‘’Yield farming is a high-risk, volatile investment strategy where an investor stakes, lends, borrows, or locks crypto assets on a decentralized finance platform to earn a higher return’’.

– Investopedia

What is Yield Farming?

Yield farming is a way to earn high returns – yields, on your cryptocurrency holdings by leveraging DeFi protocols. It’s like planting seeds – your crypto, in a virtual field – DeFi platform to harvest rewards – interest or additional crypto.

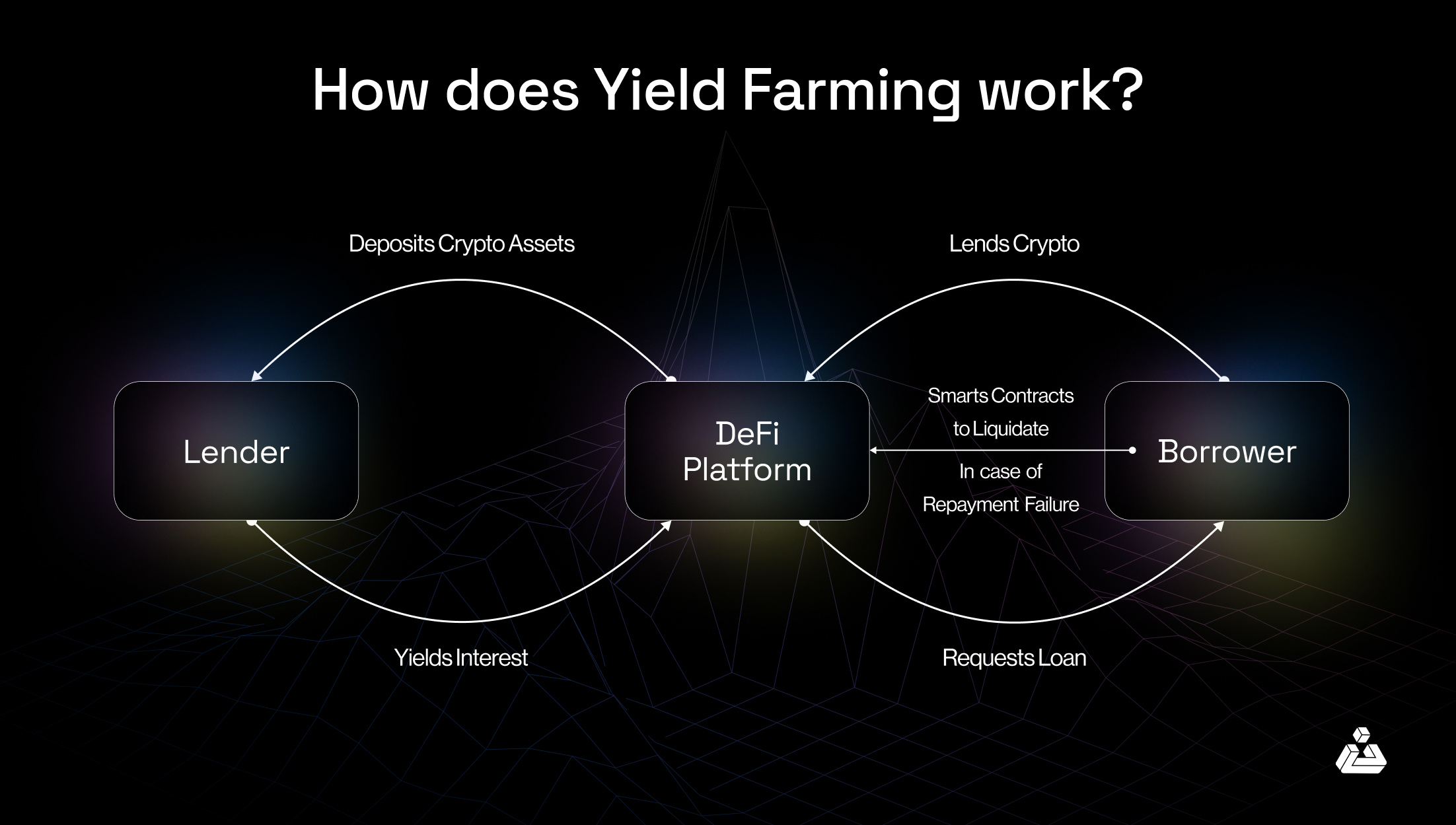

How Yield Farming Works?

Yield Farming is a cornerstone of the decentralized Finance (DeFi) ecosystem, offering crypto investors a way to earn high returns by leveraging various DeFi platforms. The process involves staking or lending crypto assets to generate rewards, which can significantly surpass traditional finance returns. Here is an outlook on how yield farming works.

Deposit:

You deposit your cryptocurrency into a decentralized application (dApp) or a liquidity pool.

Lend:

The dApp or liquidity pool uses your cryptocurrency to lend or stake it to other users, similar to how a bank lends money to customers.

Earn rewards:

In return, you earn a reward in the form of additional cryptocurrency.

Compounding:

The reward is usually a percentage of the total value of the cryptocurrency you deposited, and it can be earned daily, weekly, or monthly, depending on the specific dApp or liquidity pool.

Compound pioneered this phenomenon in the world of crypto assets. However, it was quickly realized that yield farming is not without risks.

Risks In Yield Farming

Yield farming, while offering the potential for high returns, comes with inherent risks that investors must carefully consider before diving in. Let’s delve into some of the biggest concerns:

Scams and Ponzi Schemes

- Deceptive Marketing and False Promises: The allure of high returns can make investors susceptible to scams disguised as legitimate yield farming projects. These schemes employ complex mechanisms and misleading marketing tactics to lure unsuspecting victims.

