We’re entering a new era of finance, one that extends beyond traditional systems and into a blockchain-powered economy. This innovation bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi), unlocking global access, liquidity, and programmability. In this article, we explore how Real World Assets (RWAs) are reshaping industries, review the top RWA projects of today, and dive into the trends shaping the future of tokenized finance.

If you belong to Gen Z, you might recall a time before digital finance which still exists today in some parts of the world, an era when traditional record-keeping was paper-based and managed by intermediaries. Financial transactions relied on manual, venue-based services, forming a physical network.

Next came the digital finance era, where record-keeping became digitized. However, data still needed reconciliation across different systems, and electronic records were maintained separately. Despite advancements, this approach remains the most widely used today, as financial services continue to rely on automated systems that operate independently

Now, you’re witnessing the transition into the post-digital finance era, marked by tokenization. In this phase, value transfer and messaging occur on a single, digitized network, paving the way for a decentralized financial ecosystem. Self-executing, composable services are transforming industries through this institutional decentralized finance framework.

In this article, we’ll explore Real World Assets (RWAs), their revolutionary impact on various industries, current RWA market landscape, impact of bridging the gap between traditional finance and decentralized finance, and insights on the future growth of RWAs.

What are Real World Assets?

Real World Asset (RWA) tokenization is shaking up industries by turning physical assets like real estate, gold, or stocks into digital tokens on a blockchain. This allows people to own small pieces of valuable assets without needing a lot of money upfront, making them more accessible to everyone.

RWAs make it easier to buy and sell these assets quickly, boosting flexibility and opportunity for investors globally. RWAs bridge the gap between traditional finance and decentralized finance (DeFi), making previously illiquid assets more accessible and liquid through blockchain technology.

Current RWA landscape

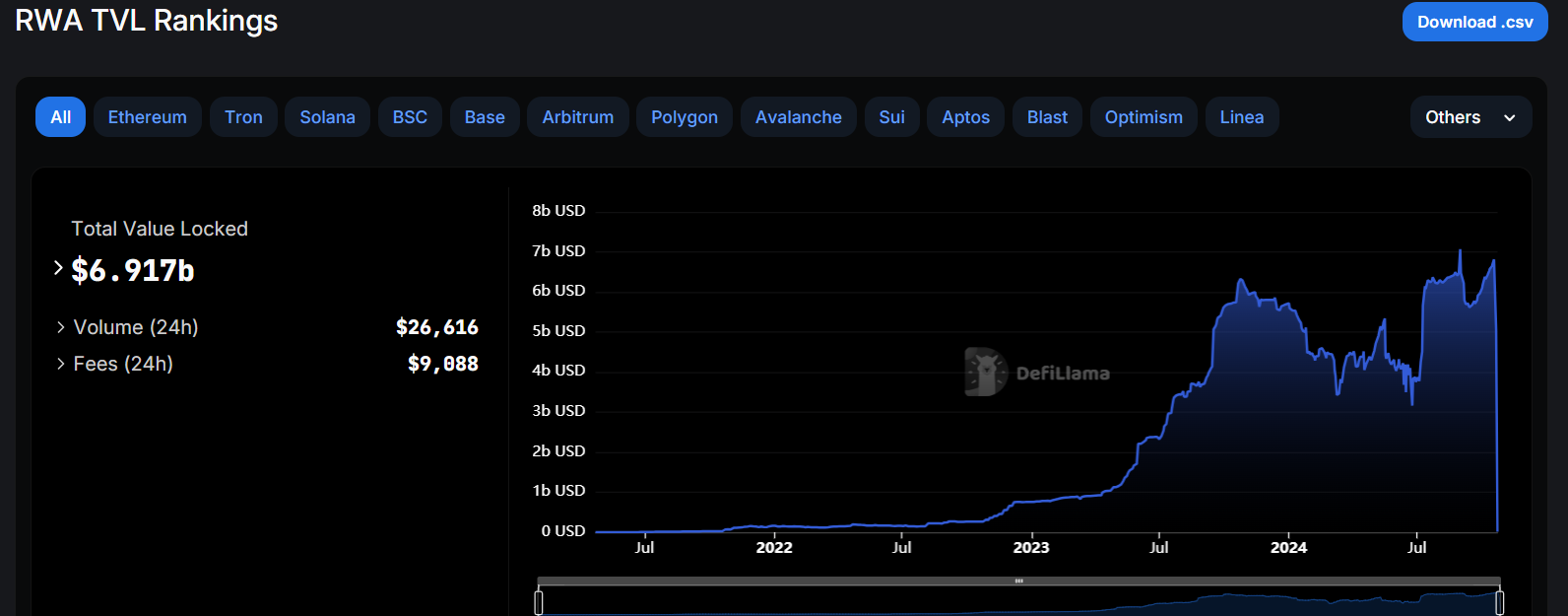

The RWA TVL Ranking chart above tracks growth of RWAs from 2022 to 2024. Up until mid-2022, RWA TVL stayed relatively low, indicating that the tokenization of real-world assets had not yet gained widespread traction.

A significant spike is seen towards the end of 2022, showing growing interest in tokenized real-world assets. The boom continued through 2023, reaching a peak in mid-2024. A brief dip followed, likely due to market volatility, but the rebound suggests renewed confidence in RWAs.

The current total value locked exhibits all time high, 6.917 billion dollars, signifying how these tokenized assets are becoming more important in the DeFi ecosystem. The RWA market is growing rapidly, with predictions of it reaching US$16 trillion by 2030.

Some Notable RWA Projects

We are going to shed light on some of the most notable RWA projects, with their market valuation and the industries they target.

1. MakerDAO (RWA Vaults)

TVL: $1.782 billion

Target Industry: Multiple, including real estate and trade finance

MakerDAO has one of the largest RWA vault systems, allowing real-world assets like real estate and invoices to be used as collateral to mint DAI, a decentralized stablecoin. This has made Maker a leader in integrating traditional assets into decentralized finance (DeFi) through tokenization.

2. Tether Gold (XAUt)

TVL: $679.06 million

Target Industry: Precious metals (Gold)

Tether Gold represents ownership of physical gold, with each token backed by one troy ounce of gold. This RWA project allows investors to trade and hold tokenized gold, providing liquidity and easier access to this traditional asset class while benefiting from blockchain’s transparency.

3. Ondo Finance

TVL: $640.72 million

Target Industry: Investment funds, real estate, and fixed income

Ondo Finance specializes in tokenizing investment vehicles such as private credit and real estate, allowing investors to access fixed-income products and structured finance solutions. Ondo bridges traditional finance (TradFi) and decentralized finance by making these asset classes more accessible to DeFi users.

