The Real World Asset tokenization sector has had a massive breakout during the year 2025, paving the way for significant growth through the end of the decade. RWA tokenization sector could see 50x growth by 2030.

It is now possible to digitize and represent practically any physical or non-digital asset on blockchain networks from commodities and real estate to artwork and intellectual property. Tokenization allows assets that were previously confined to traditional markets to have global accessibility, liquidity and transparency.

In this article, we’ll explore the top 10 RWA tokenization projects in 2025, highlighting how they are revolutionizing industries and enabling investors to tokenize real-world assets. We’ll also cover the benefits of RWA tokenization and how you can tokenize your own assets.

What are RWAs?

To grasp the concept of RWA tokenization, understanding the broader concept of tokenization is crucial. Tokenization is converting any kind of asset, whether it’s physical, intangible or financial into a digital token that can be traded on a blockchain.

This could include things like stocks, intellectual property, carbon credits or even digital representations of traditional assets. RWA tokenization is a specific type of tokenization, focusing on real-world assets, physical assets like real estate, commodities (gold, oil etc), bonds, commercial papers or artwork.

The aim is to take these tangible assets and represent them as digital tokens on blockchain making it possible for people to sell, buy, and trade portions of real world assets more easily and securely.

Benefits of RWAs

These benefits listed below make tokenized RWAs an attractive choice for investors and institutions, pushing traditional markers toward innovative blockchain solutions.

-

Programmability

Tokenization allows assets to have embedded rules, like automatic dividend payouts, voting rights or governance functions. This flexibility enhances investment options and opens the door to new financial products and markets.

-

Transparency

Blockchain based transactions are transparent and immutable meaning unalterable, reducing the potential for fraud or disputes. The clear tracking mechanism allows to build trust and accountability in asset ownership and transfers.

-

Global Accessibility

With tokenization, assets become accessible worldwide, enabling investors to trade around the clock and reach broader, global markets. Transactions become seamless due to reduced intermediary requirements.

-

Lower transaction costs

Tokenization minimizes reliance on intermediaries which lowers fees and makes transactions more cost-effective. Direct peer-to-peer transactions lower costs, especially in high fee markets like real estate and securities

-

Fractional Ownership

Investors can buy smaller portions of traditionally high value assets like real estate or art, lowering entry barriers and democratizing access to previously exclusive markets.

-

Efficient Settlements

Tokenized transactions are nearly instant, a significant improvement over traditional settlement systems, which can sometimes take several days. The faster settlement improves liquidity and asset accessibility.

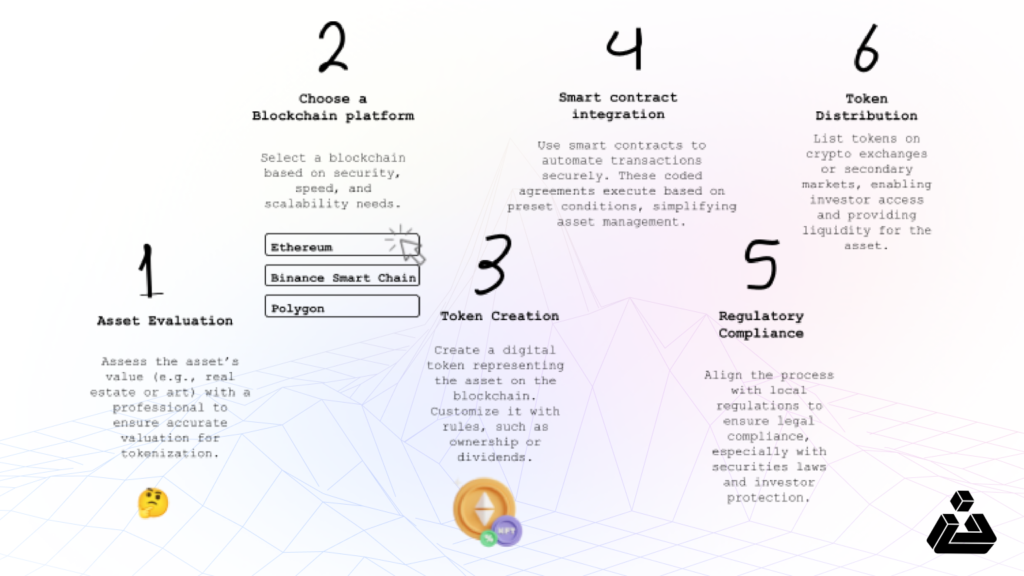

How to tokenize your Real World Assets

Top 10 RWA projects in 2025

Here are some top 10 RWA projects positioned according to their total value locked (TVL) to date:

1. MakerDAO (RWA Vaults)

TVL: $1.782 billion

Target Industry: Multiple, including real estate and trade finance

MakerDAO has one of the largest RWA vault systems, allowing real-world assets like real estate and invoices to be used as collateral to mint DAI, a decentralized stablecoin. This has made Maker a leader in integrating traditional assets into decentralized finance (DeFi) through tokenization.

