What is Berachain?

Berachain is a high performance, EVM-identical Layer 1 blockchain leveraging Proof of Liquidity (PoL) as its consensus mechanism. It is built using BeaconKit, a modular framework developed for CometBGT consensus into EVM-compatible execution environments. BeaconKit offers increased composability and features like single-slot finality (SSF), ensuring efficient block production and high throughput. This setup allows Berachain to utilize unmodified Ethereum execution clients, adopt the latest EVM upgrades, and maintain full compatibility with Ethereum’s tooling and infrastructure advancements.

Background

Berachain’s journey began in the DeFi summer of 2021 with the launch of Bong Bears, a collection of 100 NFTs. Following this initial success, the team expanded their offerings with derivative NFT collections and introduced rebasing mechanics, providing ongoing benefits to early holders and attracting a growing community. This DeFi native, highly engaged audience laid the foundation for the idea of creating Berachain, a Layer 1 blockchain designed to align the interests of validators, developers, and users. Originally coined as a meme, Berachain evolved into a serious project, currently progressing through the second phase of its testnet, with the mainnet launch slated for the end of the year.

Problems with the Traditional PoS Model

In the traditional Proof of Stake (PoS) model, validators stake native gas tokens as collateral to secure the network, earning rewards for their role in transaction processing. However, this model inherently lacks protocol level incentives for developers and users, limiting engagement and growth at the application layer. As a result, applications must design their own incentives, leading to a disconnect between the blockchain protocol and the dApps built on top of it.

This misalignment often results in the creation of “ghost chains”, blockchains with robust security but minimal real world activity. For instance, Cardano, despite being one of the top 10 blockchains by market cap with $6 billion staked for network security, has very low on-chain activity. Its Total Value Locked (TVL) stands at $195 million, placing it outside the top 25 blockchains in TVL, despite its market position. Other notable examples of ghost chains include NEAR, Celo, and Kadena. Each of these networks has significant capital staked for security, but the lack of active user engagement and developer-driven applications limits their broader adoption. These examples illustrate a fundamental issue: a secure L1 blockchain generates little value if no one is building on or using it.

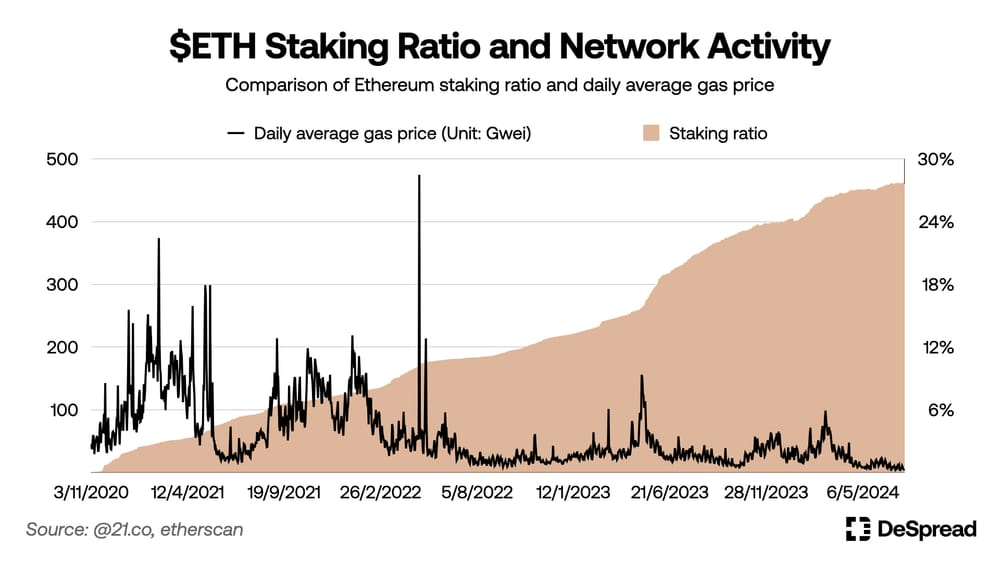

In addition, in most Proof of Stake (PoS) networks, the native token has a dual purpose: it is used both for transaction fees and as a bond to secure the network. This creates a problem, as security does not scale with liquidity. When tokens are staked for security, they are locked up and are unavailable for on-chain activities, reducing liquidity. For example, with 30% of Ethereum’s total supply staked, there is limited liquidity for transactions and DeFi activities. This limits scalability, as liquidity is critical for driving ecosystem’s growth and adoption.

Source: https://research.despread.io/report-berachain-2/

While platforms like Lido Finance offer liquidity for staked Ether, allowing it to be used in various DeFi activities, users still need regular ETH to pay for on-chain transactions.

Another major issue with PoS chains is that at the protocol level, rewards are only distributed to validators, leaving developers and users without direct incentives. This forces applications to create their own incentive mechanisms to foster network growth and liquidity. The lack of alignment results in poor coordination between validators, developers, and users. Validators focus solely on timely rewards, regardless of on-chain activity, while developers prioritize factors like total value locked (TVL) and user engagement over the security of the network itself.

How Berachain’s PoL Aligns Liquidity and Security?

Berachain addresses the limitations of the traditional Proof-of-Stake (PoS) model through its innovative Proof-of-Liquidity (PoL) consensus mechanism, which ensures that liquidity and security scale together. PoL utilizes a tri-token model that balances the needs of users, developers, and validators, aligning incentives across the entire ecosystem. Before diving into the technical details of the PoL system, it’s essential to understand the function of each token and how they contribute to maintaining network security, liquidity, and governance.