4. BlackRock BUIDL

TVL: $539.69 million

Target Industry: Institutional investments

BlackRock BUIDL is an initiative by BlackRock, the world’s largest asset manager, to bring institutional-grade investment products onto blockchain platforms. This involves tokenizing traditional securities and assets, opening up decentralized markets to large institutional players.

5. Paxos Gold (PAXG)

TVL: $536.9 million

Target Industry: Precious metals (Gold)

Similar to Tether Gold, Paxos Gold offers tokenized gold on the blockchain. Each PAXG token represents one troy ounce of physical gold stored in professional vaults. Paxos focuses on providing investors with a stable, trusted asset like gold in a highly liquid and tradable form on DeFi platforms.

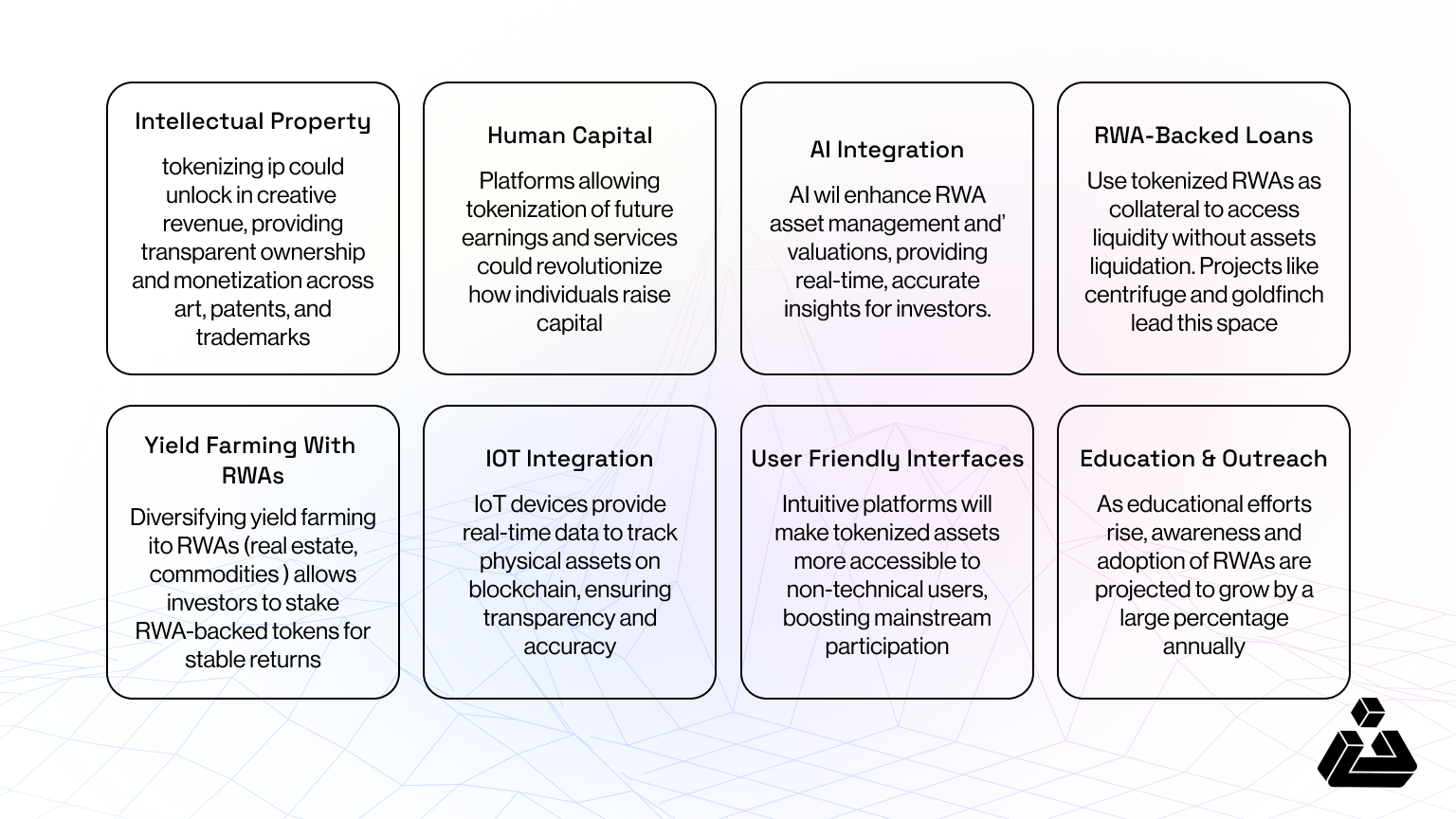

Future Trends and Developments in RWA Tokenization

The Real-world assets (RWA) sector in DeFi is set for significant growth, offering new opportunities and innovations. Here is a breakdown of some key trends, potential directions and advancements:

