In 2018, the world of blockchain entered the new era of DeFi with the launch of Uniswap V1, offering a way to earn yield on your capital completely on-chain. But what began with a flat 0.3% trading fee has evolved in a world of Defi yield avenues ranging from liquidity provisioning to staking, re-staking, lending markets and much more. The explosion of these protocols across hundreds of chains has multiplied the options further, with thousands of pools and protocols competing for liquidity.

This competition also helped protocols get more mature with time. Uniswap V3, for example, offered not just a variety of fee tiers but configurable price ‘ticks’ to increase capital efficiency; many other protocols followed the same pattern. To attract liquidity, protocols began offering incentive programs that could temporarily push APYs to eye-catching levels. At the same time, as TVL across DeFi grew, security breaches became more frequent, leading to millions of dollars in user losses.

Hence, for an average user, navigating this landscape is not just about “finding the highest APY” but more about risk profiling the protocol, diversifying exposure, and monitoring returns, all while navigating the complexities of bridges, DEXes, time-locks, and more. Making it almost impossible for anyone outside of crypto-native circle to fully enjoy the potential of DeFi yields.

So although DeFi yields exist in abundance, they are fragmented, volatile, and locked behind systems that were never designed for mass adoption. This is exactly where yield aggregators step in.

Yield Aggregators

Yield aggregators emerged as a natural response to this fragmented and complex landscape, taking the burden off users in a variety of ways. Some are mere listing platforms, aggregating strategies across chains on one page allowing users to curate those based on their own risk appetite. You can call them as off-chain aggregators. In contrast, on-chain aggregators offer their own vault where you deposit once and let them combine yield from multiple strategies (our focus is on these aggregators). Over time, different flavors of these yield aggregators have been developed with varying levels of trustlessness, security, cross-chain inclusivity, lockup periods, and strategy diversity. Each comes with its own USP and captures a specific market share based on the input chain, input token and risk profile. Some examples include Morpho Vaults V1, a permissionless aggregator for third-party curated Morpho lending markets (V2 allows adding external same chain strategies as well), and Sommelier, a strategy-focused aggregator offering curated vaults powered by off-chain automation. [See also DefiCarrot, Makina Finance, Reflect Money]

That said, building a robust yield aggregator isn’t trivial. From strategy design to contract security, the challenges compound quickly and the moment you go cross-chain, the difficulty rises even higher. With all underlying complexity, keeping the product accessible and ready for mass adoption requires careful design choices. The rest of this case study dives into exactly how we approached these challenges, the decisions we made, and the lessons we learned along the way.