-

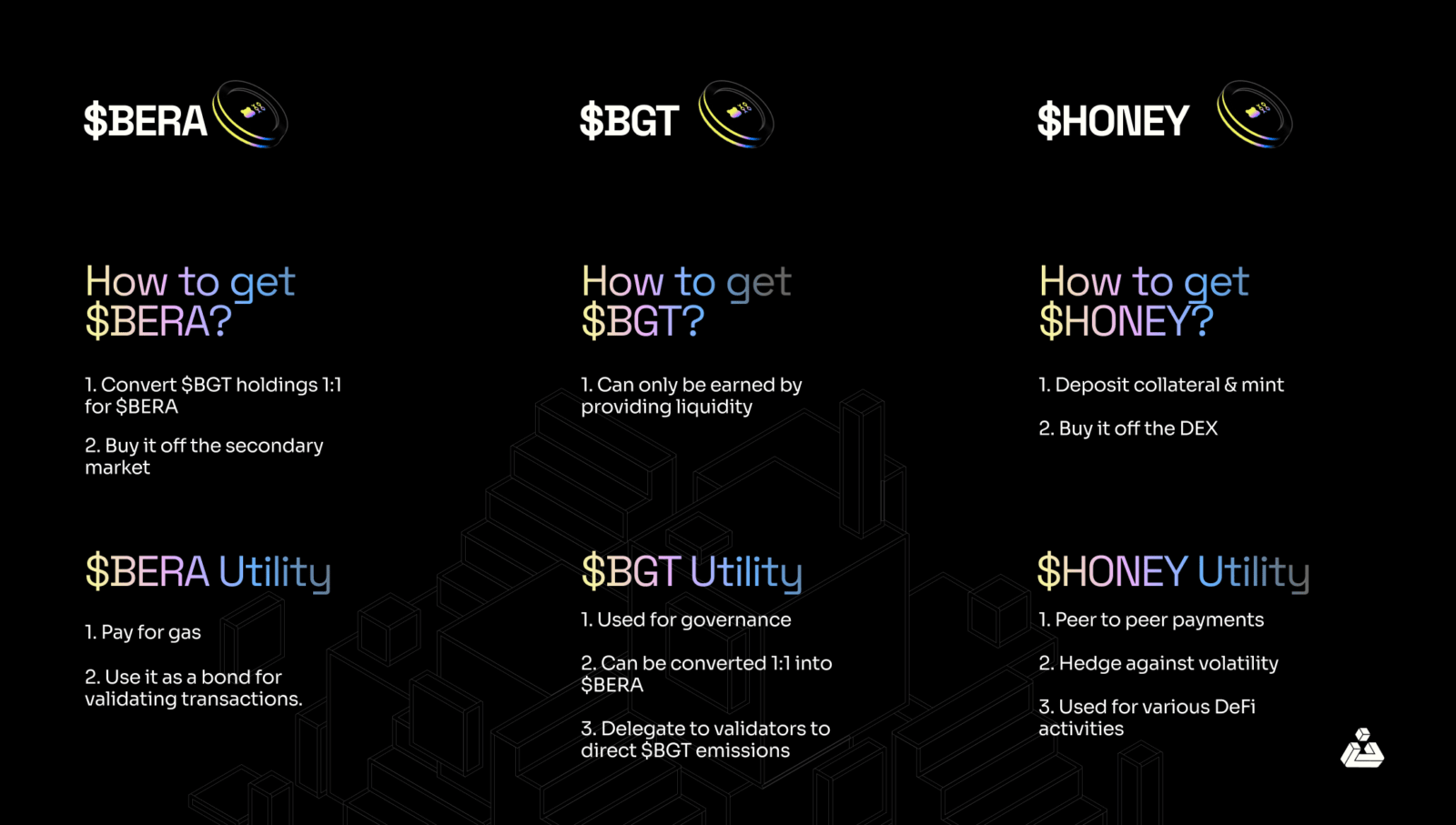

$BERA

$BERA is the native gas token of the platform used to pay for transactions. Users can obtain the $BERA token by converting their $BGT holdings 1:1 into $BERA.

-

$BGT

$BGT is the non-transferable soulbound governance token of the platform, and it can only be acquired by providing liquidity in PoL eligible reward vaults. $BGT can be used to delegate to validators so that they direct more emissions to vaults where the user provided their liquidity.

-

$HONEY

$HONEY is the native stablecoin of Berachain, soft pegged to the US Dollar. It can be minted by depositing whitelisted collateral into a vault, with the eligible assets determined through governance. Additionally, $HONEY can be earned as protocol fees by participating in governance and delegating $BGT emissions.

How does PoL Work?

