The concept of RWA tokenization is quickly reshaping how real-world assets are accessed, owned, and traded globally. Imagine owning a luxury hotel like the St. Regis Aspen Resort , a property typically out of reach for everyday investors. In 2018, it became one of the first real-world assets (RWAs) to be tokenized on the Ethereum blockchain, with $18 million in shares turned into security tokens accessible to anyone in the world.

This moment marked a turning point, showcasing how RWA tokenization can open up traditionally exclusive investments like real estate, bonds, and commodities to a global audience via blockchain technology.

The power of RWA lies in the process of transforming real world assets, such as stocks, real estate, and commercial paper into tokens that can be traded on the blockchain. Real-world assets (RWA) are gaining significant traction in the blockchain space, and in 2024, they have seen more momentum than ever before.

In this blog, we’ll unravel what RWA’s are, and how they work. Moreover, we’ll explore the key benefits of RWAs, and the industries they are revolutionizing. Finally, We’ll understand the challenges RWAs face and the future it holds.

What is RWA Tokenization?

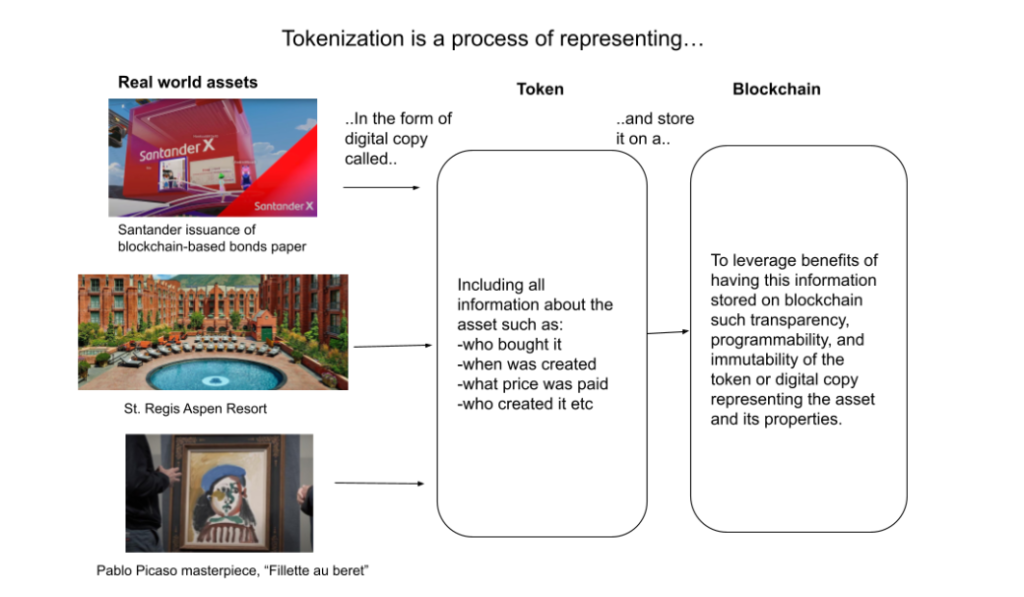

To grasp the concept of RWA tokenization, understanding the broader concept of tokenization is crucial. Tokenization is converting any kind of asset, whether it’s physical, intangible or financial into a digital token that can be traded on a blockchain.

This could include things like stocks, intellectual property, carbon credits or even digital representations of traditional assets. RWA tokenization is a specific type of tokenization, focusing on real-world assets, physical assets like real estate, commodities (gold, oil etc), bonds, commercial papers or artwork.

The aim is to take these tangible assets and represent them as digital tokens on blockchain making it possible for people to sell, buy, and trade portions of real world assets more easily and securely. This is demonstrated in the infographic below.

How They Relate:

- Tokenization is the general process of converting any asset into a digital token.

- RWA Tokenization is a subset of tokenization that specifically deals with real-world, physical assets.

How does RWA tokenization work?

We saw how St. Regis Aspen, a luxury resort, a famous painting or a bank like Santander, issuing blockchain based bonds paper and all of this converts in a digital copy called token, and is being stored on blockchain. This is the RWA tokenization process that follows:

- Asset Verification: The physical asset, like real estate, is verified and authenticated to ensure its value and legitimacy.

- Token Creation: A digital token is created on the blockchain, representing ownership or rights to that asset. Depending on the nature of the asset, it can take the form of either an NFT (Non-Fungible Token) or a fungible token.

- Trading: These tokens can then be bought, sold, or traded on the blockchain, with each transaction securely recorded and ownership transferred digitally.

