EIP 6963 & the future of Ethereum Wallets

EIP-6963 is going to be a game changer in the user’s experience of interacting with DApps and it will allow new players to come into the wallet space and have a fair chance of competing with other wallets.

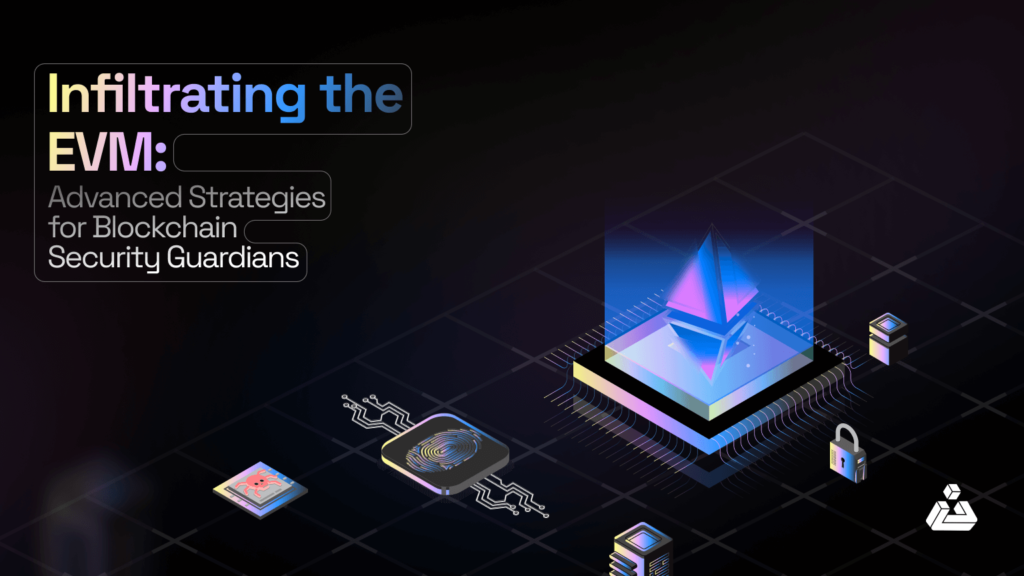

Infiltrating the EVM: Advanced Strategies for Blockchain Security Guardians

Learn advanced strategies for blockchain security guardians in this groundbreaking article series by BlockApex Labs. Gain insights into the Ethereum Virtual Machine (EVM), smart contract vulnerabilities, and thorough auditing techniques. Stay ahead in the evolving world of blockchain security and prevent financial losses with comprehensive knowledge. Join us for the article series and course today.

Web 2.0 Security vs Web 3.0 Security: An Innovative Adaptation?

Web 3.0 is a semantic web where it promises to establish information in a better-existing way than any current search engine can ever attain. Web 3.0 promotes four concepts which mainly are authenticity, i.e, every piece of information existing on the internet is a fact or derived from a fact. Integrity, willingness to abide by moral principles, and ethical values. Transparency, the data present on the internet is accessible for every user to witness. Lastly, Confidentiality which is achieved by Blockchain technology, where every user’s identity is anonymous, making it secure.