The cryptocurrency space is constantly changing, so staying on top of market trends is crucial. The crypto landscape offers many opportunities driven by new market regulations and complexities. Crypto investors and traders need analysis and research tools to maximize profits and optimize strategies. Without the right tools, there’s a high risk of losing capital.

Finding the right tools can be challenging, which is why we’ve created a guide covering exchanges, wallets, tax calculators, and bots for analysis. The complexity of the crypto market requires accurate and timely data to fully capitalize on opportunities. In 2025, platforms like Binance and Messari, which integrate market analysis, trading, and education, will become essential.

In this guide, we will go a little deeper into the guide of trading tools, their benefits, features, and the role they play in the crypto market strategy.

List of the 10 Best Crypto Tools in 2025

The cryptocurrency trading platforms offer tailored features for market analysis as well. These platforms provide its users with comprehensive market analytics, real-time data, futures, and margin trading analysis. They also provide educational content for the complex features of cryptocurrency investment. With their seamless integration of market analytics, they provide the investors, with the functionality of market movements and how to employ complex strategies to get the full potential of investments. Some of them include Binance, Coinbase, Crypto.com, Bitstamp and OKX. Let’s find the top 10 tools that have been the top choice for most investors in the crypto market.

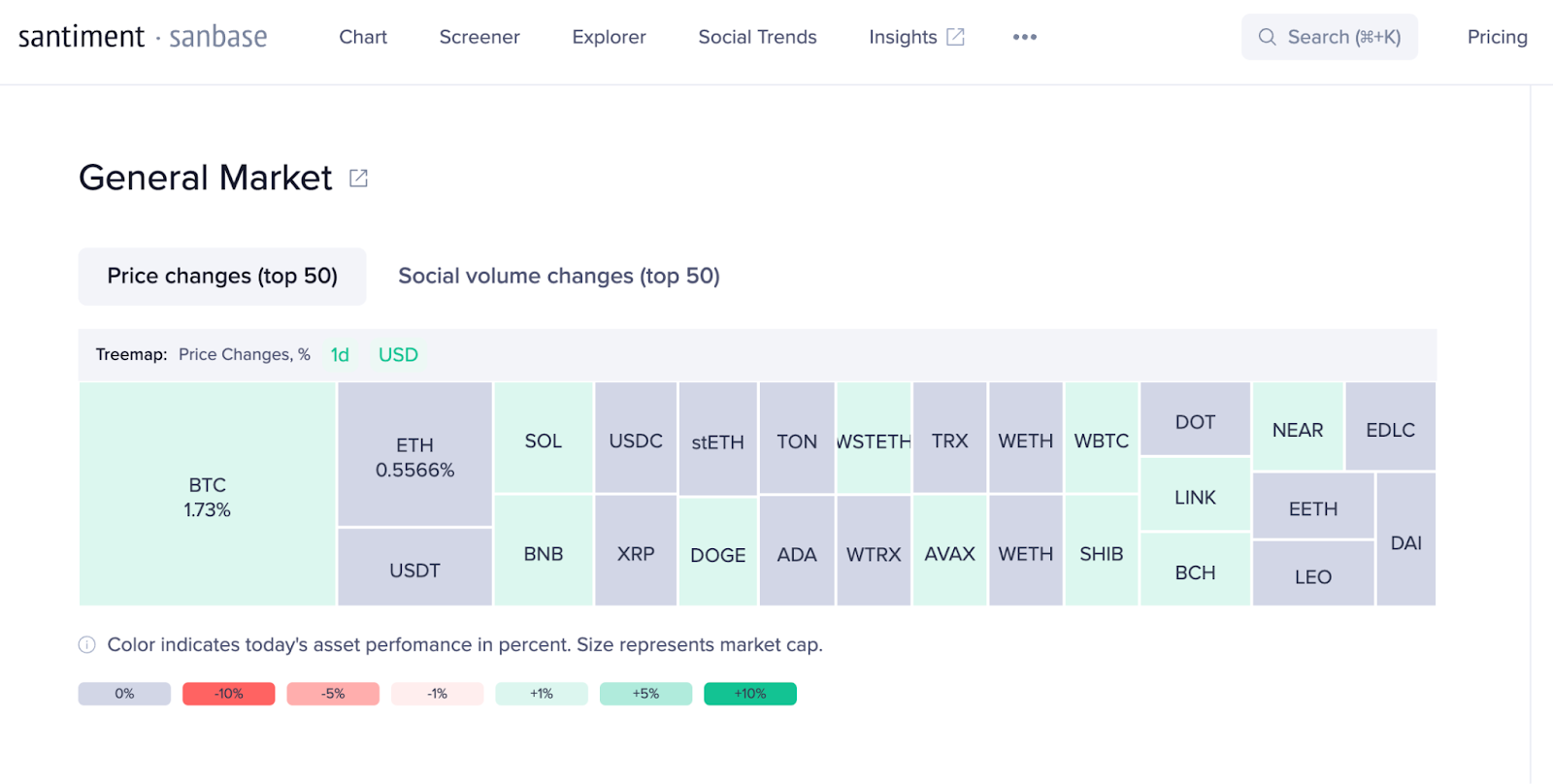

01- Santiment

Santiment is of the top choice for the investors of the crypto industry. The tool covers over 2000 project analysis. Not just real data, santiment also provides project updates, market movements and the sentiment of the project on social media. It has some AI integration models which provides the overall summary of the project to let investors decide whether to make investments or not.

Santiment is a paid tool which offers free trial for a limited time with restricted features. The free trial is approximately for 30 days where the investors can get familiarized with the tool and its offerings. To improve ROI, Santiment also offers a pro version which offers additional features like alerts, per hour updates and behavioral reports.

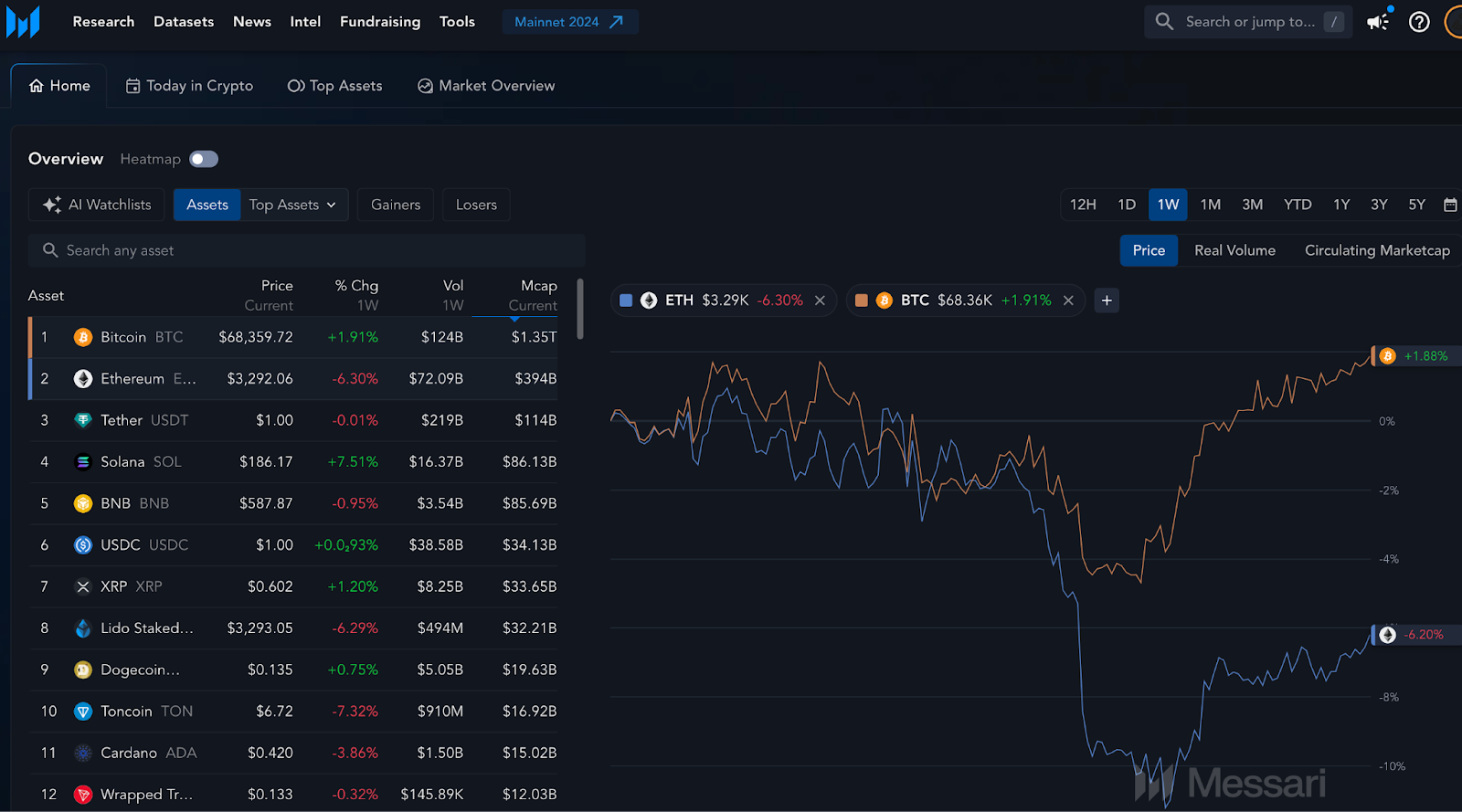

02- Messari

Messari is a crypto tool that aggregates data from the markets and presents it to users in the form of charts and research reports. Messari also provides hundreds of charting tools which lets the user filter the assets, add a watchlist and get the alerts. The users can also get the real time asset data and the important updates of crypto space.