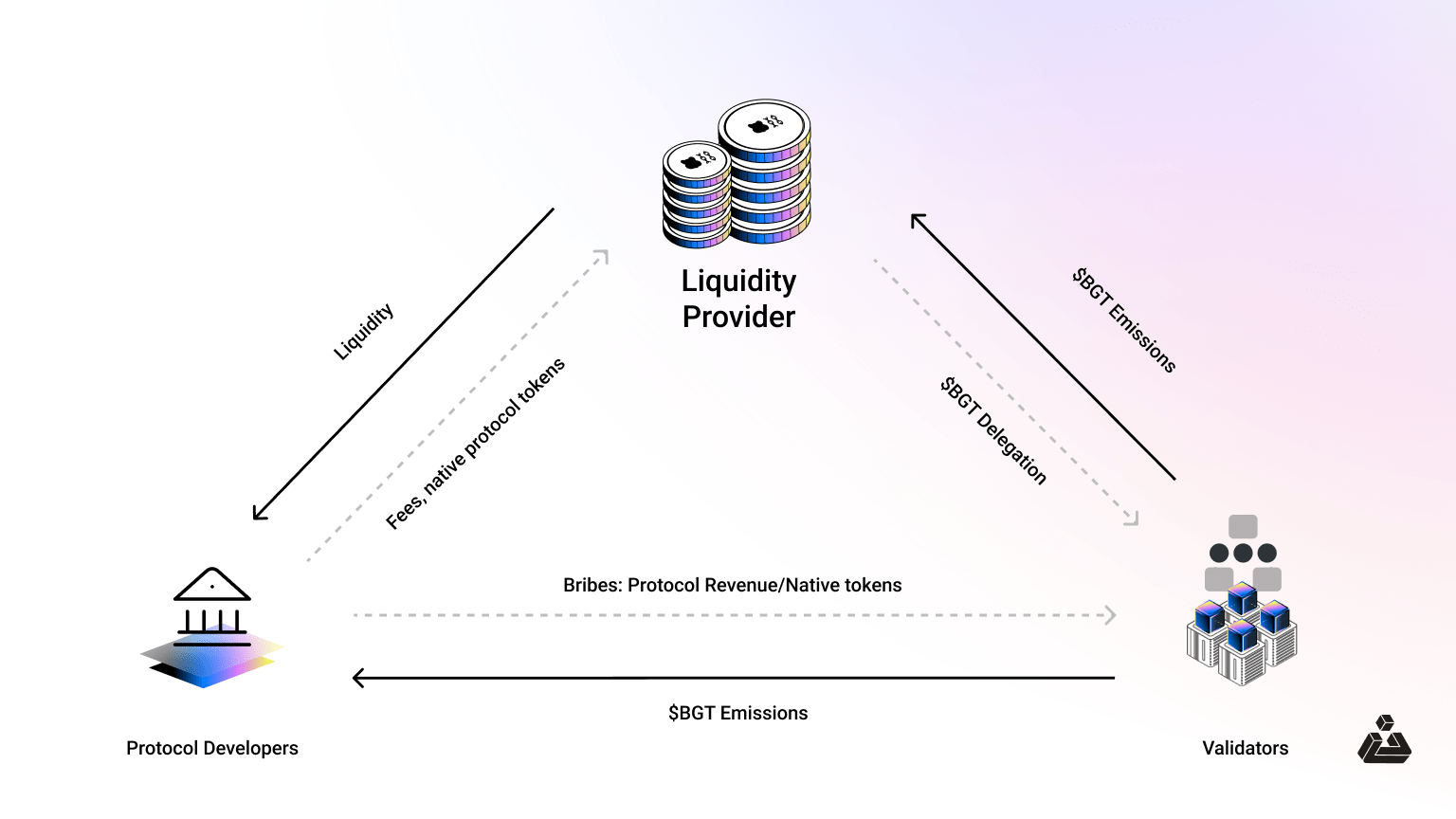

On a high level, three types of stakeholders make up an L1 ecosystem i.e., validators who secure the network, developers who build on the network, and users who utilize the network. PoL aligns the incentives of all these players such that their individual actions create synergistic outcomes for everyone.

To participate as a validator on Berachain, individuals must bond 69,420 $BERA tokens (a placeholder given by the team the actual amount is TBA). Once bonded, validators can produce blocks. In the initial version of Berachain’s testnet, the selection of block producers was weighted by delegation size, meaning those with higher delegations had a better chance of being chosen. However, in the bArtio testnet (v2), all validators have equal chances of producing blocks.

Unlike traditional Proof of Stake (PoS) systems, where validators earn network’s gas tokens as rewards, Berachain’s Proof of Liquidity (PoL) rewards validators with $BGT (Bera Governance Token). The amount of $BGT allocated depends on the validator’s delegation, the higher the delegation, the more $BGT they receive. Validators then distribute $BGT to reward vaults of their choice. Users, by providing liquidity on BEX (Berachain’s native DEX), such as in the $HONEY/$BERA pool, receive receipt tokens. Staking these tokens in reward vaults makes them eligible for $BGT distributions. This system is similar to how Curve incentivizes liquidity, but in Berach3wain, it’s the validators who direct emissions, aligning incentives between users and validators.

Liquidity providers can one-way burn their earned $BGT 1:1 for $BERA or delegate $BGT to validators, influencing where emissions are directed. The higher the delegation, the more $BGT a validator can allocate, which boosts their commissions. Validators also earn transaction fees, similar to PoS systems.

Additionally, developers and protocols can offer incentives to validators, using their own tokens or protocol fees, to direct $BGT emissions to their specific vaults, enhancing liquidity. This system creates a synergistic feedback loop, where validators, liquidity providers, and developers are aligned, each benefiting from their actions in a positive, reinforcing cycle.

Berachain’s PoL Analysis

With a foundational understanding of Berachain and its Proof of Liquidity (PoL) mechanism, we can now dive deeper into the potential discussion points surrounding this innovative model. We will highlight critical questions, assess the distinctive aspects of PoL, and explore the attack vectors that could arise, given the unprecedented nature of Berachain’s design.

Does Transaction Volume Scale with TVL?

Since Berachain’s incentive structure operates like a perpetual liquidity mining program, it can be compared to traditional liquidity mining campaigns. The goal of most liquidity mining programs is to bootstrap initial liquidity, increasing TVL to reduce trade slippage and boost trading volumes and fees. The ideal outcome is transitioning from an incentive driven phase to one where liquidity providers earn sustainable returns from fees as trading volumes grow. However, in Berachain’s case, the reliance on perpetual incentives introduces questions about whether this liquidity can remain stable and productive over the long term. Incentives can become less effective over time, and TVL alone doesn’t guarantee increased trading activity, which is essential for the growth of the network.

To understand this, let’s take a step back and look at it from an abstract viewpoint.

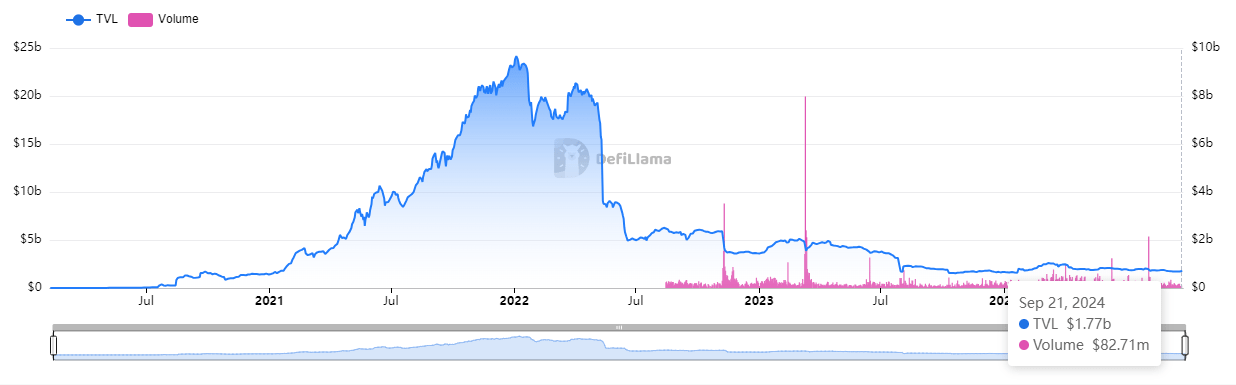

The Proof of Liquidity (PoL) model addresses the cold start problem faced by many protocols by issuing block rewards from day one to attract liquidity providers. This approach is comparable to traditional liquidity mining programs, which have historically succeeded in driving high Total Value Locked (TVL) during active periods. A prominent example is Curve Finance during the peak of the Curve Wars, where it achieved a TVL of around $24 billion despite generating lower trading volumes than Uniswap, which had a TVL of $8 billion at the time.

