In 2024, Solana emerged as a pivotal player in the blockchain landscape, garnering significant attention from traditional finance (TradFi) institutions. Its high scalability, low fees, and robust infrastructure have positioned it as a strong contender for integration into traditional financial systems.

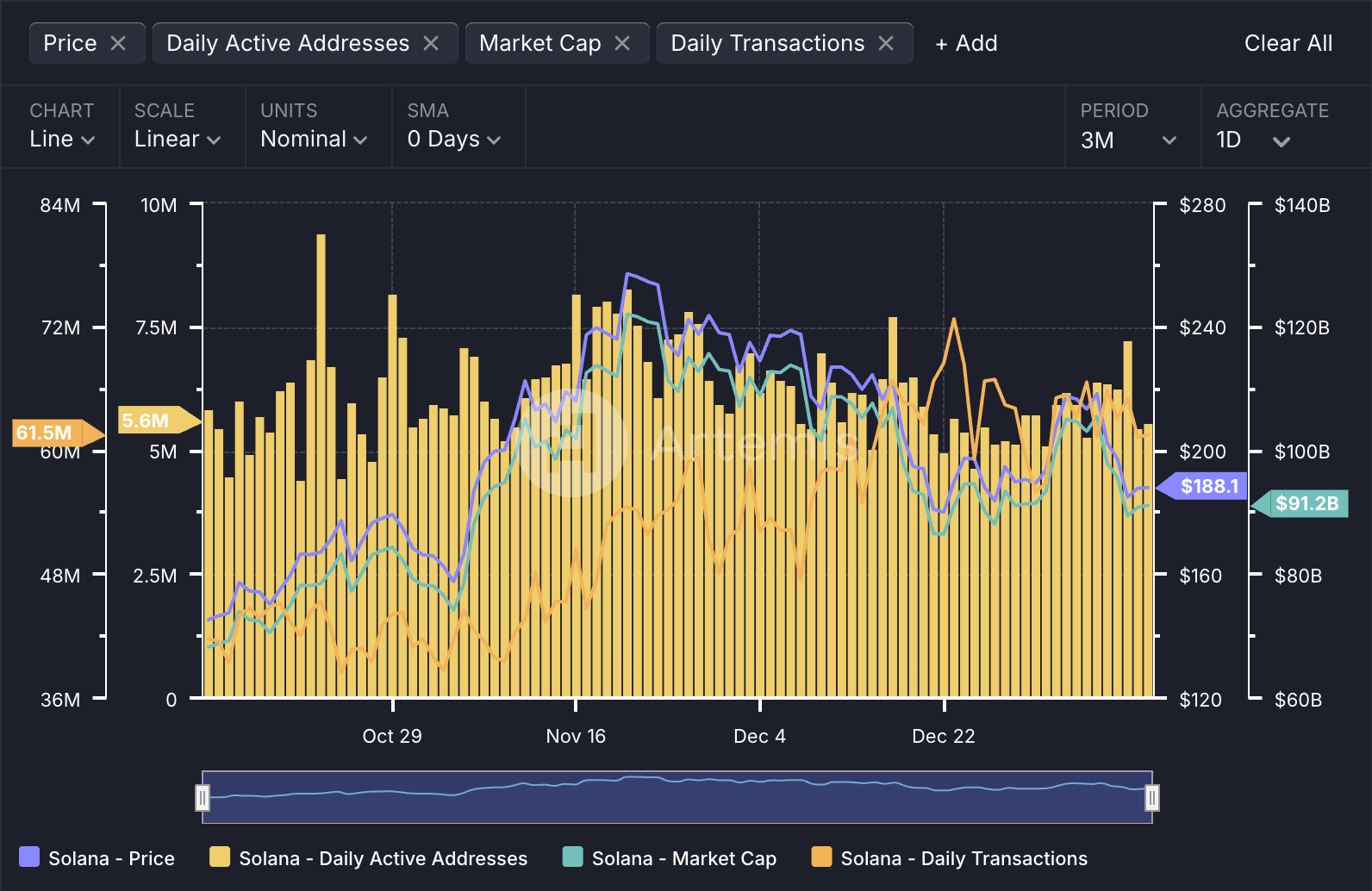

Solana is thriving with impressive metrics, including 61.5 million daily transactions and 5.6 million active addresses, demonstrating a vibrant ecosystem and growing user engagement. With a Market Cap of $91.2 billion, Solana showcases its robust DeFi presence and potential for continued expansion.

Source: Artemis (As of January 12, 2025)

The question now is: is Solana truly ready to support the rigorous demands of TradFi?