Messari also has a large amount of educational content and states of various platforms such as The Graph platform which could be overwhelming for a new user, but experienced traders find messari seamless to trade and navigate. Messari is also a paid tool which is worth spending not only for research reports but trading analysis of DAOs, Layer2, and other protocol reporting.

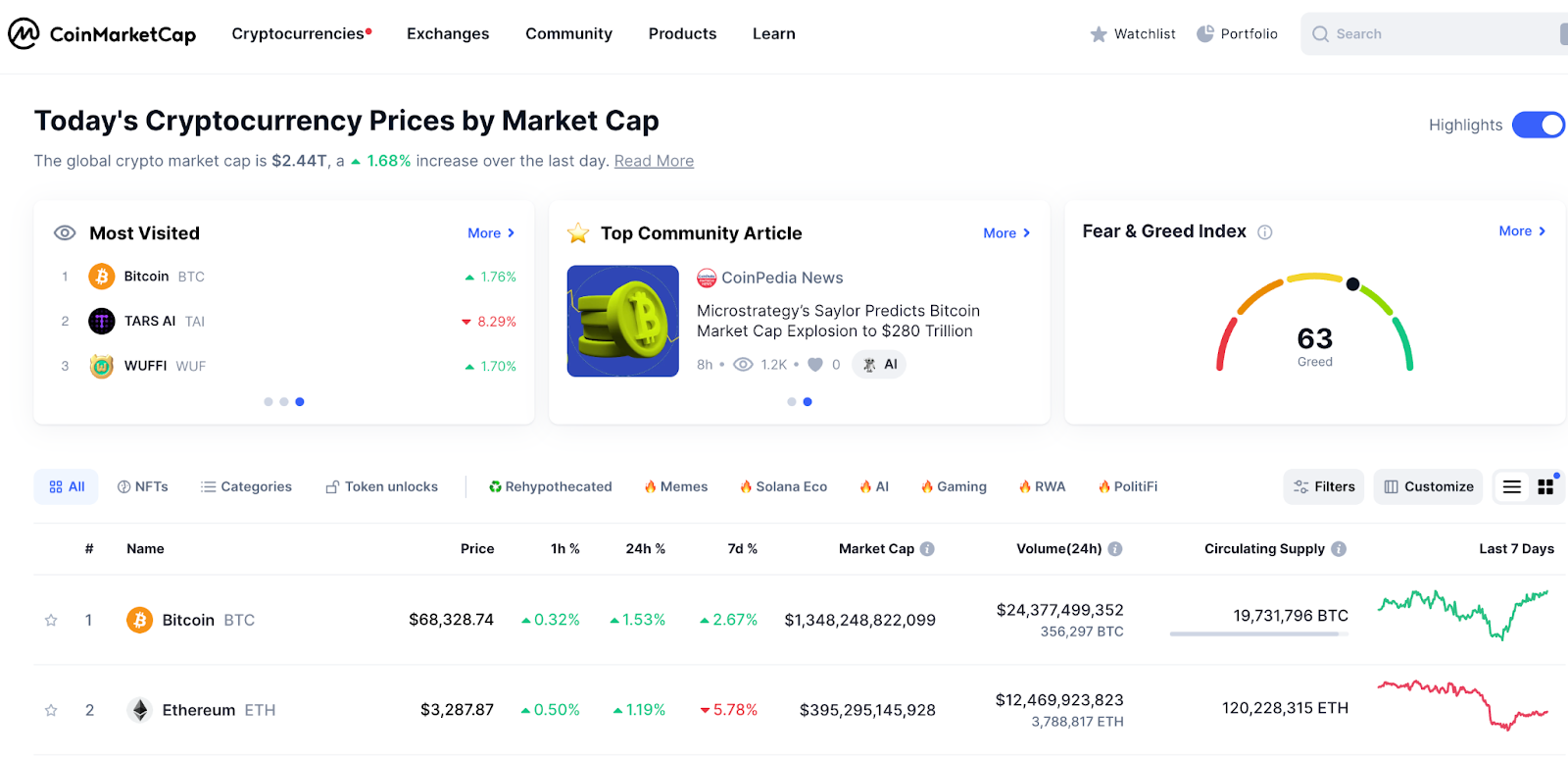

03- CoinMarketCap

CoinMarketCap is no doubt one of the most common and trusted trading platforms. Some of its tools and researches are public which allows the limited access of APIs for the developers to to get alatest nine marketplace data endpoints and 10K call credits /month but No historical data.