-

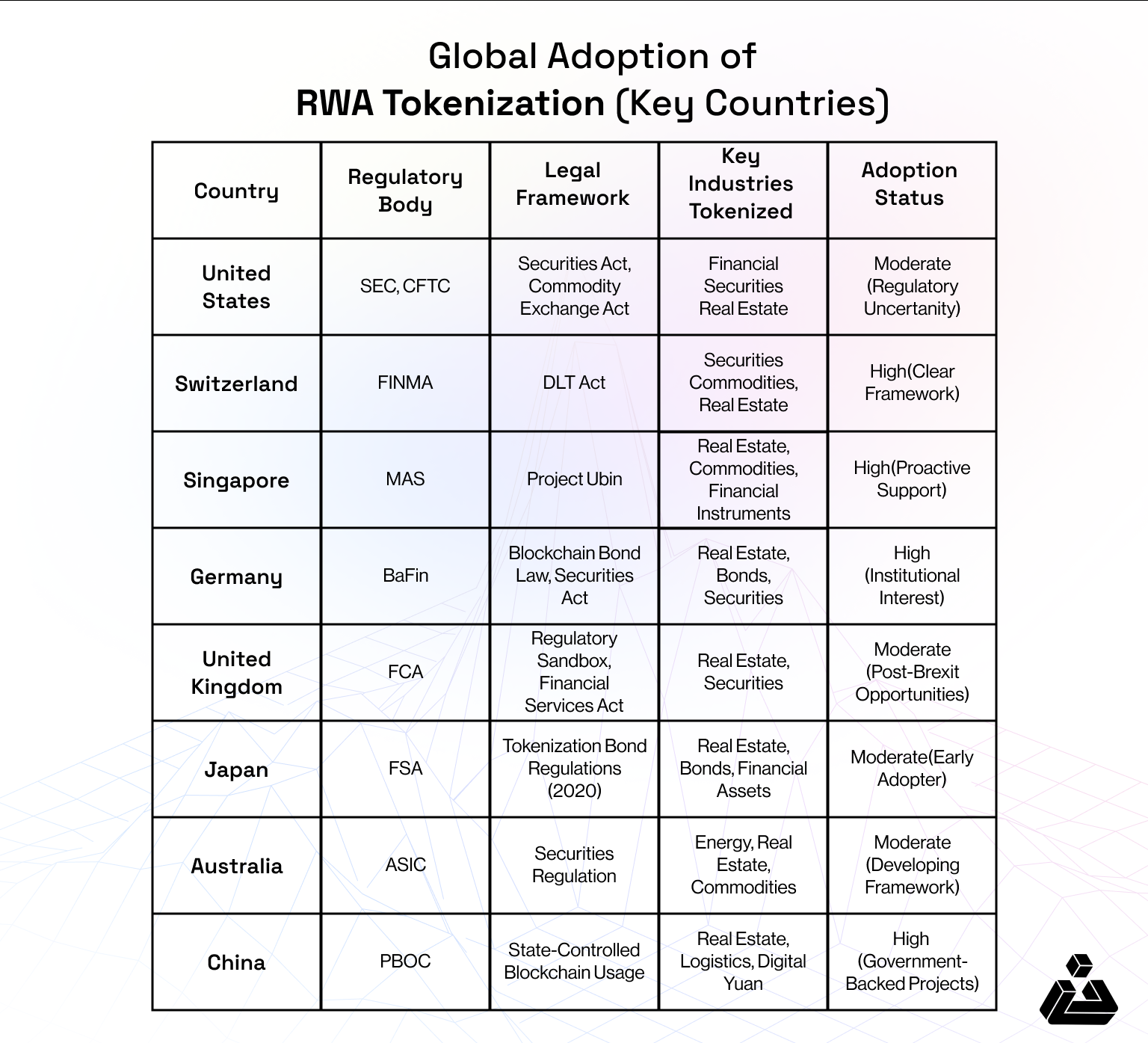

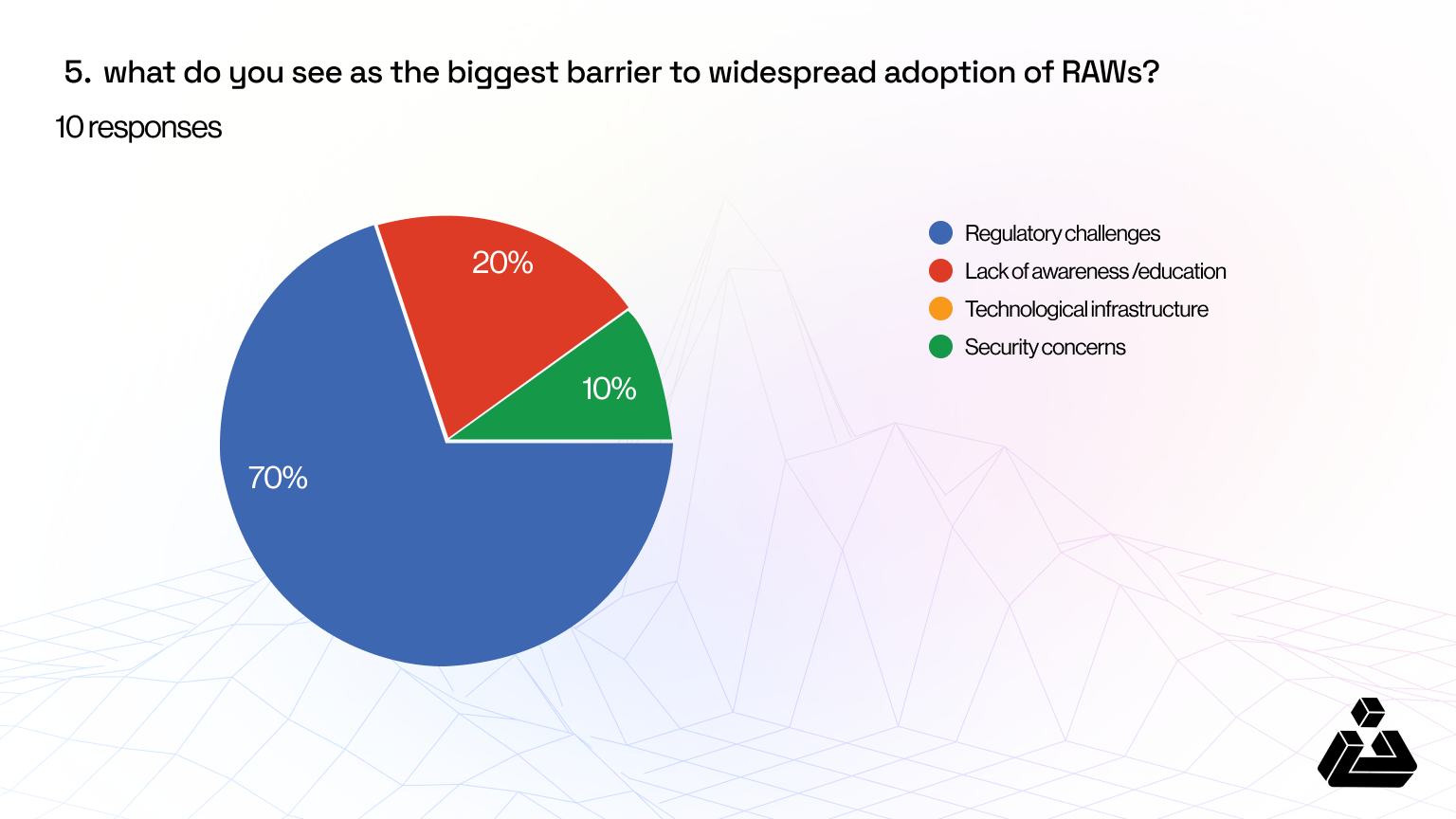

Regulatory Impact

Regulatory landscape seems to be a barrier in adoption of RWAs. Different jurisdictions have varying regulations, impacting how RWAs can be tokenized and traded. As regulations evolve, they will directly affect how RWA tokens comply with legal standards, ensuring accessibility, liquidity, and investor protection.

For instance, Security Token Offerings (STOs) in 2018 highlighted regulatory challenges, especially as the US SEC began treating tokenized assets similarly to traditional securities. This further lengthened the duration of approval processes alongside increased consumer protection, hindering innovation and limiting market expansion. However, institutional interest grew post-2021, with firms like BlackRock and Fidelity exploring compliant tokenization, indicating a gradual regulatory shift.

However, fast forward in 2024, market cap reached approximately $8 billion, so with expected growth of $16 trillion by 2030 if regulations continue to evolve providing clearer and cohesive standards, while maintaining trust, security and accessibility in the tokenized asset space, the trend toward structured regulatory frameworks will attract broader investor participation.

-

Layer 2 Integration

Layer 2 solutions are critical for scaling RWA tokenization. These solutions lower transaction costs and improve efficiency. Polygon and Arbitrum are working on Layer 2 integrations, enabling tokenized RWAs to become more efficient and interoperable across multiple blockchain ecosystems.