However, this influx of liquidity on Curve highlights a critical issue: much of the capital was mercenary liquidity, which flowed into the platform primarily to farm the CRV emissions while yields were high. Once yields began to decline, this capital would migrate to other platforms offering better returns. This behavior raises concerns about the sustainability of such liquidity mining strategies, particularly in terms of retaining liquidity and creating long-term value. As of today, Curve’s capital efficiency is only 2%, compared to Uniswap v3’s 67% and Uniswap v2’s 23%, as reported by DappRadar. Here, capital efficiency is defined as the volume traded divided by the TVL.

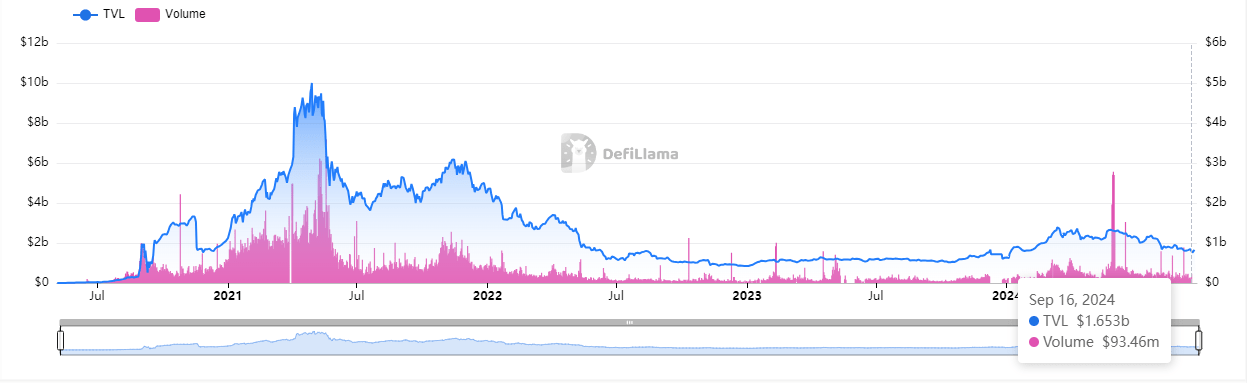

Curve DEX: TVL vs Traded Volume

Source: https://defillama.com/

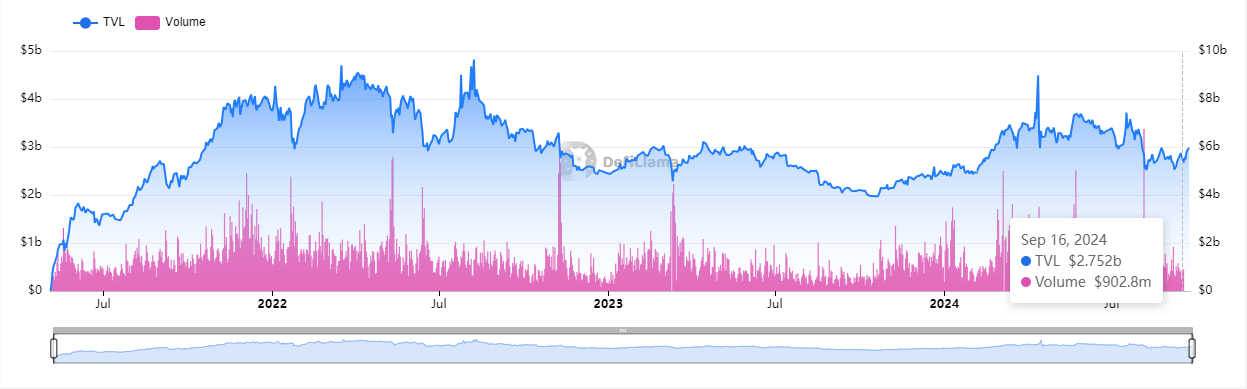

Uniswap V2: TVL vs Traded Volume

Uniswap V3: TVL vs Traded Volume

One could argue that capital efficiency varies depending on the specific use cases of different decentralized exchanges (DEXs). For example, Curve is primarily designed for stablecoin swaps, which naturally leads to lower trading volumes compared to other DEXs. As a result, when evaluating the effectiveness of a liquidity mining campaign, it may be more appropriate to focus on the liquidity added to the platform per dollar spent on incentives, rather than purely on trading volume. However, the key point remains: whether it’s a DEX or a Layer 1 protocol, simply generating high TVL is of little value if users are not actively engaging with the platform and contributing to trading activity.

For Berachain, while the PoL model can attract significant liquidity early on, the main challenge is ensuring that this liquidity remains “sticky” , that is committed to the platform and continues to generate meaningful trading volume and protocol fees in proportion to the incentives spent. The long-term sustainability of the PoL mechanism relies on maintaining this delicate balance as there are countless examples of ghost chains operating in space.

To achieve sustainable growth, the fee revenues must eventually surpass, or at least come close to, the cost of maintaining incentives. High TVL alone does not guarantee long-term value. Instead, Berachain must align its incentive structure with creating actual value for the network liquidity that drives real economic activity, rather than capital that jumps from one yield farming opportunity to another. The success of Berachain’s PoL model will depend on how well it directs its incentives toward generating lasting value, not just high TVL, but capital that actively supports the ecosystem’s growth.