How we Built

Decisions that worked

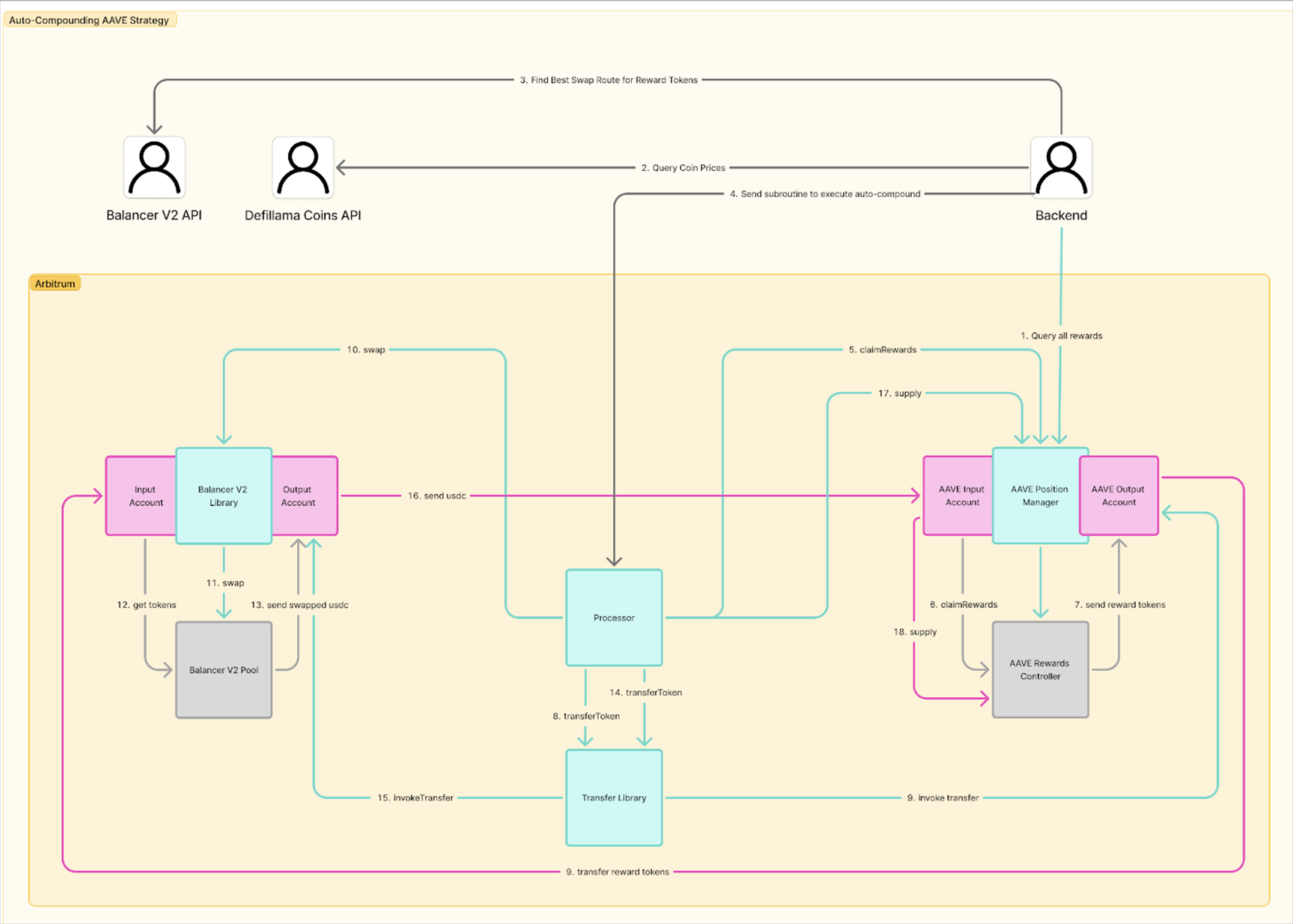

One of the earliest choices that paid off was to keep things simple and add complexity only when needed. For instance, when we started risk profiling of strategies, we began by filtering strategies in the lending market, then gradually layered in yield aggregator strategies, and eventually added fixed-maturity tokens. We followed the same approach during our implementation: build a basic foundation first, then add checks and optimizations incrementally. Whether it was auto-compounding reward tokens received from strategies, ignoring dust amounts, or introducing auto-healing logic to keep the system resilient during unexpected failures; the incremental path ensured stability without slowing progress.

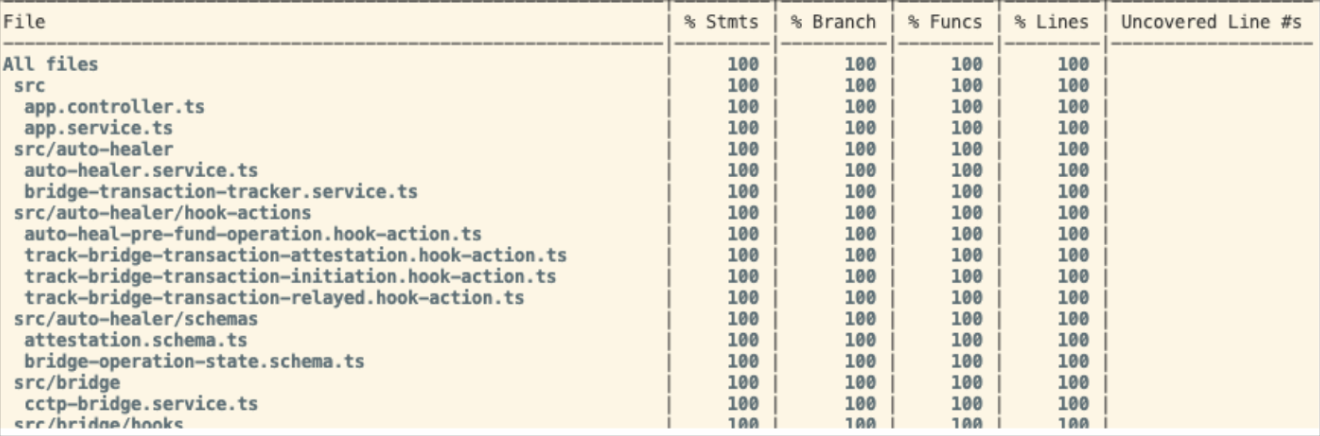

Another key decision was practicing Test-Driven Development (TDD). While speed often takes priority in early-stage startups, handling user funds demands an extra level of discipline. TDD gave us that safety net. It kept the codebase clean and modular, made large-scale refactoring feasible, and encouraged SOLID principles by design. The end result was a system where adding new functionality felt natural, not risky.