Technical Foundation

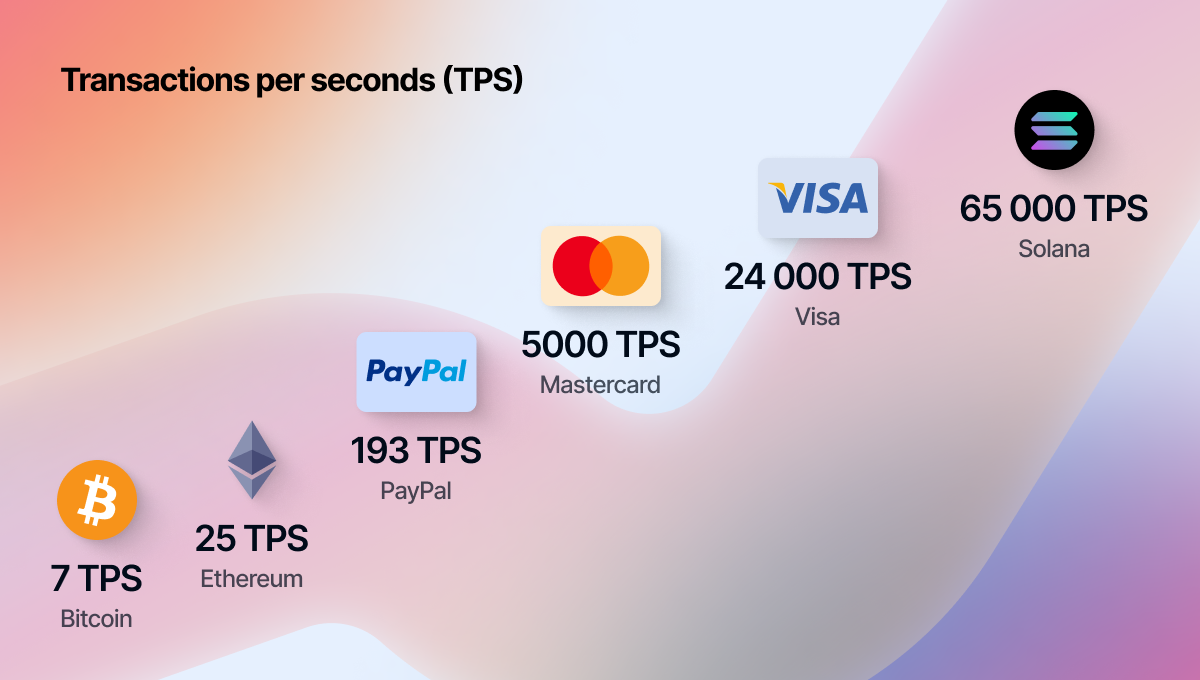

Solana’s technological foundation is a key factor in its appeal to financial institutions. The blockchain uses a unique Proof of History (PoH) consensus mechanism, which allows for high throughput and efficiency. With Solana processing over 2,000 transactions per second (TPS) and having remarkably low transaction costs, it outpaces many other blockchain networks, offering the scalability and cost-effectiveness that large-scale financial applications require.

This high-performance foundation is critical when considering traditional finance, where transaction speed and cost are essential. Traditional payment networks such as Visa and Mastercard handle millions of transactions daily, and Solana’s ability to process transactions with low fees and high speed places it in direct competition with these legacy systems. For financial institutions that have long been burdened with slow settlement times and high processing fees, Solana’s infrastructure offers a compelling solution to modernize and streamline financial operations.

Institutional Adoption Gains Momentum

As Solana’s technology continues to mature, its adoption by institutional players in the finance sector has gained significant momentum. A notable example of this is Franklin Templeton, a renowned asset management firm, which launched a mutual fund natively on Solana. This move not only demonstrates the blockchain’s scalability and low-cost advantages but also highlights the growing confidence in Solana as a platform capable of meeting the rigorous demands of institutional investors.

In addition to Franklin Templeton’s initiatives, Citigroup’s exploration of Solana for implementing smart contracts and facilitating cross-border transfers is a clear indicator of the blockchain’s potential in enhancing the efficiency of global financial operations. Citigroup’s interest underscores a broader trend in which major banks and financial institutions are recognizing blockchain’s capacity to reduce costs, increase transparency, and improve the speed of transactions. As more institutions explore Solana for financial services, it is evident that the blockchain is becoming a strong contender for mainstream TradFi adoption.