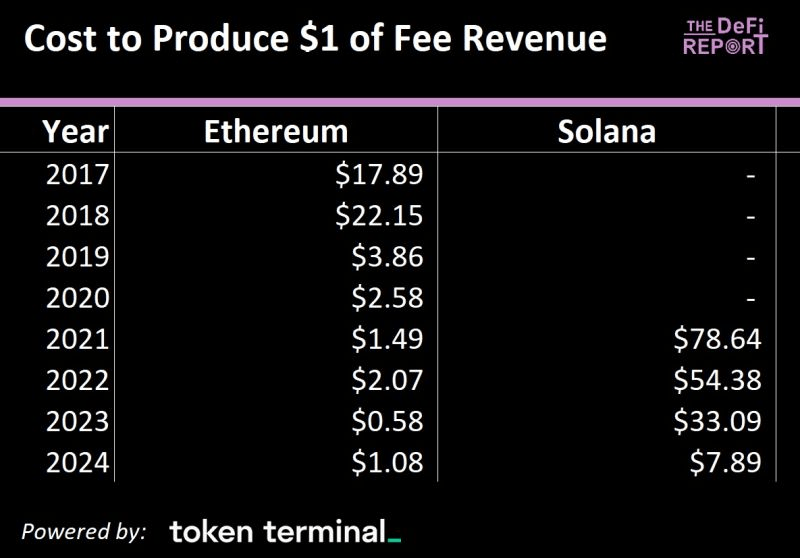

The ideal scenario for any chain would be to gradually reduce its incentive spending relative to the fees it generates, much like Ethereum and Solana, two of the most active and sustainable blockchains in the space.

Source: https://thedefireport.io/

It’s important to note that, unlike Ethereum and Solana where protocol-level incentives are primarily directed towards validators, Berachain’s incentive structure extends to all ecosystem participants. In assessing sustainability, we don’t compare the incentive spent with TVL, as TVL alone doesn’t fully capture the network’s economic activity. Instead, the focus should be on comparing the incentive spend with the fees generated, as this better reflects real demand.

How Berachain plan to attract active users?

While we recognize that Total Value Locked (TVL) alone is only meaningful with a substantial user base to actively utilize it, the question arises: how is Berachain attracting this user base? Unlike other blockchains, Berachain isn’t focused on promoting scalability improvements or solving the blockchain trilemma. As noted by Cap’n Jack Bearow, Berachain’s Head of DeFi, “We’re not trying to be the next Ethereum or Solana killer in terms of technology. Instead, Berachain aims to be the premier destination for earning the best yield on your assets.”

This raises an important question: Is liquidity alone enough to drive adoption on a Layer 1 blockchain? The answer is more nuanced than it may seem. In theory, the value of a Layer 1 blockchain should be derived from the cumulative value of all the applications and protocols built on top of it and more. However, in practice, many Layer 1s that we label as ghost chains have struggled, despite technological innovation at the infrastructure level.

The core issue lies in their focus: these chains prioritized incentivizing supply-side participants, like validators and liquidity providers, without equally giving importance to the demand side, the developers and users who drive actual network activity and utility. This is where Berachain fills in as it emphasizes the importance of healthy liquid markets to grow adoption and utility on-chain.