While, RWA is giving investors a gateway to previously hard–to-reach markets. Layer 2 technology enhances RWA utility through faster transactions, lower fees and scalability improvements, essential for making these assets accessible to a broader range of investors. A notable development within this ecosystem is Bitlayer, touted as the ‘first Bitcoin security-equivalent Layer 2 solution’, built on the BitVM paradigm.

Another significant project, BitPerp offers advanced trading tools for Bitcoin inscriptions like BRC20 tokens and Runes on Bitcoin Layer 2 networks. By providing a robust liquidity hub, BitPerp simplifies RWA trading, providing a seamless experience for managing diverse assets on the blockchain.

The growth of L2 solutions reflects their potential to support RWA tokenization, with increasing adoption likely to enhance the interoperability and efficiency of these assets. This depicts a promising path toward an inclusive, tokenized economy where wealth management integrates seamlessly with decentralized finance.

-

DeFi-TradFi Collaboration

The increased collaboration between DeFi and traditional finance (TradFi) is one of the most exciting developments. Ondo Finance, for instance, has pioneered tokenized bonds and treasuries, bridging the gap between crypto liquidity and traditional financial markets, giving investors access to stable assets.

The on-chain representation of real-world assets (RWAs) will significantly impact financial markets. In traditional finance (TradFi), RWAs will enhance liquidity and programmability, facilitating innovations like automated compliance and instant settlement. For instance, tokenized real estate can enable fractional ownership and real-time trading, boosting liquidity.

In decentralized finance (DeFi), RWAs will introduce reliable assets, enhancing decentralized applications (dApps). Tokenized commodities, such as gold, can be integrated into DeFi protocols, allowing users to borrow and lend against these assets with reduced volatility.

Deloitte survey found that more than 76% said they believe digital assets will serve as a strong alternative to or replacement for fiat currencies in the next five to 10 years.This acceptance can lead to increase in adoption of RWAs. As secondary markets develop, Tokenized bonds could also help improve liquidity and accessibility. Overall, RWAs will streamline transactions and create new opportunities in both TradFi and DeFi.

-

Market Growth & Innovation

Art and collectibles, real estate and commodities like gold or precious metals have already been established as mainstream real world assets (RWA). Tokenized real estate enables fractional ownership, making property investments more accessible. Commodities like gold and oil are increasingly being tokenized for easier trading and investment.

Additionally, the art market is seeing the rise of tokenized artworks, allowing collectors to buy shares in high-value pieces. The future of RWAs looks promising, with continued advancements in technology enhancing liquidity and democratizing access to these asset classes.

Some renowned platforms have been instrumental in bringing real-world debt, such as invoices and private credit, on-chain. These platforms allow investors to fractionalize ownership and create new opportunities for portfolio diversification Below are some key growth areas:

- Tokenized Treasuries: The market for tokenized U.S. Treasuries has rapidly grown to around $600 million, reflecting rising interest in traditional instruments like bonds amid declining DeFi yields.

Projects like Ondo Finance and Centrifuge are leading this trend with specialized bond funds for crypto market makers.

- Private Credit: Tokenization of private credit is enabling the transfer of real-world debt assets onto blockchain platforms, making them accessible to accredited investors through fractionalization.

Platforms like Credix facilitate investments in tokenized private notes backed by receivables, with recent filings indicating significant growth potential.

- Invoice financing: This market has immense potential, with unpaid invoices totaling around $3 trillion in 2024. Tokenizing invoices provides easy financing for small and medium enterprises (SMEs), allowing them to unlock liquidity and reduce friction in traditional financing models.

For instance, InvoiceMate, a decentralized marketplace in the MENA region, has successfully tokenized over $275 million in invoices.

Some more emerging trends and predictions..

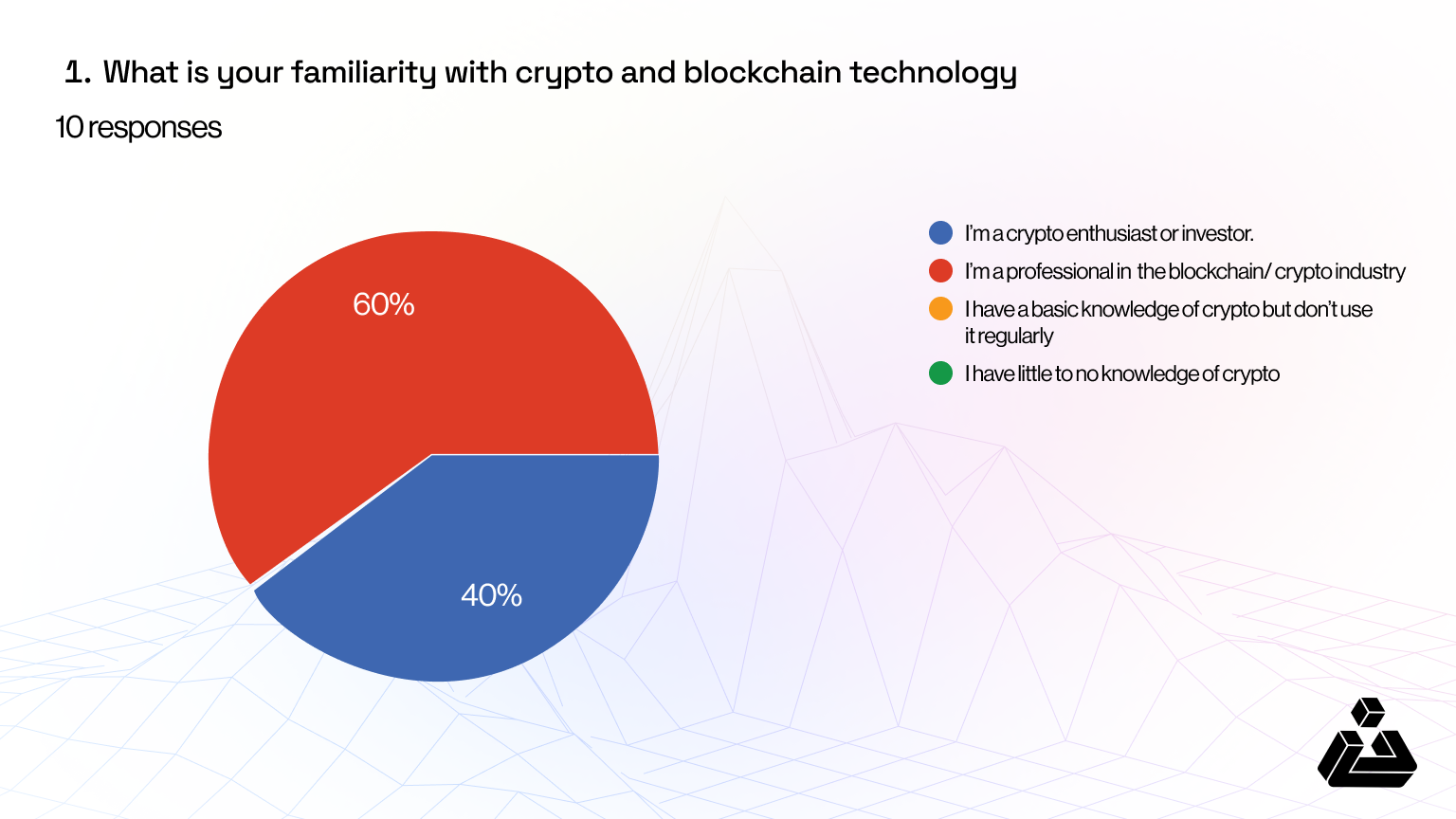

Let’s study some insights we have gathered from a survey to understand the trends, awareness ratio and carefully make some predictions.