For smart contract design, we leaned heavily on valence-protocol by timewave, which proved to be a strong foundation. It allowed us to write small, secure, and testable “Library” contracts to fulfill our custom use-cases while supporting the construction of arbitrary routines to facilitate deposits, withdrawals, auto-compounding rewards, and even auto-healing procedures.

Finally, by leveraging Subgraph, we kept the UX aligned with our goal of making DeFi yields accessible beyond crypto-native audiences. While our system only supports async withdrawals, we ensured that the UX remains as intuitive and simple as possible, auto-completing withdrawals from a dedicated service as soon as they are claimable to keep things simple and straightforward. Our subgraph also allowed the user to track status of their withdrawals and the estimated time left for its completion.

Lessons Learned

But the path wasn’t as smooth as it sounds. Some of our early assumptions had to be revisited, and the process taught us valuable lessons about the realities of building in DeFi.

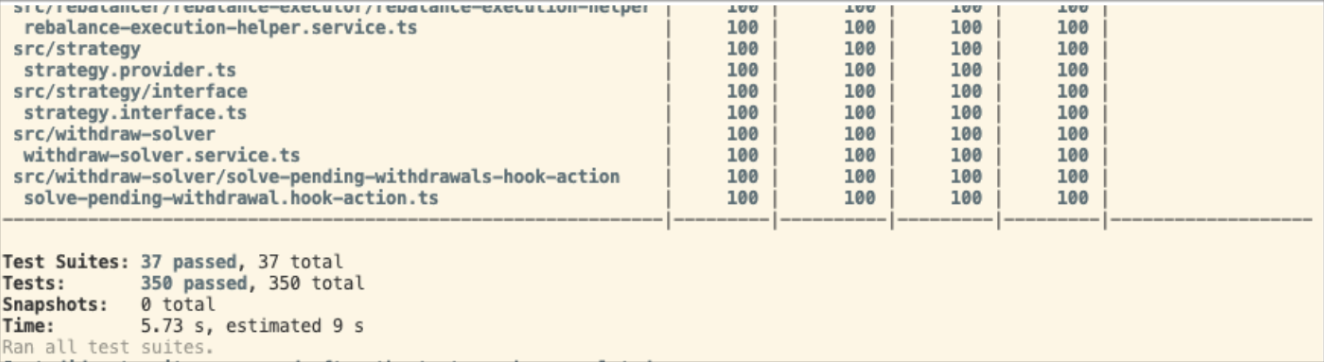

We faced the first major setback with our attempt to apply quantitative finance models like ARCH and GARCH to strategy curation. The goal was to model volatility and build a generic optimizer for changing market conditions. In theory, it made sense, but in practice, most strategies were younger than two years and some even younger than 6 months which means our model won’t be able to capture complete market cycles.

ince each strategy had a different historical span, fitting a consistent model across all of them was infeasible, and building individual models for hundreds of strategies was equally impractical. After consulting industry experts, we shifted to a more balanced approach: qualitative analysis to screen strategies, and limited quantitative parameters helping in deriving relative risk scores of strategies. This hybrid method proved more realistic for an aggregator as it eliminates the need of all asset-level risk scoring which is native to lending markets.

Another early misstep was our attempt to make this cross-chain aggregator fully trustless from day one. This required cross-chain queries, handling stale responses, error management, and cross-chain invocation of transactions. After exploring options with the IBC Eureka team and other bridge providers, we realized that not only was this incredibly complex, but some parts were practically impossible with the current infrastructure. Even where technically feasible, bridge relay delays made the system unusable. We decided instead to start with a centralized but trust-minimized model and evolve toward greater trustlessness as the cross-chain ecosystem matures.

Lastly, (and this might be a bit low-level discussion), we initially tried to create deterministic subroutines in valence-protocol to follow standard authorization flows. Caveats were that we had to dynamically update target allocations on each optimizer run on-chain, include zero transfers transactions, and create new subroutines whenever strategies were added. The result was bloated gas costs, backend inefficiencies, and little security benefit, especially since dynamic authorizations introduced their own risks. We pivoted to a simpler design: an admin account that can make arbitrary calls to the processor, but restricted by the library functionality. While not fully trustless, this still ensured that our admin account (or compromised backend) without owner access cannot perform an operation which leads to loss of funds.

Outcomes & Operating Cost

At the end of the day, what mattered most was execution. In just four months, we shipped a fully working system with 100% test coverage across the stack, our centralized backend, smart contracts, and even our subgraph indexer. Along the way, we contributed 5+ libraries to valence-protocol and also upstreamed an ethers v6 implementation for the nestjs-ethers package, pushing improvements back into the ecosystem.