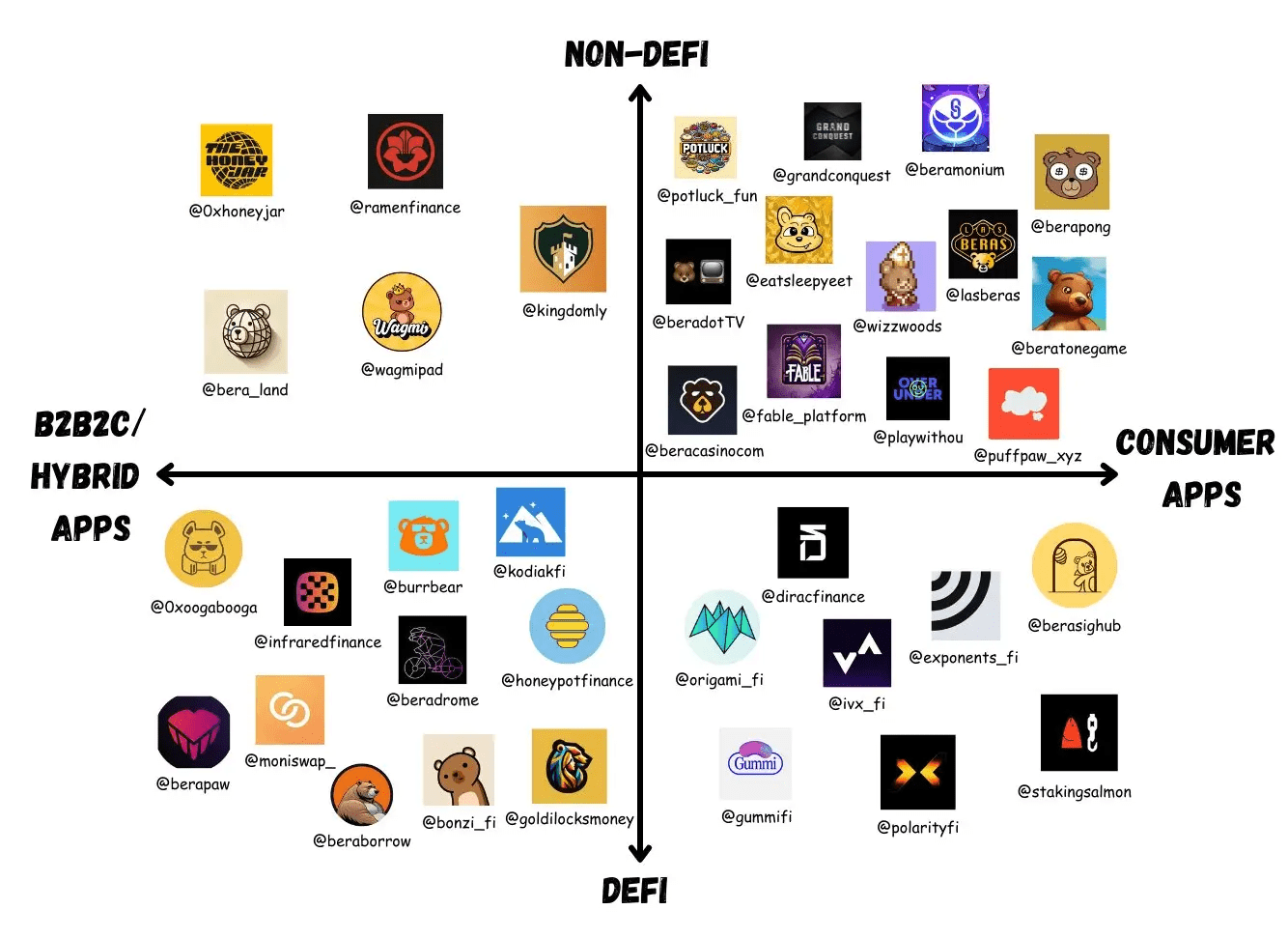

Berachain Ecosystem

Berachain is launching with three core native applications: BEX (the native decentralized exchange), BERPS (the native perpetual exchange), and BEND (the native lending and borrowing protocol). In addition to these foundational protocols, a diverse suite of applications is under development on Berachain, ranging from advanced DeFi protocols to consumer facing applications, all aimed at driving widespread user adoption and engagement across the ecosystem.

Source: https://www.blocmates.com/articles/what-are-the-top-projects-in-the-berachain-ecosystem

At the heart of it all is Berachain’s Proof of Liquidity design, which creates powerful synergies across protocols and enables DeFi users to deploy the same set of capital across various yield strategies.

For core DeFi users, Berachain opens up countless yield-generating opportunities through the interconnectedness of different protocols built on its PoL model. Let’s consider a general example of how a user might deploy capital and generate yields without delving too deeply into specific protocol details.

Imagine a user holds $HONEY, the native stablecoin of Berachain’s ecosystem, and wants to put it to work. The user heads to Kodiak, Kodiak, a concentrated liquidity AMM, and swaps their $HONEY for $BERA. This $BERA can then be deposited into Kodiak’s flywheel islands, where the user passively earns $BGT emissions as part of PoL, utilizing Kodiak’s set-and-forget liquidity provisioning strategies.

But the earning potential doesn’t stop there. The user can take the $BGT they’ve accrued and move over to Beradrome, where they can engage in governance to direct further liquidity incentives to specific reward vaults they provide liquidity for. This strategy allows the user to influence the flow of rewards and further optimize their yield, creating a layered, interconnected yield strategy that maximizes returns through smart capital deployment.

Liquidity as a Catalyst to Adoption

Berachain is poised for launch with a diverse suite of applications, offering users a wide array of yield-generating opportunities right from day one. Through its Proof of Liquidity (PoL) mechanism, Berachain not only incentivizes developers to build on the platform but also ensures applications can tap into the abundant liquidity available within the ecosystem. For any DeFi application, liquidity is essential: for DEXs, it enables smooth and efficient trades with minimal slippage; for lending/borrowing protocols it improves capital utilization and streamlines liquidations; and for leverage protocols, it supports higher volumes of leveraged positions.

The interconnectedness of applications within Berachain’s ecosystem, combined with liquid positions for users, creates a positive feedback loop. As liquidity grows, returns for liquidity providers (LPs) and users increase, further attracting more capital into the system, and reinforcing ecosystem growth.

The key question that arises, however, is whether this Total Value Locked (TVL) and liquidity will remain sticky enough to sustain its levels over time. From a game theory perspective, the perpetual nature of PoL incentives may help retain liquidity, but this will likely vary between protocols, as they compete to offer the most attractive yields. In practice, liquidity might not always be sticky and mercenary capital may still flow to the highest short-term rewards.

How Berachain Addresses the Liquidity Stickiness Problem

Recognizing this potential challenge, the Berachain team has made efforts to bring VC and institutional money on-chain, as seen in their pursuit of a liquidity lead focused on injecting more stable TVL into the system. This strategy aims to reduce dependence on mercenary capital and create a more stable foundation of liquidity. However, while this approach is strategic, it also introduces the potential risk of centralization, as larger institutional capital could exert disproportionate influence over the network. We will explore these centralization risks in more detail shortly.

Another key strategy Berachain is adopting to maintain a stable TVL for both the chain and its applications is the Boyco initiative. Powered by Royco, Boyco enables applications to create liquidity acquisition marketplaces ahead of their launch. This initiative allows users to pre-deposit funds into a range of decentralized applications (dApps) set to launch on Berachain. Boyco addresses historical challenges in liquidity raising, including centralization, lack of transparency between users and dApps, inefficient allocation of funds, and limited opportunities for negotiation.

In addition, the PoL flywheel itself allows liquidity providers to unlock many other potential revenue streams so they don’t have to migrate their capital in search of the best yield. Liquidity providers can earn $BGT while also enjoying the benefits that LPs usually enjoy across DeFi. This includes liquidity mining rewards, native dApp fees, etc. For example, when users provide liquidity to Kodiak and stake their LP tokens in Kodiak’s reward vaults, they can receive rewards from multiple sources. In addition to $BGT rewards, they also earn trading fees generated by the liquidity pool and receive liquidity mining incentives in Kodiak’s native token, $KDK.

Up to this point, we have primarily addressed the challenges of TVL stickiness and user adoption on Berachain through qualitative insights. Given the novelty of the Proof of Liquidity (PoL) model, it remains difficult to quantify many of these aspects with precision. As a result, our focus now shifts toward exploring other potential challenges the chain may encounter with its PoL mechanism.