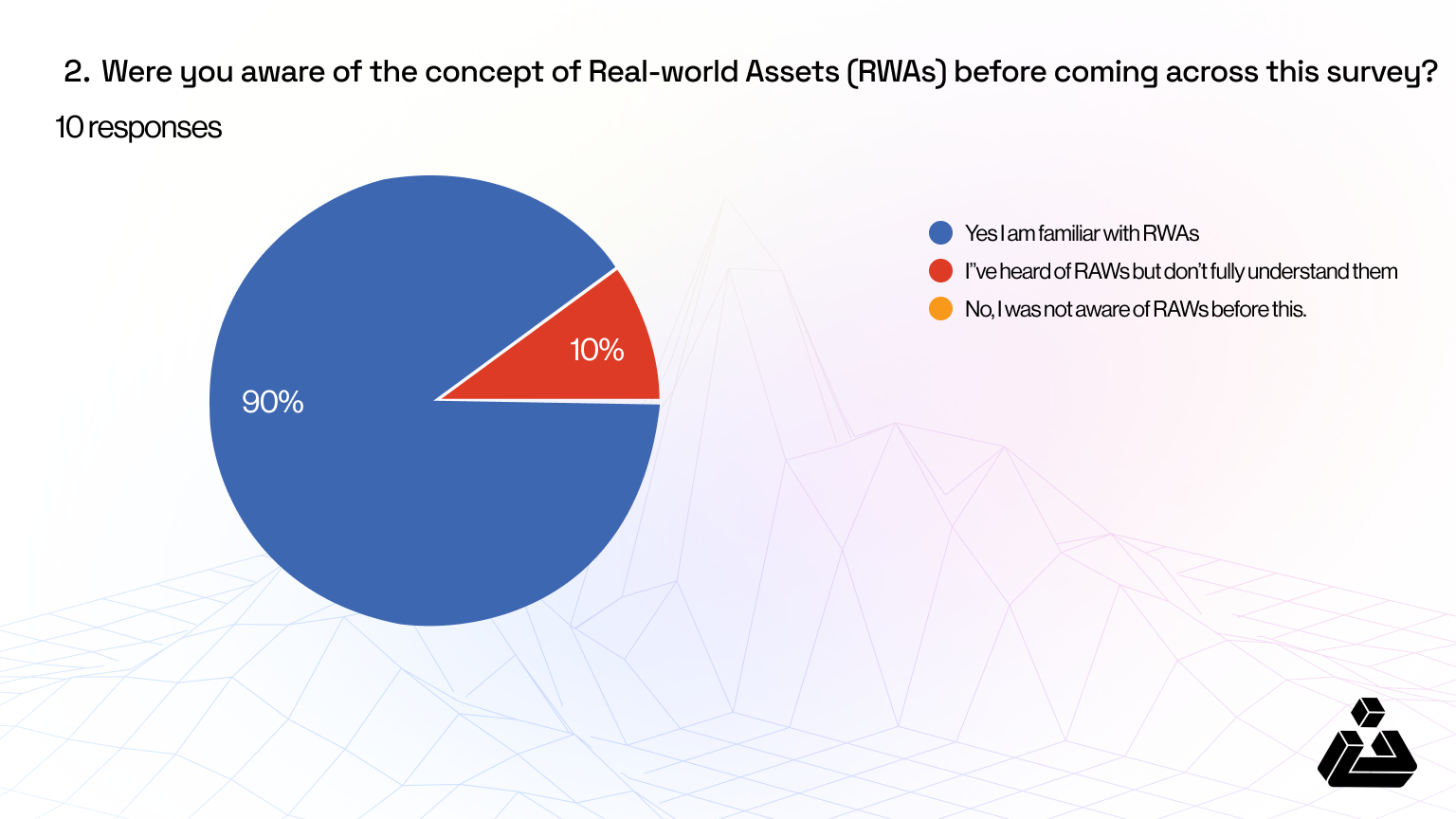

Two types of people had participated in the survey. Majority was made up of the 60 percent who are professionals in the crypto industry and forty percent who are crypto enthusiasts or investors.

Since most people belonged to such categories and had a know-how before taking this survey, mostly all were aware of RWA. So chances of people who don’t belong to blockchain or are not interested might not know anything about RWA and actually are the ones who should be having at least a beginner level knowledge.

According to Bandura’s social learning theory, people learn by observing others within a community. Awareness programs and workshops can help drive their interest so more people can benefit from RWAs and spread awareness to others.

Even a basic conversation between a blockchain enthusiast and a non-technical friend could spark curiosity and open doors to further exploration

