The intersection of blockchain technology and game theory represents a compelling fusion where economic strategies and technological innovations converge. This connection focuses on utilizing game theory’s principles to design and secure blockchain networks. Within the context of the Semantic Web, game theory plays a pivotal role in designing algorithms and protocols for autonomous agents to interact efficiently and securely, especially when dealing with decisions made under uncertainty. By applying game theory, developers can ensure these agents work towards the collective good of the system, aligning their actions with overall goals such as data integrity, privacy, and efficient resource use.

Furthermore, game theory is crucial for open-looped systems, where the absence of direct feedback loops necessitates careful design of initial conditions and rules governing system interactions to ensure stability and prevent exploitation. This framework allows anticipation of potential strategic behaviors and the design of mechanisms that encourage cooperation, discourage malicious actions, and adapt to evolving conditions without direct intervention, making it central to the decentralized and autonomous nature of blockchain environments.

What’s Game Theory?

Game theory is a branch of mathematics and economics that studies decision-making in situations where outcomes depend on the choices of multiple participants, each with their own set of preferences and strategies.

This theoretical framework is built around key actors

- Players– the decision-makers

- Strategies– the choices available to the players

- Payoffs– the results of the strategies

The Prisoner’s Dilemma

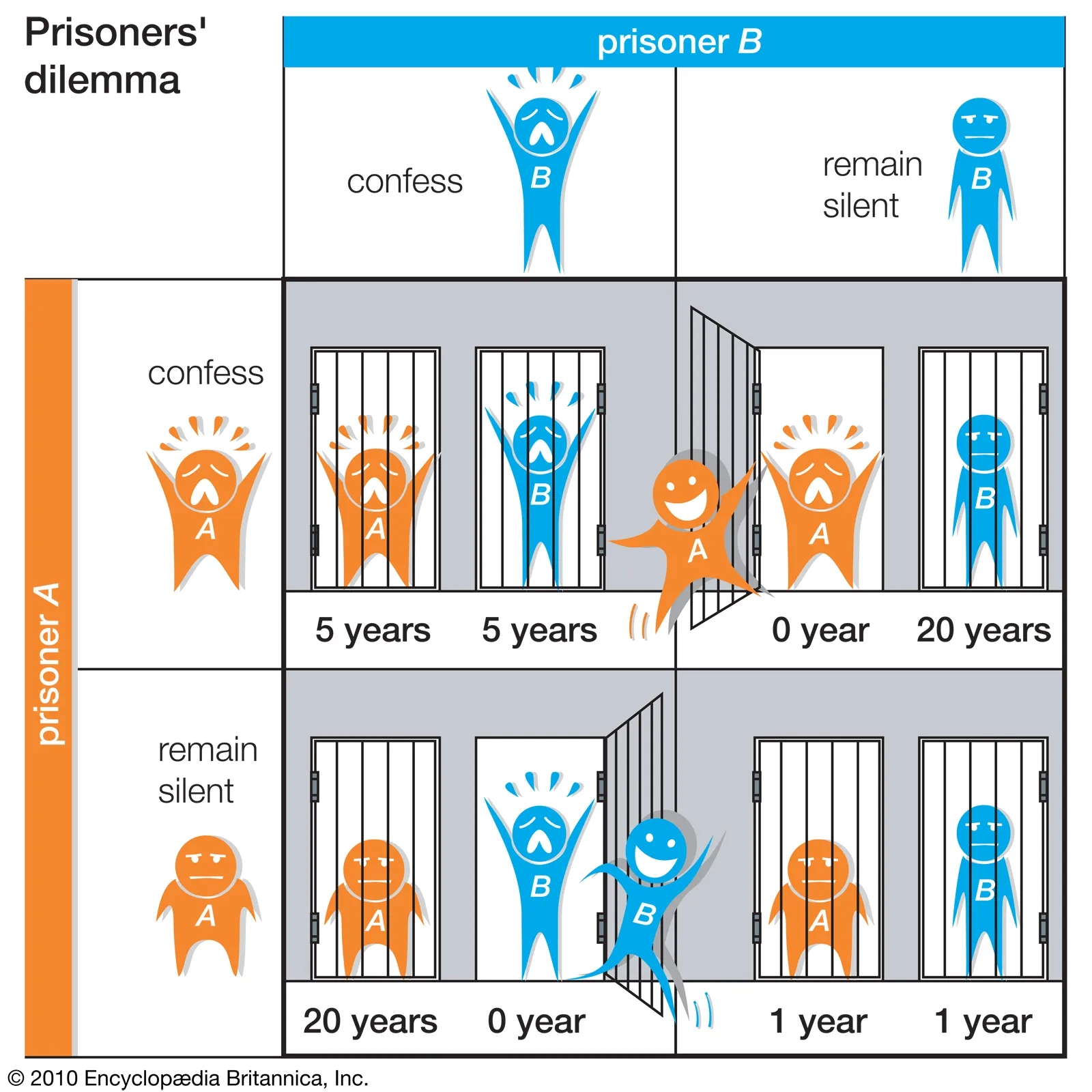

One of the most illustrative examples of game theory in action is the Prisoner’s Dilemma, a scenario that captures the conflict between individual rationality and collective benefit. This dilemma involves two prisoners, A and B, suspected of committing a crime together. Held in separate cells, they cannot communicate with each other and must independently decide whether to confess (betray the other) or remain silent.

What will the prisoners do? What is the right answer? The answer is Game theory 😉

This scenario underscores the challenge of strategic decision-making in the absence of trust and direct communication, embodying game theory’s exploration of human interaction. Despite mutual benefit from cooperation, the lack of trust and communication drives each prisoner to betray the other, leading to a worse outcome for both.

Game theory and blockchain

Where there is decision-making, there is game theory. In the field of blockchain, game theory provides a foundational structure for ensuring the integrity and sustainability of decentralized networks.

Here are some key areas where game theory intersects with blockchain technology:

01- Consensus Mechanism Design

One of the most crucial applications of game theory in blockchain is in the design of consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS). These mechanisms rely on economic incentives and deterrents to encourage participants (miners or validators) to maintain the network’s integrity.

Let us see in detail how game theory applies to PoW and PoS;