Centralization Concerns

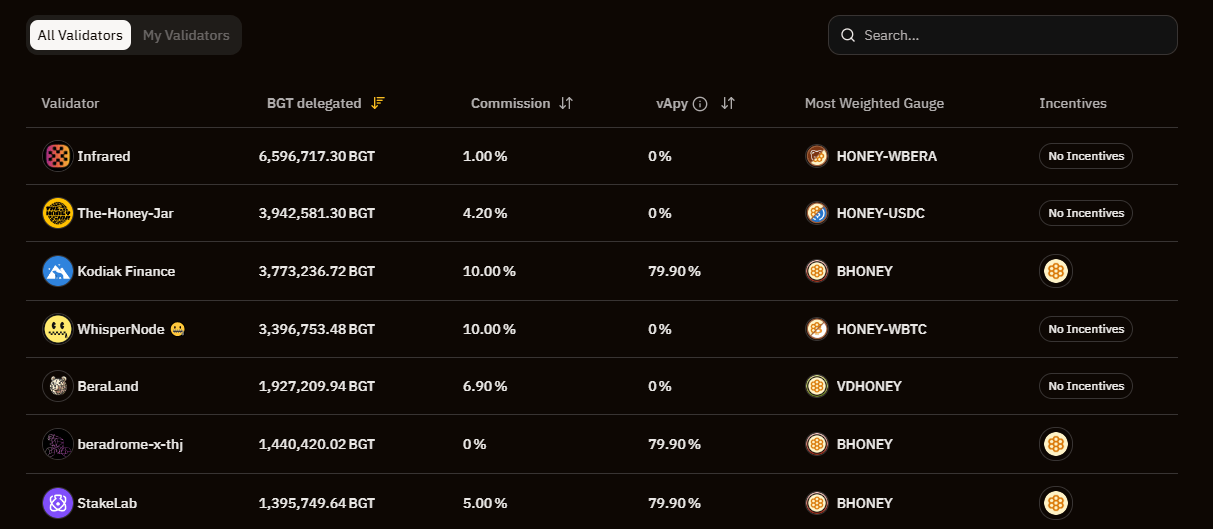

In version 1 of the Berachain testnet, block producers were selected based on the amount of $BGT delegated to them by users. The more $BGT delegated to a validator, the higher their chances of being selected to produce blocks and earn $BGT emissions. However, this system raised centralization concerns, as a validator with significantly more $BGT delegation could dominate block production, accumulating more $BGT emissions and increasing their influence.

In response, version 2 of the testnet addressed this issue by introducing an equal chance of block production for all validators, regardless of the amount of $BGT delegated to them. The only factor tied to delegation is the amount of $BGT emissions distributed. For example, a validator with higher $BGT delegation still earns more emissions per block, but the chance to produce blocks remains evenly distributed across all validators.

To illustrate this, on the bArtio testnet, the maximum emissions are fixed at 1500 $BGT after each validator has statistically produced one block. The actual reward each validator distributes depends on their delegation weight. For instance, if a validator controls 10% of the total $BGT staked in the network, they would be able to allocate 10% of the 1500 $BGT (i.e., 150 $BGT) to the reward vaults.

One immediate observation is that early applications or those with their own validator sets might gain a significant advantage. Applications building on Berachain, such as Infrared Finance, Kodiak Finance, and Beradrome, already operate their own validators. This could give them an edge because controlling a validator allows them to direct emissions to their own reward vaults, securing perpetual $BGT emissions rather than relying on short-term liquidity incentives. The mechanism has been dubbed as PoL^2 (PoL squared).

This dynamic potentially undermines the liquidity bootstrapping narrative. Instead of paying for short-term liquidity or rent-seeking incentives, applications with their own validators can continuously receive emissions. As validator setup and maintenance costs become the new funding model for applications, only those with significant financial backing or institutional capital will be able to afford and sustain their validators, leading to centralization of protocol-level incentives.

Source: https://bartio.station.berachain.com/validators

The $BGT emission model introduces another layer of centralization risk. Based on the emission formula, the more $BGT delegated to a validator relative to the overall delegation, the higher the block rewards they receive. Conversely, validators with smaller delegations will earn proportionally fewer $BGT emissions. As a result, validators who accumulate a large delegation early on gain a compounding advantage as they can distribute more $BGT emissions, attract more delegations, and continuously outpace smaller validators. This positive feedback loop continues until delegation weights reach equilibrium, where demand for that validator’s delegation levels off.

Applications running their own validators could exacerbate this issue. Early movers or well-funded projects will be able to establish validators with large delegations, ensuring they capture a larger share of $BGT emissions. This presents a serious centralization concern for both the network and newer applications building on Berachain, as it creates barriers to entry and entrenches early, well-funded participants in positions of power. The system may naturally trend towards centralization, where a few dominant validators and their associated applications capture the majority of the rewards, further limiting the potential for a more diverse and decentralized validator set.