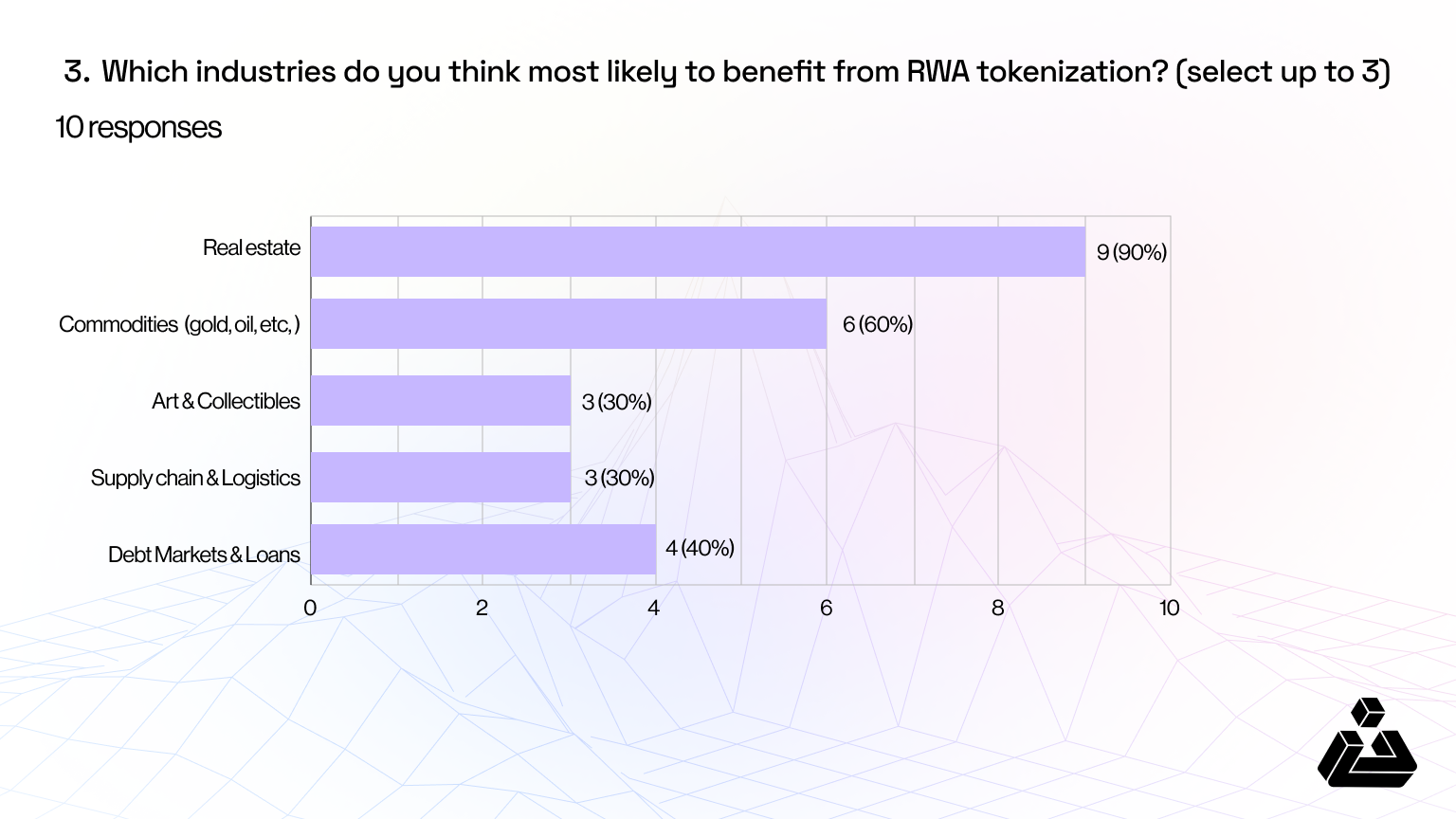

Real Estate emerges as the top industry revolutionizing RWA tokenization pretty much for the same reason we see MakerDAO as a top project in RWA tokenization. It is most appealing to people because real estate is one of the most valuable assets in the world and being able to own it is difficult and expensive.

The concept of fractional shares in RWA allows investors to buy part of that property or a resort. Some notable projects shaping the current domain of real estate and expected to set the bar high in future are RealT, Tangible and Lofty AI.

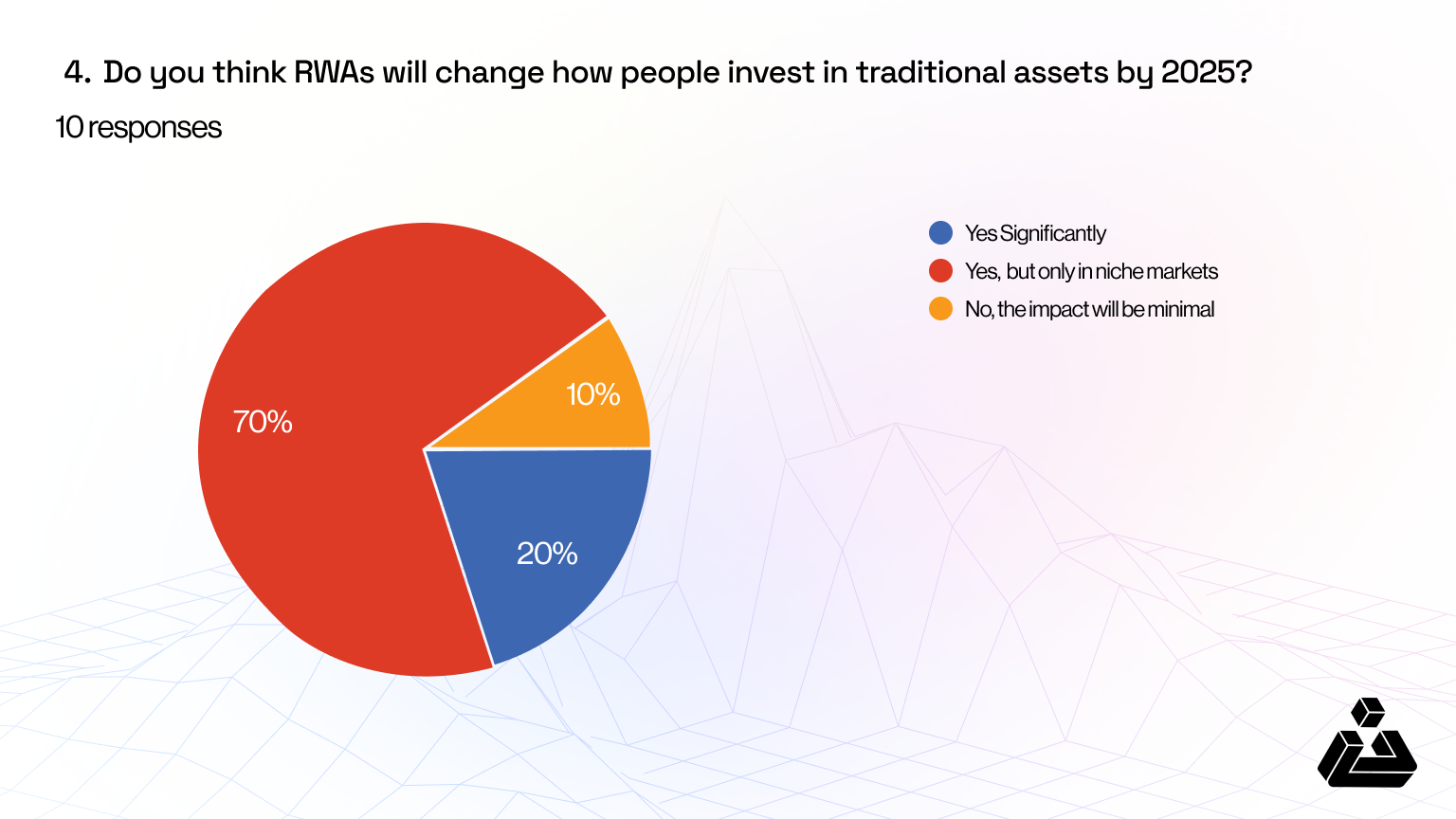

The responses seem closer to reality, as the larger chunk, 70 percent represents people who believe that niche markets are to be targeted for investments. This can be deciphered as that it will first transform specialized sectors rather than mainstream investment markets.

