Beanstalk protocol got hacked for around $74M through exploiting the governance mechanism & stealing all the BEANS & Curve LP tokens stored in the Beanstalk protocol. It is a bit complex hack, let’s break it down step by step.

Proposal creation transaction on BeanGovernance

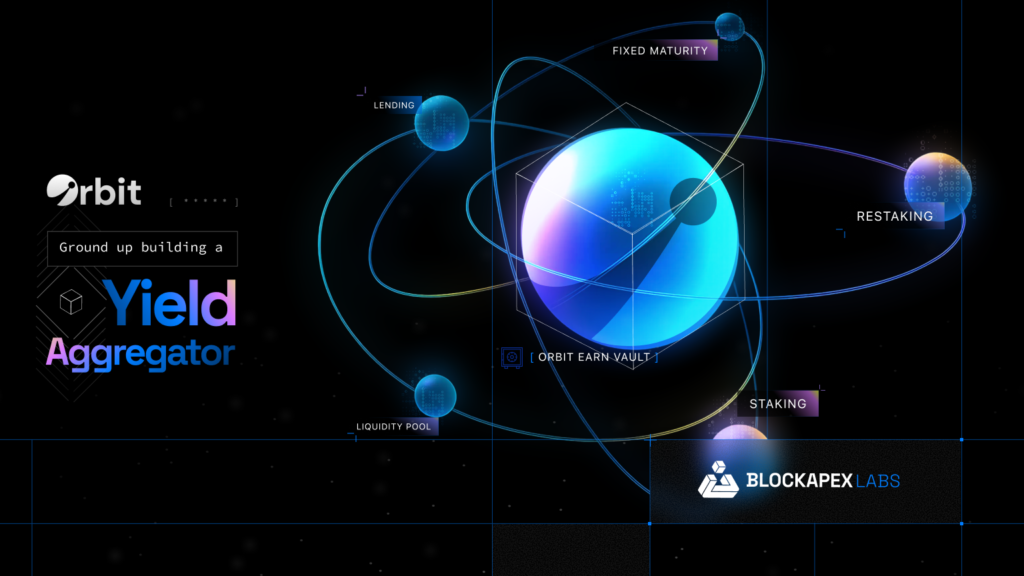

Imperative Functions of the Protocol

Before diving into the hack let’s analyze how the governance system worked for the protocol & why the proposal was important.

- The idea of a proposal is to modify the beanstalk protocol in any way that attracts or affects the interest of the community.

- A proposal for governance can be created by anyone who has deposited beans into the protocol. Anyone who hasn’t deposited beans will not be able to create the proposal.

- The proposal in this scenario is a smart contract that will be executed if enough votes pass for it. An example of this can be to whitelist other pools for governance voting, etc.

- If anything goes wrong, there is also an emergencyCommit function that bypasses all of the individual votes & executes the proposal. It can be called after a waiting period of one day.

The Intent

The attacker created 2 Proposals.

The malicious contract requested the following tokens to be sent over to the exploit contract address.

- BEAN3CRV-f, A BEAN-CRV metapool on curve.

- BEANLUSD-f, A BEAN-LUSD metapool on curve.

- UNI-V2 ETH/BEAN, A liquidity pool for ETH-BEAN.

- BEAN token.

Undertakings of the Exploit

- The attacker starts by taking a flashloan of $1 Billion from AAVE v2 containing the following assets.

- 350,000,000 DAI

- 500,000,000 USDC

- 150,000,000 USDT

- The attacker takes yet another Flashloan from Uniswap v2 for 32,100,950 BEAN & Sushiswap for 11,643,065 LUSD.

- Then the attacker deposits DAI, USDC & USDT to Curves 3Pool (DAI/USDC/USDT) to get 979,691,328 3Crv tokens.

- Exchange 15,000,000 CRV tokens to 15,251,318 LUSD on BEANLUSD-f pool.

- Add single asset liquidity 964,691,328 CRV to get 795,425,740 BEAN3CRV-f.

- The attacker deposits 32,100,950 BEAN & 26,894,383 LUSD to get 58,924,887 BEANLUSD-f

- The user then deposits BEANLUSD-f & BEAN3CRV-f to the beanstalk contract to get enough voting power.

- The attacker calls Diamond.vote(18) At this point user has control over 66% of the voting power.

- The proposal gets executed by calling the Diamond.emergencyCommit(18) function on beanstalk protocol which sends the following tokens back to the exploit contract.

- 36,084,584 BEAN

- 0.540716100968756904 UNI-V2 ETH/BEAN.

- 874,663,982 BEAN3CRV-f.

- 60,562,844 BEANLUSD-f.

- 100 BEAN minted to the exploit contract.

- Removes 874,663,982 CRV single liquidity to get 1,007,734,729 CRV tokens.

- Removes 60,562,844 BEANLUSD-f single liquidity to get 28,149,504 LUSD.

- Returns flashloan of 11,678,100 LUSD to Sushiswap.

- Returns flashloan of 32,197,543 BEAN to Uniswap V2.

- Exchanges 16,471,404 LUSD to get 16,184,690 CRV on LUSDCRV-f.

- Removes liquidity from 511,959,710 3CRV Pool to get 522,487,380 USDC, 358,371,797 DAI, 156,732,232 USDT.

- Returns flashloan on aave for 350,315,000 DAI, 500,450,000 USDC & 150,135,000 USDT.

- Removes liquidity on 0.540716100968756904 Uniswap V2 to get 10,883 Eth & 32,511,085 BEAN.

- Donated 250,000 USDC to Ukraine Donation Wallet.

- Swap 15,443,059 DAI to 15,441,256 USDC on Uniswap V3.

- Swap 37,228,637 USDC for 11,822 Eth on Uniswap V3.

- Swap 6,597,232 USDT for 2,124 Eth on Uniswap V3.

- Leaving the attacker with over 24k Eth ~ $72M in profit.

The Exit Strategy

The hacker used tornado cash & split the ~24k Eth into chunks of 1, 10 & 100 Eth to disappear in thin air. One thing to note is that this hack was a result of a bad governance design and not an economic design.

HACK YOURSELF!

Here is the Github repo that has POC for the hack.

Read More:

Cream Finance Hack: What Motivates Hackers to Return Stolen Funds?