- Proof of Work (PoW): Miners compete to solve cryptographic puzzles, and the winner adds the next block to the chain. PoW incentivizes honest mining through rewards and disincentivizes malicious behavior by making attacks computationally expensive (high cost for the attacker). This is an example of a Prisoner’s Dilemma, where cooperation (honest mining) benefits everyone, while defection (malicious behavior) can be tempting but ultimately leads to worse outcomes for all.

- Proof of Stake (PoS): Validators lock up their tokens as collateral, and the chance of validating a block is proportional to the staked amount. This creates a “skin in the game” scenario where malicious behavior risks losing locked tokens, aligning validator incentives with network security. This is an example of a repeated game, where past actions and reputations influence future behavior, encouraging long-term cooperation.

02- Tokenomics

The design of a blockchain’s token economy can also be influenced by game theory. By understanding the strategic behavior of users, developers can craft token distribution mechanisms, governance protocols, and other economic structures that encourage desired behaviors, such as participation, investment, and development within the ecosystem essential for growth.

Let us see how Game theory applies in Tokenomics

- Initial Coin Offering (ICO): Token distribution mechanisms can be designed to incentivize early participation and long-term holding. For example, offering discounts to early buyers or distributing rewards based on holding periods encourages users to buy and hold tokens, aligning their interests with the network’s growth. This can be seen as a coordination game, where individual benefits increase through collective action.

- Burning mechanisms: Burning a portion of transaction fees or tokens can create scarcity and increase their value over time. This incentivizes holding tokens over spending them, potentially benefiting long-term investors. This is similar to a common pool resource game, where managing a shared resource (the token supply) requires collective action for long-term sustainability.

03- Network Attacks and Defense Strategies

Game theory can help predict and defend against potential attacks on a blockchain network. By analyzing the cost-benefit calculations of potential attackers, developers can design systems where the cost of attacking the network is always higher than the potential gains, thereby deterring such actions.

Some examples of how game theory works here are as follows

- Sybil attacks: An attacker tries to control the network by creating a large number of fake nodes. Game theory can help design voting systems that make Sybil attacks expensive and ineffective, such as requiring higher stakes or computational resources for voting power. This can be viewed as an arms race, where attackers and defenders constantly adapt their strategies.

- 51% attacks: An attacker gains control of over half the network’s hashing power, allowing them to manipulate the blockchain. Game theory can help design economic incentives that make it prohibitively expensive to acquire such a large stake, making 51% of attacks less likely. This is another example of a Prisoner’s Dilemma, where individual incentives might push toward attacking, but collective harm discourages such actions.