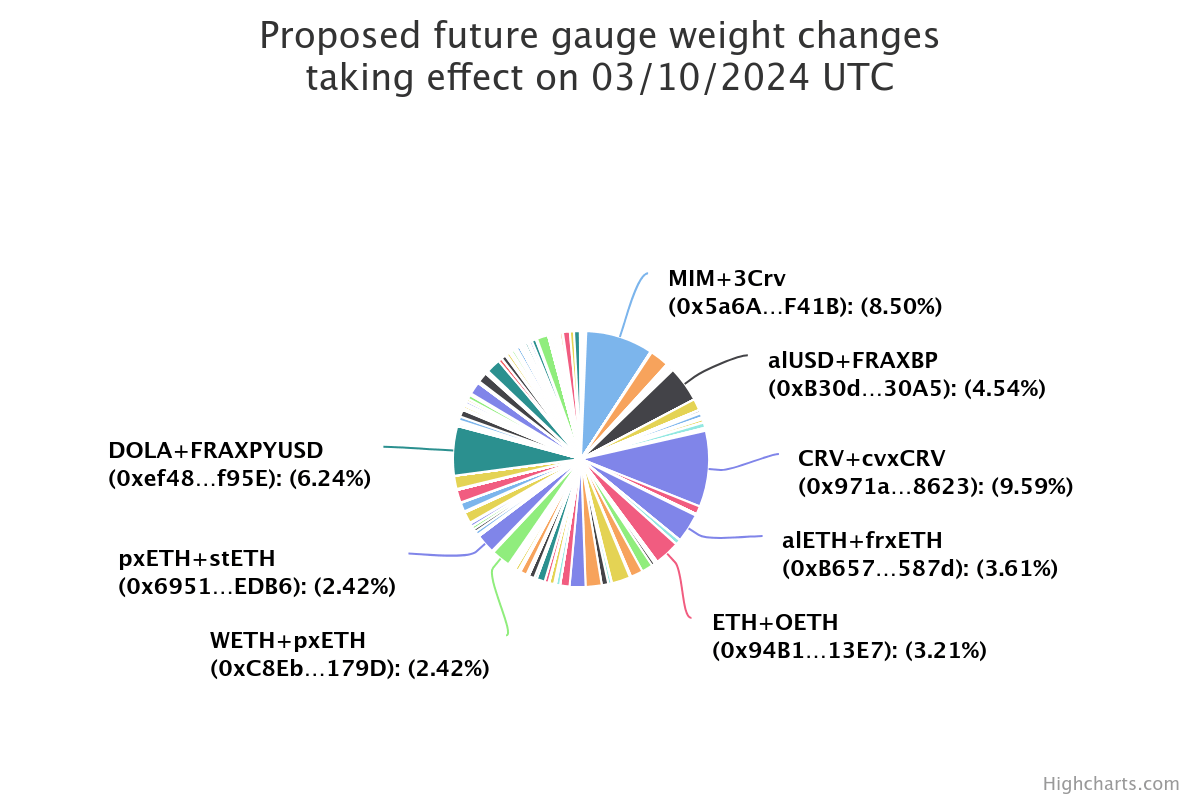

We have seen similar dynamics play out in the Curve Wars, where protocols like Yearn and Convex managed to control over 50% of the voting escrowed CRV (veCRV), effectively directing more than half of all CRV emissions to their respective platforms. While the distribution of CRV incentives has since improved, the top 10 pools still command more than 40% of the rewards, reflecting an ongoing concentration of power.

Source: https://dao.curve.fi/gaugeweight

In the case of Berachain, $BGT emissions serve as protocol-level incentives. In theory, every application building on Berachain should have access to these emissions. However, much like in the Curve Wars, there is a risk that early movers and well-funded applications with significant validator delegations could secure a disproportionate share of $BGT emissions and keep building on them.

The Current $BGT Emission Model

The $BERA token demand is tied to network fundamentals. It’s necessary for running the chain, securing validators, and facilitating all on-chain activities. Its demand is a function of network usage and security, with a clear correlation to the chain’s activity level. For $BGT, we know that liquidity provision is the only proxy to gauge the demand for $BGT, so we can say that its emissions model should follow the state of liquidity in the system.

As explained earlier, there is a fixed maximum limit on the amount of $BGT emissions per block, determined by the rewardRate() function from the Block Reward Controller contract. This emission rate is not static but is adjusted according to the amount of $BGT delegated to validators. The larger a validator’s delegation relative to others, the greater the portion of this rewardRate() they can distribute. So delegation is a way to decide who gets how much from a set pool of emissions. In other words, it’s like the chain has a fixed budget to incentivize liquidity and $BGT holders compete to bid for a share of the budget.

This makes the emissions process insensitive to liquidity dynamics. For instance, consider a scenario where two validators share 50% delegation weight, and there are 10,000 $BGT in circulation, but only 20% are actively delegated. Even if total delegated $BGT drops to 10%, these validators will still control the same relative share of emissions (e.g., 750 $BGT each per block). Similarly, an increase or decrease in liquidity does not affect the $BGT emission rate.

However, if we take a step back, this model is already well-established and proven in the market, as seen with the success of Curve Finance. The key difference with Berachain is that liquidity providers don’t need to time-lock their reward or governance tokens. Instead, with a fixed emission schedule and a dynamic delegation mechanism, the rewards system adapts naturally to varying liquidity levels.

During periods of lower liquidity, the value of rewards for individual liquidity providers increases, as the total emissions remain constant but are shared among fewer participants. This creates an incentive for more users to provide liquidity when it’s scarce. Conversely, during periods of high liquidity, the rewards get distributed among more users, reducing the emissions earned per provider. This self-regulating mechanism helps balance liquidity levels, as it motivates participation based on the current state of the market. As a result, the system finds its equilibrium, where liquidity adjusts to match the incentives.

But still the model risks creating a feedback loop where validators or applications with larger delegations continue to receive disproportionate emissions. Validators with early or large delegations can accumulate more $BGT over time, creating barriers to entry for new participants.

Conclusion

In this article, we touched upon the intricacies of Berachain’s ecosystem, focusing on its Proof-of-Liquidity (PoL) consensus mechanism. We examined the unique benefits it offers, such as aligning liquidity provisioning with network security and incentivizing ecosystem participants. At the same time, we touched on some of the potential limitations that could arise, particularly regarding the risk of centralization as larger validators accumulate disproportionate rewards.

However, several aspects remain unexplored, such as the game-theoretic dimensions of Berachain’s economic design. As we’ve seen in other decentralized finance (DeFi) projects like OlympusDAO, even well-designed mechanisms can falter if user comprehension and community sentiment don’t align with the protocol’s design. The confidence of users plays a critical role in maintaining the stability of such systems, and misinterpretation or rapid shifts in sentiment can undermine even the most sound models. Berachain, too, may face similar challenges as it scales and interacts with a growing and diverse community.

Additionally, there are technical challenges yet to be fully understood, such as how Berachain might handle a sudden surge in TVL. If TVL explodes, it could strain the ecosystem’s infrastructure, leading to unforeseen bottlenecks or vulnerabilities. While the testnet has provided useful insights, the real test will come when the mainnet goes live, and the system is exposed to the unpredictability of real-world conditions.

References

https://www.theperiphery.io/ghost-chains-are-the-misguided-result-of-a-multichain-strategy/

https://blog.berachain.com/blog/reward-vaults-explained

https://blog.berachain.com/blog/the-pol-post

https://bartio.station.berachain.com/validators

https://research.despread.io/report-berachain-2/

https://www.blocmates.com/articles/what-are-the-top-projects-in-the-berachain-ecosystem

https://bartio.beratrail.io/address/0xbDa130737BDd9618301681329bF2e46A016ff9Ad/contract/80084/code