AI agents have recently become the talk of the town, but the term remains somewhat ambiguous and open to interpretation. The spectrum of AI applications is vast, particularly in the domain of DeFi. This convergence has given rise to a new term in the blockchain space: ‘DeFAI’.

AI agents prove to be a game changer especially for DeFi use cases such as automated agent networks, and automated trading. The AI agent market peaked at a $17 billion market cap, while the emerging DeFAI sector, valued at $1 billion, distinguishes itself by integrating blockchain with AI in practical ways.

Unlike early AI agents, which primarily served as automated social media bots with minimal on-chain activity, DeFAI focuses on developing AI-driven tools to optimize and automate complex blockchain operations.

In this blog, we’ll demystify the concept of AI and DeFi (DeFAI) and explore how AI is revolutionizing the DeFi space, along with its key benefits. We’ll then dive into use cases and address some gray areas, including ethical dilemmas and regulatory uncertainties. Finally, we’ll wrap up with a look at the future prospects of AI in DeFi.

AI + DeFi = DeFAI

Understanding AI agents is crucial to help understand how they function and facilitate DeFi technology. We’ll briefly touch upon both AI agents and DeFi separately to get hold on the terms, and then moving onto the synergy between AI and DeFi.

What are AI Agents?

AI agents are amorphous, and account to multiple meanings such as intelligent assistants capable of performing tasks on their own, or to elaborate, software program that autonomously

interacts with its environment, gathers data, and performs tasks to achieve specific goals.

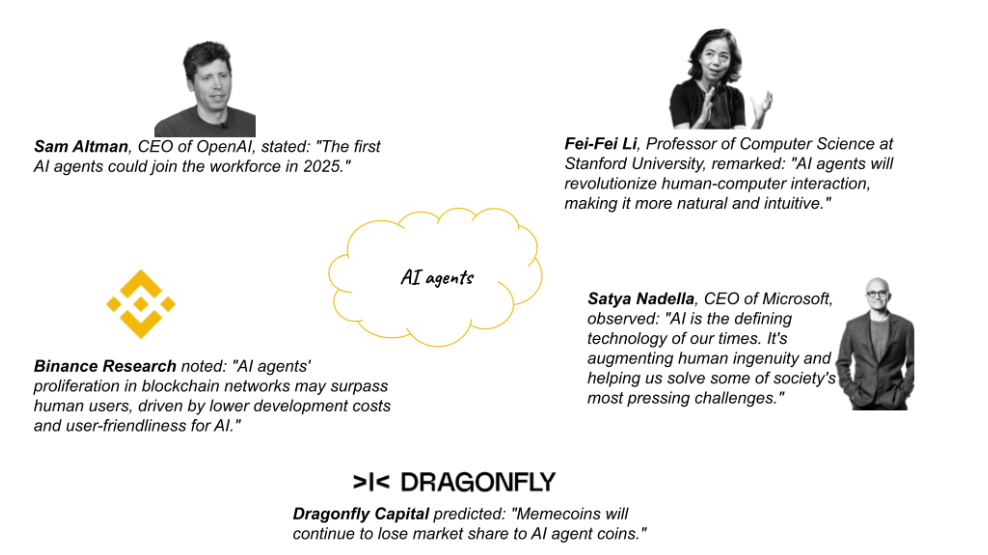

A glance into what industry experts have to say

On a high-level, in traditional AI, agents are entities that perceive and act upon their environment. In the LLM era, the term is narrower, focusing on systems that exhibit agentic behavior—a spectrum rather than a binary definition. Factors influencing agentic behavior include:

- Environment and Goals: Systems operating in complex environments or pursuing goals independently are more agentic.

- User Interface and Supervision: Systems that act autonomously with minimal supervision and understand natural language are more agentic.

- System Design: Systems leveraging tools, planning mechanisms, or dynamic control flow driven by LLMs exhibit higher agentic qualities.

What is DeFi?

Decentralized Finance (DeFi) refers to financial services built on public blockchains, primarily Ethereum, enabling users to perform functions traditionally supported by banks, such as earning interest, borrowing, lending, trading derivatives, purchasing insurance, and more.

DeFi offers speed, reduced reliance on paperwork, and eliminates the need for intermediaries. Similar to traditional finance (TradFi) in functionality, DeFi enhances accessibility, as it is global, peer-to-peer (direct transactions without central intermediaries), pseudonymous, and open to everyone.

Advanced use cases include liquidity provision, staking, and algorithmic stablecoins, with platforms like Aave for lending and borrowing, Compound for earning interest, Uniswap for decentralized trading, and Yearn Finance for automated yield optimization leading the way in this evolving space.

The Synergy of DeFi and AI

The integration of AI and blockchain is not a new concept. From decentralized model training in the Bittensor subnet to GPU and computing resource markets like Akash and io.net, and the rise of AI and memecoins on Solana, blockchain has consistently supported AI development through resource aggregation, paving the way for sovereign AI and consumer-grade applications.

Key Areas of DeFAI:

- Yield Optimization & Portfolio Management

- DeFAI Platforms & Infrastructure

- Market Analysis & Forecasting

- User-Friendly AI Applications

AI enhances DeFi by improving price discovery, risk management, liquidity optimization, and user experience, while DeFi provides a decentralized and transparent foundation for deploying AI models. This integration addresses data privacy, bias, and centralization challenges in traditional AI.