Key Benefits of RWA

- Increased Liquidity: Tokenized assets can be traded 24/7 on global marketplaces, offering higher liquidity compared to traditional asset sales.

- Fractional Ownership: Tokenization divides high-value assets into smaller, affordable shares, making them accessible to a wider pool of investors. St. Regis Aspen Resort’s case study demonstrates fractional ownership.

- Global Accessibility: Tokenized assets eliminate geographical barriers, allowing investors from anywhere to participate in the market, expanding reach.

- 24/7 Market Access: With blockchain, assets can be traded anytime, offering round-the-clock access to buyers and sellers.

Which Industries is RWA Tokenization Revolutionizing?

We will explore some common RWAs and the impact of tokenization on these traditional models.

-

Real Estate

Real estate investments are often limited to high-net worth individuals due to large capital requirements. Fractional ownership as discussed earlier, allows smaller investors to participate, and tokens can be easily traded, increasing liquidity.

BlockSquare, leverages blockchain technology to enable the tokenization of real estate assets, offering a technical infrastructure that allows for digitizing property values into digital tokens representing fractional ownership.

-

Commodities

Commodity trading (gold, oil etc) typically requires large capital and manpower for physical handling. Commodities can be tokenized making them accessible to small investors without dealing with physical storage or inventory.

Tether Gold (XAUT) offers gold-backed tokens, representing real gold stored in vaults.

-

Debts and Bonds

Bonds are often inaccessible to small investors, with slow settlement times. Tokenized bonds allow fractional ownership, faster transactions, and greater market access.

Centrifuge tokenizes assets like invoices, bringing debt instruments into DeFi markets.

-

Art and collectibles

High-value art and collectibles are typically for elite buyers and lack liquidity.

Tokenizing art allows fractional ownership, making expensive assets accessible and tradable.

Maecenas tokenizes fine art, allowing investors to buy shares of valuable pieces.

-

DeFi

Financial services are centralized, with limited accessibility. RWAs are used as collateral in DeFi, enabling loans and financial services tied to real-world assets.

MakerDAO accepts tokenized real estate as collateral for decentralized loans.

Challenges of RWA Tokenization

Below is a table summarizing the key challenges of RWA tokenization, regulation of ownership being a major challenge.

| Challenge | Description | Possible Solutions |

|---|---|---|

| Regulation of Ownership | Requires a supranational framework for fractionalization and enforceability of tokenized asset rules. | Develop a global framework for decentralized systems and enforce tokenized asset rules. |

| Network Effect | Necessary for RWA tokenization to attract users to a decentralized blockchain. | Encourage early adopters and partnerships to build a user base and highlight benefits of shared ownership. |

| Oracle Problem | Challenges in securely accessing external data for accurately reflecting tangible RWAs. | Trends that seem to solve the problem: 1) Utilize innovation and game theory for accurate data reporting. 2) Enhance digitalization for better integration. |

| Tokenization Standards | Lack of standardization complicates regulatory compliance and investor trust. | Develop a unified framework addressing legal and technical challenges to promote industry-wide standards. |

| Infrastructure | Operational challenges arise when migrating data from centralized to blockchain infrastructure. | Create phased migration strategies to ensure continuity while updating infrastructure for blockchain support. |

Future of RWAs

While the future of RWAs is a chapter on its own which we will cover in another article, we will quickly discuss the future of RWAs in approaching 2025 and beyond. The RWA market is growing rapidly, with predictions of it reaching US$16 trillion by 2030.

In 2024 we already saw, landscape for Real World Assets (RWAs) underwent significant transformation due to increased tokenization, bridging Traditional finance (TradFi) and DeFi.

Key Growth Areas:

- Tokenized Treasuries: The market for tokenized U.S. Treasuries has rapidly grown to around $600 million, reflecting rising interest in traditional instruments like bonds amid declining DeFi yields.

Projects like Ondo Finance and Centrifuge are leading this trend with specialized bond funds for crypto market makers.

- Private Credit: Tokenization of private credit is enabling the transfer of real-world debt assets onto blockchain platforms, making them accessible to accredited investors through fractionalization.

Platforms like Credix facilitate investments in tokenized private notes backed by receivables, with recent filings indicating significant growth potential.

Final thoughts

As RWA tokenization gains mainstream adoption, it will redefine asset ownership and open new doors for decentralized finance. These developments signal the beginning of a new era for RWAs, offering innovative financial instruments that will reshape the valuation and interaction with traditional assets in the digital age.

BlockApex, is at the forefront of leading innovation and technology. If you are looking to securely Tokenize real world assets , follow our process and book a free consultation!