- Siphoning Funds and Pyramid Structures: Fraudulent actors may create smart contracts that appear to offer lucrative yields but ultimately steal funds or disappear. Others operate multi-level marketing schemes reliant on new investor participation to sustain payouts for existing members.

Smart Contract Vulnerabilities

- Coding Errors and Exploits: Yield farming protocols rely heavily on complex smart contracts to automate various functions. However, even well-written code can be susceptible to smart contract vulnerabilities. These attack vectors vary from reentrancy to flash loan exploits. These vulnerabilities can be exploited by malicious actors to steal funds or manipulate the protocol entirely.

- Auditing Challenges: Even well-audited contracts can be vulnerable to unforeseen attack vectors or zero-day exploits. Mitigating these risks requires constant vigilance, thorough audits, and adherence to secure coding practices.

Regulatory Uncertainty and Compliance Risks

- Gray Area and Evolving Regulations: The nascent and rapidly evolving nature of yield farming creates regulatory uncertainty. Yield farming activities may fall under the purview of financial regulations, but clear legal frameworks are often lacking. This ambiguity creates potential compliance risks for both farmers and platforms.

- Unclear Guidelines and Potential Restrictions: Unclear regulatory guidelines can lead to inadvertent violations of financial laws. As regulators grapple with this emerging trend, they may introduce stricter regulations that could impact the profitability of yield farming operations.

Liquidation Risk

When you borrow assets to amplify your yield farming gains, you put up collateral (your own crypto) to secure the loan. If the value of your collateral plummets, it might fall below a minimum threshold set by the protocol. This triggers a liquidation event, where your collateral is forcefully sold to repay the loan. This can be disastrous if the market dips sharply, leaving you with nothing but losses.

Impermanent Loss

Imagine you deposit your crypto into a liquidity pool to earn rewards. If the price of your deposited assets fluctuates significantly while they’re locked in the pool, you might experience impermanent loss. This doesn’t necessarily mean you’ve lost money permanently, but it means the value of your holdings upon withdrawal could be lower compared to simply holding the assets directly. Highly volatile or new tokens pose a greater risk of impermanent loss due to their unpredictable price movements.

Bubble Risk

The recent surge in the popularity of yield farming has caused some experts to be concerned about a potential bubble. If investor sentiment sours, a sudden drop in asset prices could lead to widespread losses across the DeFi ecosystem.

People indulge in yield farming because it does have benefits, let’s have a look at some of these benefits.

Benefits of Yield Farming

Yield farming offers several benefits, including:

- High Returns: Yield farming can offer high returns, often in the form of annualized percentage yields (APYs) of 100% or more.

- Flexibility: Yield farmers can switch between assets, protocols, and strategies to maximize returns.

- Diversification: Yield farming allows investors to diversify their portfolios by investing in different assets and protocols.

- Passive Income: When it comes to generating passive income in crypto, staking and yield farming present contrasting risk-reward options for investors.

Biggest Yield Farming Liquidations

Yield farming, a high-risk, high-return investment strategy, has seen its share of liquidation events. Here are some of the biggest ones:

Compound’s COMP Token Distribution

In November 2020, Compound, a leading DeFi lending protocol, experienced one of the largest liquidation events in DeFi history. The incident was triggered by a sharp drop in the price of DAI, a stablecoin.

- Cause: A sudden drop in the price of DAI below its $1 peg led to a cascading series of liquidations.

- Impact: Over $90 million worth of loans were liquidated in a short period, affecting numerous users.

- Outcome: The event highlighted the risks associated with stablecoin volatility and prompted discussions about better risk management mechanisms in DeFi protocols.

Aave (AAVE) Liquidations

Aave, another major DeFi lending platform, also experienced significant liquidation events:

- January 2021: A market correction led to large-scale liquidations on Aave. This was part of a broader market sell-off that affected multiple DeFi platforms.

- Impact: $23.26Millions of dollars worth of collateral were liquidated as prices of various cryptocurrencies plummeted.

- Outcome: These events underscored the importance of collateral management and the potential for rapid, large-scale liquidations in volatile markets.

Even today liquidations take place on a daily basis.

Source: https://www.theblock.co/data/decentralized-finance/cryptocurrency-lending/lending-market-liquidations-daily

Final Thoughts

Yield Farming is a double-edged sword. “Yield farming is like being paid to take on risk. The potential returns can be enormous, but so can the losses”. It’s crucial to understand the mechanics and the market you’re dealing with.

According to Defillama, the total TVL locked-in yield farming is approximately $7.173B across all platforms. With Pendle having a TVL of $3.373b, followed by $1.154b in Convex Finance. While the numbers give an outlook on how big the market of yield farming is, it is without a doubt a complex and advanced investment strategy that requires a deep understanding of DeFi and the risks involved. While it can offer high returns, it is essential to carefully assess the security and audit the protocols you choose to participate in or refer to a reputable blockchain consulting company, and exercise caution to minimize losses.

Before venturing into yield farming, conduct thorough research, understand the risks involved, and stay informed about evolving regulations to navigate this complex and potentially rewarding, but also risky, financial landscape.

FAQs

- Is Yield Farming Profitable?

Yield farming can be profitable, but it is only as profitable as the market allows. The cryptocurrency market, regardless of how it is used to make money, is very volatile.

- Is Yield Farming Risky?

Yes. Yield farming can generate great returns, but it can also cause significant losses.

- What Is Another Name for Yield Farming?

Yield farming is sometimes called yield mining.

- Staking vs Yield Farming?

Staking is simple, lock crypto for rewards. Yield Farming is more complex, using DeFi protocols for potentially higher rewards (and risks).

- What’s the yield in yield farming?

The rewards you earn for participating in DeFi protocols. These can be extra crypto tokens or interest payments.

Read More:

zkVM vs zkEVM: Comparison and Differences

Credit Card Tokenization Explained