Stablecoins Support

One of the most significant indicators of Solana’s readiness for TradFi is its ability to support stablecoins and comply with regulatory standards. The launch of Societe Generale’s EUR CoinVertible (EURCV) stablecoin on Solana is a critical milestone in this regard. The EURCV is a MiCA-compliant stablecoin, designed to meet the stringent regulatory requirements for digital assets in the European Union. This not only signals Solana’s ability to support regulatory-compliant digital assets but also demonstrates that major financial institutions trust Solana’s infrastructure to handle stablecoin transactions securely and efficiently.

Furthermore, the integration of stablecoins like PYUSD from PayPal and USDC from Circle further solidifies Solana’s place in the TradFi ecosystem. PayPal’s decision to integrate its stablecoin onto Solana reflects a significant vote of confidence in the blockchain’s ability to manage large-scale digital payments. As stablecoins continue to serve as a bridge between traditional financial systems and decentralized finance (DeFi), Solana’s ability to integrate seamlessly with these digital currencies positions it as an attractive platform for financial institutions looking to bridge the gap between legacy finance and blockchain technology.

Performance Metrics: A TradFi Benchmark

To understand Solana’s readiness for traditional finance, it is important to compare its performance metrics with those of established financial systems. Payment networks like Visa, Mastercard, and SWIFT handle millions of transactions daily, and their infrastructure must meet stringent requirements for speed, reliability, and security. Solana’s ability to process transactions at a high speed, with near-instant settlement times, positions it as a viable alternative to these traditional systems.

Unlike traditional financial systems that are burdened with intermediaries, legacy processes, and high costs, Solana offers a streamlined, low-cost solution that meets the needs of modern financial systems. It now rivals Ethereum across key economic metrics, with SOL trading at just 33% of Ethereum’s valuation, reflecting its increasing influence.

The blockchain’s high throughput ensures that it can scale to handle the enormous transaction volumes associated with global finance. Whether it’s cross-border payments, securities trading, or payment settlements, Solana’s performance benchmarks align closely with the expectations of TradFi systems, making it a competitive option for financial institutions seeking to modernize their operations.