04- Decentralized Finance (DeFi)

In DeFi, game theory is used to create mechanisms and protocols that ensure fairness and prevent exploitation. For instance, mechanisms such as liquidity pools, automated market makers (AMMs), and yield farming strategies are designed considering the strategic behaviors of participants, aiming to create systems that are abuse-resistant and incentivize long-term engagement.

Let’s see briefly, some ways where game theory is used

- Liquidity pools: Users deposit crypto assets into pools to earn interest. Game theory helps design pool mechanisms that incentivize providing liquidity while ensuring fair rewards and minimizing risks of pool manipulation. This can be modeled as a coordination game where providing liquidity benefits everyone, and designing the pool efficiently requires considering the strategic behaviors of depositors.

- Flash loans: Borrowing large amounts of crypto instantly without collateral, exploiting arbitrage opportunities, or manipulating markets. Game theory can help design systems that mitigate flash loan risks, such as requiring time delays or whitelisting specific uses. This is an example of a dynamic game, where attackers constantly evolve their strategies, requiring defenders to adapt their responses.

05- Governance

Blockchain governance involves decision-making processes regarding changes to the protocol. Game theory is applied to design voting systems that mitigate the risks of centralization and encourage decision-making that benefits the whole network rather than individual stakeholders.

But how does governance exactly use game theory?

- Delegated Proof of Stake (DPoS): Token holders elect representatives (validators) to make decisions on protocol changes. Game theory helps design voting systems that prevent vote buying, and strategic manipulation, and ensure fair representation of various stakeholder groups. This can be seen as a voting game where designing the rules can significantly impact decision-making outcomes.

- DAO voting: DAOs are blockchain-based entities that operate without centralized control, governed by rules encoded as smart contracts. Game theory in DAOs is essential for designing governance mechanisms that ensure fair voting, prevent collusion, and align the incentives of all participants toward the collective goals of the organization. Strategies to encourage active participation and mitigate the risks of minority rule or the tyranny of the majority are examples of game-theoretic considerations.

06- Collective Decision Making

Public blockchains can be viewed as massively multiplayer online games where players (users, miners, developers) make decisions that affect the outcome for all. Game theory helps in modeling these interactions and designing systems that align the incentives of a diverse group of stakeholders.

Now, let’s look into a few examples of how game theory connects with collective decision-making

- Decentralized exchanges (DEXs): Users trade cryptocurrencies on peer-to-peer networks without a central authority. Game theory helps design trading mechanisms that ensure fair exchange rates, prevent front-running, and incentivize responsible participation. This can be seen as a coordination game where efficient market functioning relies on collective adherence to established rules.

- Non-Fungible Tokens (NFTs) and Digital Collectibles: The market for NFTs and digital collectibles relies heavily on concepts of perceived value, scarcity, and ownership. Game theory can analyze market dynamics, including how creators, collectors, and traders interact within these ecosystems. Strategies around pricing, bidding, and selling NFTs often reflect game-theoretic principles, where participants aim to maximize their payoffs in environments of competitive and cooperative interactions.

07- Smart Contracts

Smart contracts can be programmed to execute automatically when certain conditions are met, often involving strategic interactions between parties. Game theory helps in designing contracts that prevent manipulation and ensure that fulfilling the contract is the dominant strategy for all parties.

For example

- Escrow contracts: Hold funds securely until certain conditions are met. Game theory helps design contracts that prevent fraud, ensure fair exchange, and incentivize all parties to fulfill their obligations. This can be seen as a repeated game where building trust and reputation is crucial for successful interactions.

- Privacy-Preserving Technologies: With the increasing importance of privacy in Web 3.0, technologies like zero-knowledge proofs (ZKPs) allow for the verification of transactions or data without revealing the underlying information. Game theory helps in understanding the strategic behaviors of participants who may have incentives to either conceal or reveal information, designing systems that balance privacy with transparency and trust.

Blockapex stands at the forefront of this exciting intersection, leveraging game theory’s insights to enhance blockchain security and system design with projects such as Dafi, ScriptTV, ZeroLiquid, and more. Our work exemplifies how a deep understanding and strategic application of game theory can lead to more secure, transparent, and user-focused blockchain ecosystems.