2. Tether Gold (XAUt)

TVL: $6798.06 million

Target Industry: Precious metals (Gold)

Tether Gold represents ownership of physical gold, with each token backed by one troy ounce of gold. This RWA project allows investors to trade and hold tokenized gold, providing liquidity and easier access to this traditional asset class while benefiting from blockchain’s transparency.

3. Ondo Finance

TVL: $640.72 million

Target Industry: Investment funds, real estate, and fixed income

Ondo Finance specializes in tokenizing investment vehicles such as private credit and real estate, allowing investors to access fixed-income products and structured finance solutions. Ondo bridges traditional finance (TradFi) and decentralized finance by making these asset classes more accessible to DeFi users.

4. Paxos Gold (PAXG)

TVL: $542.03 million

Target Industry: Precious metals (Gold)

Similar to Tether Gold, Paxos Gold offers tokenized gold on the blockchain. Each PAXG token represents one troy ounce of physical gold stored in professional vaults. Paxos focuses on providing investors with a stable, trusted asset like gold in a highly liquid and tradable form on DeFi platforms.

5. BlackRock BUIDL

TVL: $523.54 million

Target Industry: Institutional investments

BlackRock BUIDL is an initiative by BlackRock, the world’s largest asset manager, to bring institutional-grade investment products onto blockchain platforms. This involves tokenizing traditional securities and assets, opening up decentralized markets to large institutional players.

6. Hashnote USYC

TVL: $387.65 million

Target Industry: Stablecoins

Hashnote USYC is a unique RWA token backed by U.S. Treasury yields, providing stable, regulated income through blockchain technology. The token allows investors to access traditional, low-volatility assets with blockchain transparency, offering a steady return backed by real-world financial instruments.

7. Franklin Templeton

TVL: $386.53 million

Target Industry: Institutional Funds

Franklin Templeton’s venture into blockchain includes tokenized shares of U.S. government-backed money market funds across multiple chains. The project is part of a broader initiative to integrate blockchain transparency with secure, stable investments, giving institutional investors a way to diversify with digital access to traditional assets.

8. Usual Money

TVL: $360.99 million

Target Industry: Stablecoin Infrastructure

Usual Money is a decentralized fiat-backed stablecoin issuer focused on transparency and community ownership. Through the $USUAL token, Usual redistributes value to its holders, emphasizing stability and accessibility as core principles in its approach to a secure, “un-tethered” stablecoin ecosystem.

9. Solv Protocol

TVL: $345.72 million

Target Industry: Bitcoin staking platform

Solv Protocol, backed by investors like Binance Labs and Blockchain Capital, is a leading Bitcoin staking platform powered by its Staking Abstraction Layer (SAL). Through its liquid staking tokens (SolvBTC.LSTs), Solv unlocks new yield opportunities for Bitcoin holders while maintaining liquidity. This innovation offers seamless entry into DeFi for Bitcoin assets, estimated at over $1 trillion, enabling diverse yield participation without liquidity compromise

10. Credix

TVL: $327.85 million

Target Industry: Private Credit Markets

Credix specializes in tokenized private credit, bringing on-chain finance solutions to emerging markets. The platform connects DeFi investors with high-yield, real-world credit opportunities, focusing on reducing entry barriers and improving access to traditionally exclusive credit markets through blockchain.

Conclusion

In conclusion, the tokenization of real-world assets (RWAs) is revolutionizing the future of finance, offering investors new ways to access and trade everything from real estate to fine art. This shift, driven by blockchain’s transparency, liquidity, and accessibility, offers benefits like programmability and lower transaction costs, while innovative projects continue to pave the way for broader market integration.

BlockApex, is at the forefront of blockchain innovation and is actively working towards the adoption of RWA. If you are looking for smart contract development services, follow our process and book a free consultation!