On the strategy side, we shortlisted 33 liquid strategies that are virtually risk-free and yield over 8% APY. To make the system resilient, we also built an auto-healing process that minimizes human intervention during normal conditions, reducing operational overhead.

From a cost perspective, we kept things lean. Our off-chain expenses are limited to the DefiLlama Pro API at $300/month and lightweight infrastructure on Railway ($5/month for a Node.js instance, MongoDB server, and cache volume). The gas cost for on-chain operations that includes price updates, rebalances, and user deposit/withdrawals depends on network congestion, chain’s gas parameters, and activity on vault. However, as we implemented deposit and withdrawal queues with a 5% liquidity buffer, the average case cost of the process remains reasonably low. Assuming ~10 deposits and ~10 withdrawals daily, with price updates every 30 minutes and rebalances every 4 hours, total gas costs sum up to around $25/month.

Why Build Yield Aggregators

In traditional finance, yield is one of the most familiar concepts, whether through saving accounts, bonds, or fixed deposits, people are used to putting money somewhere and watching it grow. That mental model carries over naturally into crypto, where stablecoins already serve as the backbone of the ecosystem, powering roughly 70% of the total trading volume.

Yet, despite their dominance, only around 5% of stablecoins are actually deposited into yield-generating avenues. That leaves a massive untapped market. The gap between what users expect (consistent, accessible yield) and what the crypto ecosystem currently offers is precisely where yield aggregators step in.

Nearly every distributor in web3 space, be it a CEX or wallet, either supports or is looking to add support for earning on idle assets, with varying needs. For instance, MENA region CEXes would be looking for aggregators with sharia-compliant strategies, or a chain specific wallet might want support for a specific token. So a massive opportunity lies here to be capitalised.

Additionally, with a reliable source of yield, the possibilities quickly extend beyond “just more APY.” You can build subscription management systems where users pay recurring costs out of their yield instead of principal, enable streaming yield into higher-risk assets, letting users auto-diversify without ever touching their capital and also create mechanisms for corporations to offer perks to consumers for depositing their principal in the vault and streaming its yield to the product, especially useful in the gaming industry.

In short, yield aggregators don’t just optimize returns, they lay the infrastructure for entirely new utilities, bridging the comfort of TradFi with the innovation of DeFi. And the surface has barely been scratched.

The Future of Yield Aggregators

If DeFi is to ever reach mass adoption, yield aggregators will likely play the same role in crypto that savings accounts and mutual funds play in traditional finance. They are the simplest, most approachable way for users to put idle capital to work without needing to understand the complexities of liquidity pools, staking contracts, or rebasing tokens. We are already living through the transition of yield earning from “power-user tools” into default infrastructure that wallets, exchanges, and even fintech apps integrate seamlessly with yield aggregators.

Looking ahead, when yield aggregators overlap with AI, we will get interesting use cases. A user will be able to get a personalized yield aggregator on-demand based on his/her risk appetite and input token. AI will also help in improving risk management efficiency.

Further out, we may see yield aggregators becoming primitives for entirely new financial services:

- Smart corporate treasuries, where businesses park stablecoins in aggregators to manage cash flow, hedge risks, or stream employee benefits directly from yield.

- Programmable yields, where returns can be redirected automatically into subscriptions, payments, or charitable donations.

Just as mutual funds democratized access to sophisticated investment strategies in TradFi, yield aggregators have the potential to democratize global, on-chain income streams, and AI could be the force that makes them adaptive, secure, and scalable for the next billion users.

Overview of BlockApex Labs

BlockApex is a blockchain security and consulting company that provides a range of services related to blockchain technology, including smart contract development, system design, DApp development on mostly EVM-based and compatible chains, and security services such as smart contract audits, penetration testing, and formal verification.

Our team of experts has extensive experience in blockchain technology, and we have a proven track record of developing secure and reliable systems that meet the highest standards of security, code correctness, financial scalability, composability, and extensibility. We strongly emphasize formal verification and financial risk assessment to ensure that the systems we help build are robust and meet your specific objectives to steward innovation.

At BlockApex, we have two distinct branches that cater to different aspects of blockchain technology. BlockApex Labs provides consultation and development services primarily related to tech-led products in asset management, capital markets, decentralized finance, global trade, and money markets. This branch specializes in Smart Contract Development, web and mobile DApp development, and strategies for these domains.

Moreover, BlockApex Security specializes in fortifying systems built in web3 by providing high-quality blockchain security and cybersecurity services, which include smart contract audits, DApp testing, financial risk assessment, and token engineering.

Having delivered over 45 products and secured over $3 billion in TVL, we hold profound expertise in complex system designs and scalable financial applications.