Tokenization may start by making high-barrier assets like collectibles, real estate, and private credit more accessible to smaller investors, allowing fractional ownership and greater liquidity.

The focus on niche markets suggests that the regulatory and infrastructure support needed for widespread RWA adoption is still evolving. As technology and regulatory clarity improve, RWA tokenization is expected to move beyond specialized areas, gradually broadening into mainstream markets.

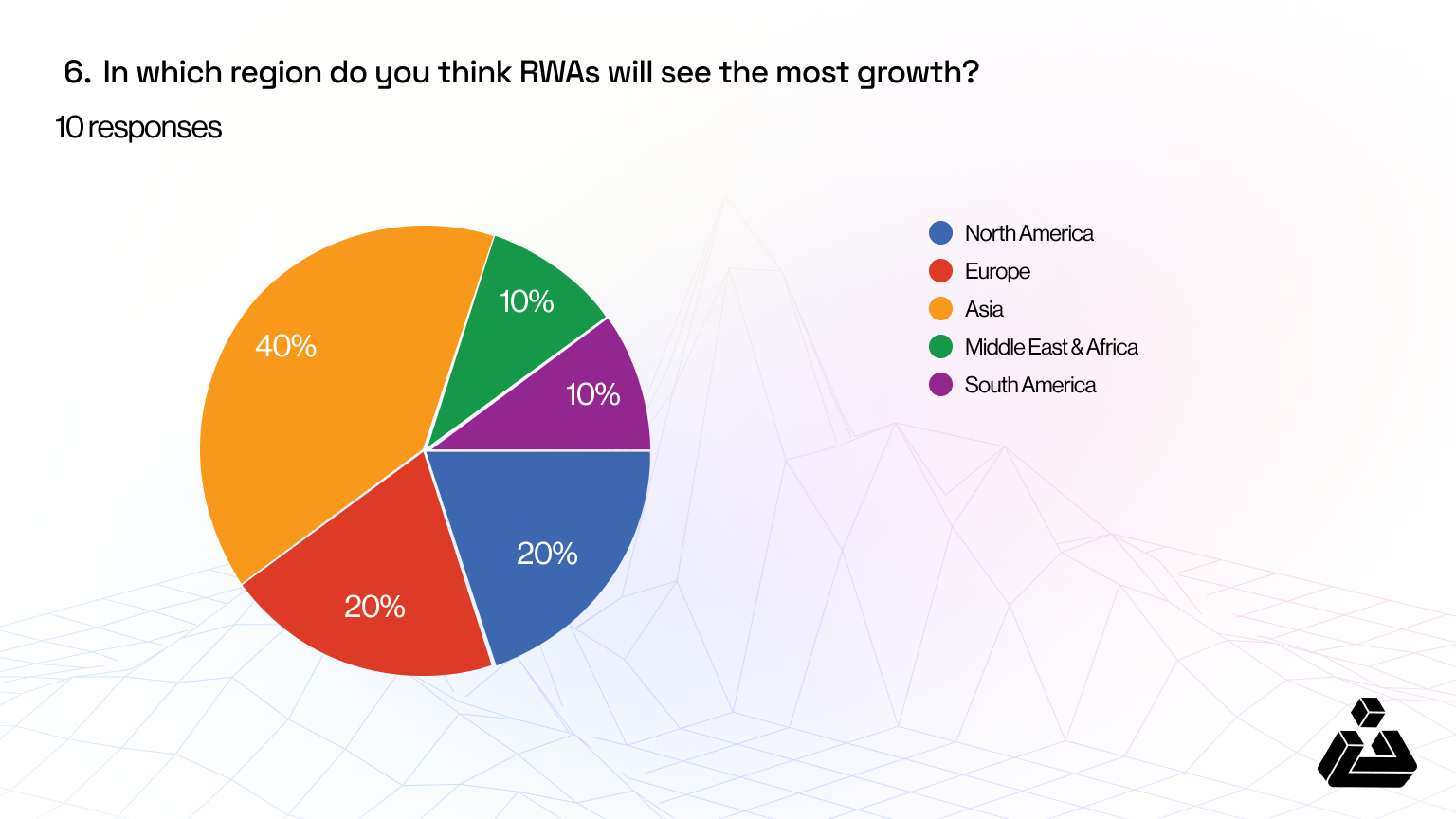

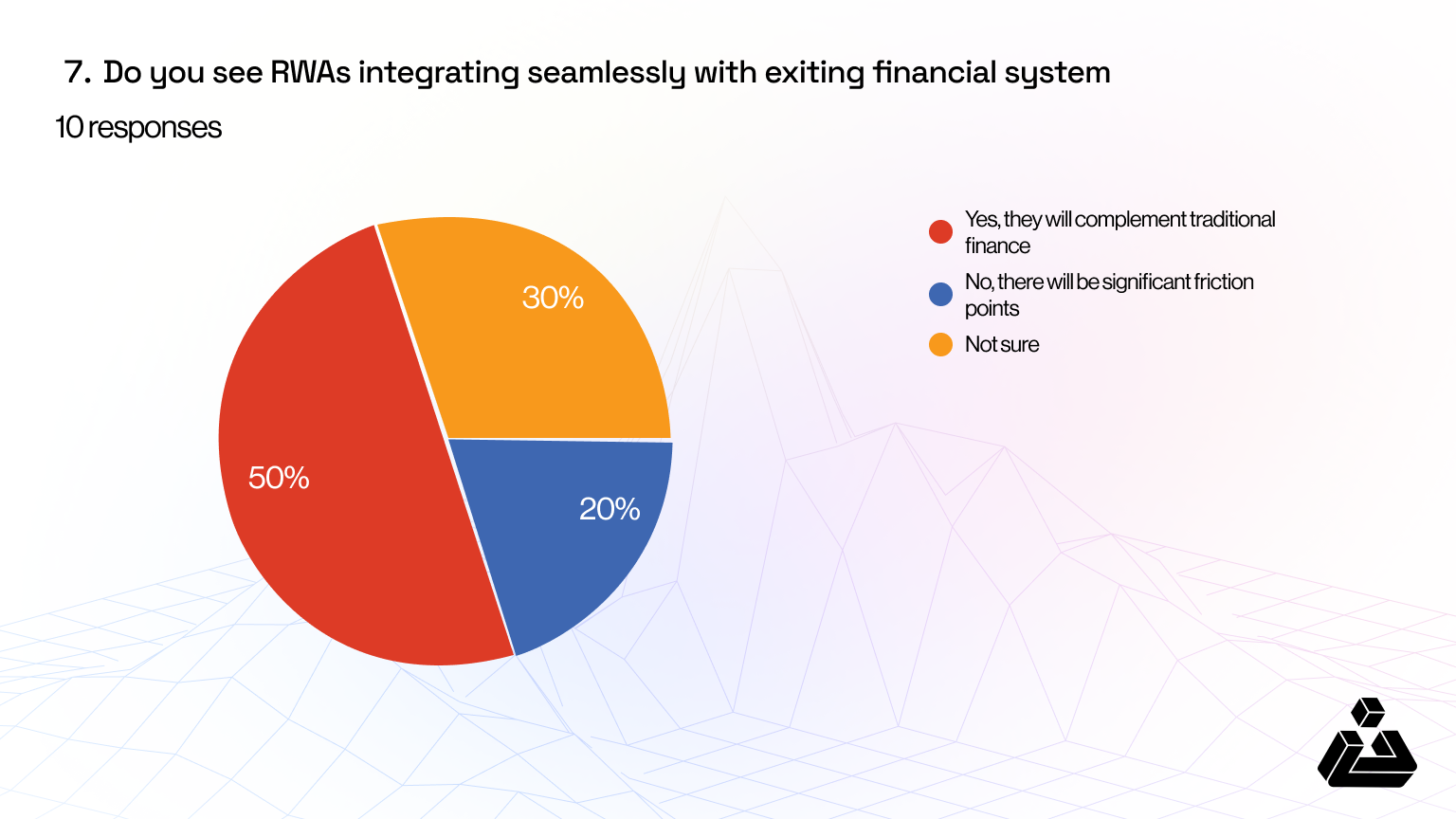

Regulatory challenges have been covered earlier in the article thus the varying regulatory challenges in different parts of the world acts as a barrier to wider adoption. Let’s hover through other responses from the survey which might be self-explanatory but caters mixed responses.

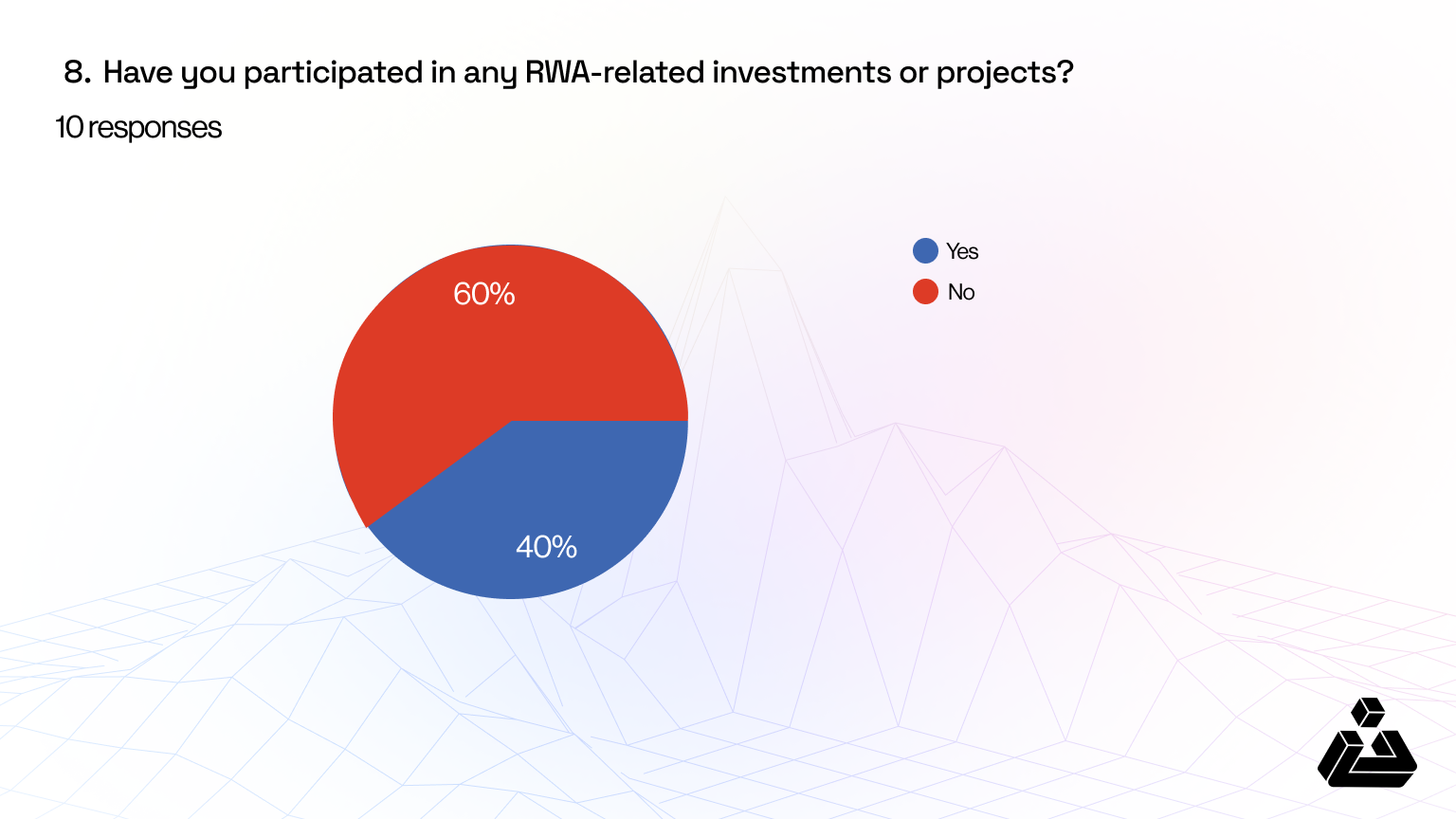

This shows that the majority of the people despite being in the blockchain industry have not really thought of investing. Perhaps, digging into the reason of what’s holding them back could be another survey for another day.

Conclusion

In conclusion, despite some of the challenges and hindrance to adoption, the potential for RWAs is vast. While we don’t know if it’s $16-trillion-by-2030-vast, as the market matures, the rise of adoption by traditional investors and the growing integration of RWAs with DeFi platforms could likely become the cornerstone of the future financial system, bridging the old with the new and opening the financial world to a brand new era.

The convergence of RWAs, Layer 2 solutions, SocialFi, and innovative platforms is ushering in a new era of digital finance and blockchain technology. These advancements democratize access to financial markets, improve asset management, and create synergistic ecosystems that merge social interaction with financial opportunities.

BlockApex, is at the forefront of blockchain innovation and is actively working towards the adoption of RWA. If you are looking for smart contract development services, follow our process and book a free consultation!