AI-Powered DeFi Use cases

- AI-Based AMMs: Advanced algorithms optimize pricing and reduce slippage by analyzing market data, user behavior, and liquidity trends.

- Lending & Credit Scoring: Machine learning evaluates on-chain and off-chain data for accurate credit scoring, enabling tailored interest rates and broader credit access.

- Intelligent Yield Farming: AI identifies profitable yield opportunities, rebalances portfolios, and minimizes risks through adaptive strategies.

- Portfolio Management: AI-driven tools provide personalized investment advice and automated strategies based on user goals and market sentiment.

DeAI and its implication for DeFi

Decentralized AI (DeAI) uses decentralized networks to develop transparent, tamper-proof AI models for DeFi applications like price prediction, risk assessment, and fraud detection. It also enables data and model sharing among protocols, driving collaboration and innovation in the DeFi ecosystem.

Terra Case Study: Understanding Challenges and Risks

Several DeFi platforms are leveraging AI to enhance their capabilities. Aave, a leading lending protocol, collaborates with Gauntlet to optimize interest rates and liquidation parameters. Uniswap employs machine learning to detect and prevent front-running attacks, while yearn.finance uses AI to identify profitable investment opportunities across DeFi protocols.

We are going to explore a platform, Terra and its collapse highlights critical lessons about the pitfalls of integrating AI into DeFi systems. Terra, a blockchain platform supporting algorithmic stablecoins like UST, exemplified how over-reliance on AI-driven solutions without robust safeguards can lead to catastrophic failures.

Below is an analysis of the Terra collapse, contextualized with principles from regulatory issues to innovation potential:

The Terra collapse highlights the risks of AI-driven DeFi solutions, where heavy reliance on automated systems led to catastrophic failure. Terra’s algorithmic stablecoin, UST, lost its peg due to flawed market assumptions, triggering a multibillion-dollar collapse.

Over-reliance on automation without human oversight left users vulnerable, while the lack of transparency in Terra’s complex algorithms fostered false confidence. Furthermore, the algorithm’s inability to adapt to extreme market conditions accelerated its downfall.

This case underscores the critical need for transparent, adaptable, and well-monitored AI systems in DeFi, balancing automation with human oversight to prevent similar failures.

Challenges in integrating AI within DeFi platforms

Integrating AI into DeFi comes with its fair share of challenges:

Technical Complexity:

Combining AI algorithms with blockchain isn’t easy. Blockchains are decentralized and unchangeable, which makes it tricky to seamlessly integrate them with AI systems.

Scalability Issues:

AI computations and blockchain transactions both demand a lot of resources. Bringing them together could worsen scalability problems, leading to higher transaction fees and slower processing speeds.

Transparency Gaps:

Many AI models operate like black boxes—what happens inside is hard to understand. Since DeFi relies on transparency to build trust, users may hesitate to engage with systems they can’t fully grasp.

Security Risks and Ethical Dilemmas:

AI systems are attractive targets for cybercriminals, who might manipulate algorithms for personal gain. This raises ethical concerns about ensuring fairness, preventing misuse, and protecting user privacy. Securing AI models and safeguarding sensitive data is critical to addressing these challenges responsibly.

Regulatory Hurdles:

The rules for AI and DeFi are still catching up. As these fields evolve, staying compliant with laws like GDPR and navigating unclear regulations remains a major challenge.

Future of AI in DeFi

According to Binance analysis, The future development of DeFi AI is poised to unfold in four key stages:

Stage One: Efficiency will be the primary goal, with tools developed to simplify and streamline complex DeFi operations. This may include AI systems that interpret imperfect data inputs, tools designed for faster transaction execution, and real-time market research that helps users make informed, goal-aligned decisions.

Stage Two: Autonomous trading will emerge, with AI agents capable of executing strategies based on external data or insights from other agents. Advanced users will be able to fine-tune these models to optimize returns for their portfolios or clients.

Stage Three: The focus will shift to wallet management and addressing AI verification concerns. Utilizing technologies like Trusted Execution Environments (TEE) and Zero-Knowledge Proofs (ZKP), DeFi AI systems will offer enhanced transparency and security, fostering trust within the ecosystem.

Stage Four: A no-code DeFi AI toolkit or AI-as-a-service model could emerge, enabling anyone to build agent-based economic systems. This would allow users to fine-tune models for cryptocurrency trading, broadening access to these powerful tools.

The integration of AI into DeFi has the potential to transform the financial sector. We can expect the development of more sophisticated, transparent, and explainable AI models that tackle the current “black box” challenge.

Moreover, AI-driven innovation could lead to new financial products and services, such as personalized, real-time financial planning, democratizing access to investment management.

Conclusion

In conclusion, as DeFi and AI technologies evolve, their integration promises to reshape the financial landscape, making it more inclusive, efficient, and innovative.

BlockApex is dedicated to solving the challenges of DeFi and AI by delivering secure, scalable blockchain solutions. We’re excited to lead the way in integrating AI to unlock innovative financial opportunities. To become part of this, book your consultation now.