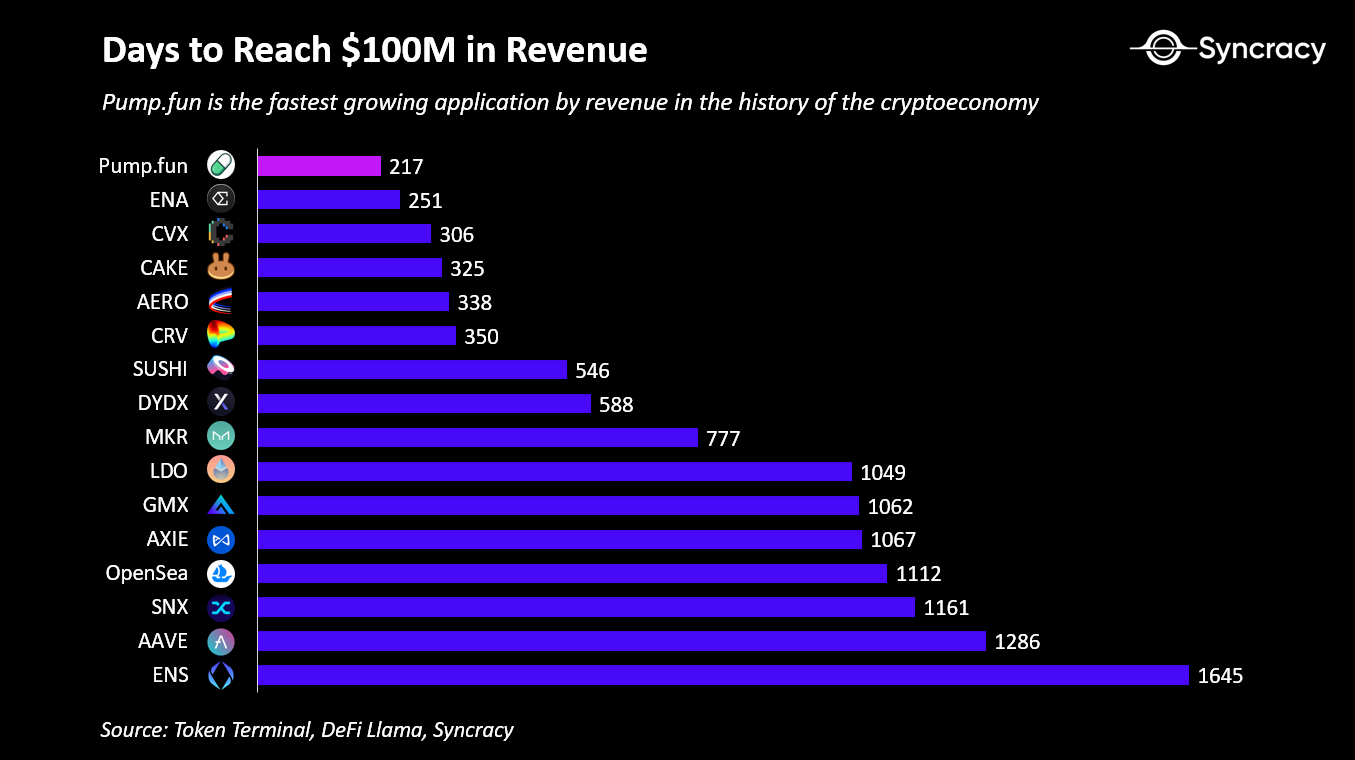

Solana’s growth is a powerful signal for developers, especially with the success of simple projects like Pump, which generated $100 million in revenue in just seven months. This highlights Solana’s potential for more complex applications. With minimal upfront costs, developers can create compelling experiences, while users cover operating costs through gas fees. Furthermore, Solana boasts nine application unicorns, including four non-financial DePIN projects, suggesting significant real-world impact.

Also Read: Why DePIN Struggles to Achieve Mass Adoption?

Supporting Structured Products

In addition to facilitating traditional payments and stablecoin transactions, Solana is also making strides in supporting more sophisticated financial products such as structured products. Structured products, which often involve complex combinations of bonds and options, are commonly used in TradFi for investment diversification. Solana’s programmable infrastructure is well-suited to support such products, allowing for the creation of decentralized alternatives to traditional investment vehicles.

Projects like Margarita Finance are leveraging Solana’s infrastructure to bring TradFi-style products into the blockchain ecosystem. By eliminating intermediaries, these products not only reduce costs but also improve accessibility, particularly for retail investors who may have previously been excluded from structured financial products.

“Margarita Finance is among those bringing TradFi’s “degen products” to Solana” – Blockworks

Margarita Finance’s use of Solana’s Token-2022 standard, for example, highlights the blockchain’s ability to handle sophisticated financial instruments while ensuring regulatory compliance. As Solana continues to support the development of these types of products, it strengthens its position as a robust platform for both institutional and retail investors.

Modularization for Scalability

Another critical aspect of Solana’s preparedness for TradFi is its approach to scalability through modularization. Drawing lessons from both traditional finance and other blockchain ecosystems like Ethereum, Solana has been developing a modular infrastructure that allows for greater scalability and flexibility. One notable development in this area is the use of appchains—application-specific blockchains that enhance scalability by allowing different applications to run independently while sharing the core benefits of Solana’s network.

This modular approach ensures that Solana can handle a wide range of financial applications, from high-frequency trading platforms to decentralized exchanges, while maintaining the high performance required by TradFi systems. Moreover, the interoperability of these appchains ensures that Solana can seamlessly integrate with other blockchain networks, further enhancing its appeal to financial institutions looking for a scalable, interoperable solution for their digital asset needs.

Also Read: Ethereum’s Growing Pains

Overcoming Challenges

Despite its progress, Solana’s integration into the TradFi ecosystem is not without its challenges. Regulatory hurdles, security concerns, and market adoption dynamics remain critical factors that could impact its widespread adoption. However, the Solana Foundation’s ongoing efforts to support innovation through grants and partnerships are helping to foster the development of projects that align with traditional financial systems’ needs. For example, initiatives like Obligate, which aims to bring on-chain bonds and structured products to the forefront, highlight Solana’s ability to support complex financial instruments while ensuring regulatory compliance.

As financial institutions continue to experiment with blockchain technology, the key challenge will be addressing the concerns around security, stability, and regulatory compliance. Solana’s ongoing focus on these issues—through robust security features, compliance with regulatory standards, and continuous network improvements—positions it as a blockchain that can address these challenges effectively.

Interested in Solana Smart Contract Security Audit?

Conclusion

The evidence is clear: Solana is not only ready for TradFi, but it is actively shaping its future for seamless integration with traditional financial systems. With increasing institutional interest from companies like Franklin Templeton, Citigroup, Societe Generale, and PayPal, Solana is positioning itself as a key player in the evolution of financial markets. Additionally, innovative projects like Margarita Finance bridge the gap between structured TradFi products and decentralized finance (DeFi), further solidifying Solana’s potential to transform the financial landscape.

At BlockApex, we recognize the importance of scalability, security, and performance in financial systems. Let our expertise guide your organization through blockchain integration with a focus on performance metrics that meet or exceed TradFi standards. As the line between traditional finance and decentralized finance blurs, Solana is poised to lead this transformation, offering a robust foundation for the next generation of financial products.