real-time AI agent interactions across decentralized platforms.

The Blockchain Race for AI Agents: A Future of Autonomous Digital Economies

As AI agents become central to digital interactions, blockchain platforms are vying for dominance in this new era of decentralized automation:

- Solana has hosted multiple hackathons focused on AI agents, fueling innovation within its ecosystem.

- Base, developed by Coinbase, offers a Developer Kit to simplify agent integration and quickly attracts developer interest.

- Arbitrum and Polygon are investing heavily in agent-specific grants to enhance their ecosystems.

- Emerging platforms like Mode network and Skale are fostering AI agent communities.

- Autonolas networks, specializing in AI-powered Layer 2 EVM chains, are gaining traction.

The stakes are high—whichever chain becomes the go-to platform for agent-to-agent transactions could define the next era of digital commerce.

The Evolution of AI Agents: Wallets, Autonomy, and New Possibilities

AI agents are shifting from simple NPCs to fully autonomous entities capable of operating independently in digital economies. To do this, they need control over their own wallets and assets.

With the advent of crypto, AI agents can now transact autonomously, unlocking new opportunities. As they manage wallets and keys, use cases like AI-operated DePIN nodes in distributed energy systems, AI-powered games, and even AI-owned blockchains may emerge.

Also Read: Why DePIN Struggles to Achieve Mass Adoption?

Decentralized Autonomous Chatbots (DACs): A New Frontier

Decentralized autonomous chatbots (DACs) would leverage Trusted Execution Environments (TEEs) to ensure autonomy and prove they aren’t human-controlled.

DACs could create content, build followings on decentralized platforms, and generate income, all while managing their assets securely. With the potential to become billion-dollar entities, DACs could revolutionize digital engagement and redefine autonomous businesses.

The Need for Proof of Personhood

As AI-generated content increases, distinguishing real from fake becomes crucial. Robust “proof of personhood” systems will verify human interactions, safeguarding against impersonations and deepfakes.

By establishing privacy-preserving digital identities, these systems increase the cost of attacks, ensuring a trustworthy and secure digital environment. This “uniqueness property” or Sybil resistance is essential for the future of digital trust.

Conclusion

In conclusion, the rise of AI agents and decentralized autonomous systems marks a transformative shift in digital economies, unlocking new possibilities for both technology and business.

As the blockchain space continues to evolve, BlockApex stands at the forefront, leading innovation by bridging the gap between AI and blockchain, ensuring secure, transparent, and efficient solutions for the future. Reach out to us today!