CoinMarketCap also provides information on market capital, trading volume, and accurate price data for various digital assets. The best part of CoinMarketCap is its user-friendly UI. The interface is also customizable and developers can integrate the data into their platforms using the advanced API options.

04- GlassNode

Another popular crypto analysis tool used by traders is Glassnode. It gathers its extensive data from different blockchains to measure trading activity on various crypto networks. It arranges this data into multiple metrics and other insights to crypto traders and investors. The seamless UI of glassnode makes it easy to monitor multiple network activities.

One big advantage of glassnode is the stats of the true number of active wallet addresses versus non-active ones. This is a critical feature in determining if there are certain community members attempting to boost the project falsely.

Like its rivals glassnode is also a paid tool which provides various fee tiers based on the speed of data accessibility and data points. The features also vary based on different fee tiers however, the users are able to get 24 hours data updates.

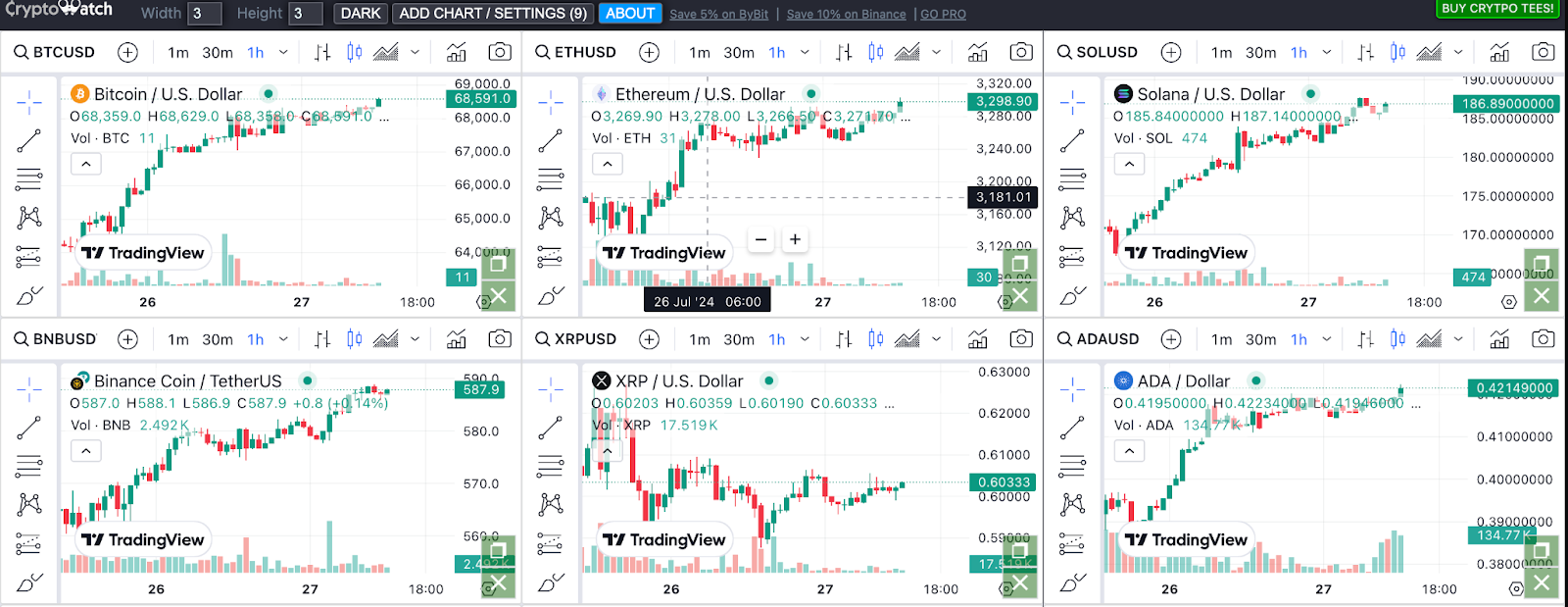

05- CryptoWatch

CryptoWatch is the most comprehensive tool owned by the popular exchange Kraken. Similar to its rivals, this tool also allows its users to track the asset prices with regards to their market movement. CryptoWatch also allows its users to access live crypto prices and order book data from over 800 exchanges.Visually it’s the most intensive analysis tool which allows users to customize their dashboard and put indicators and overlays on their favorite assets.

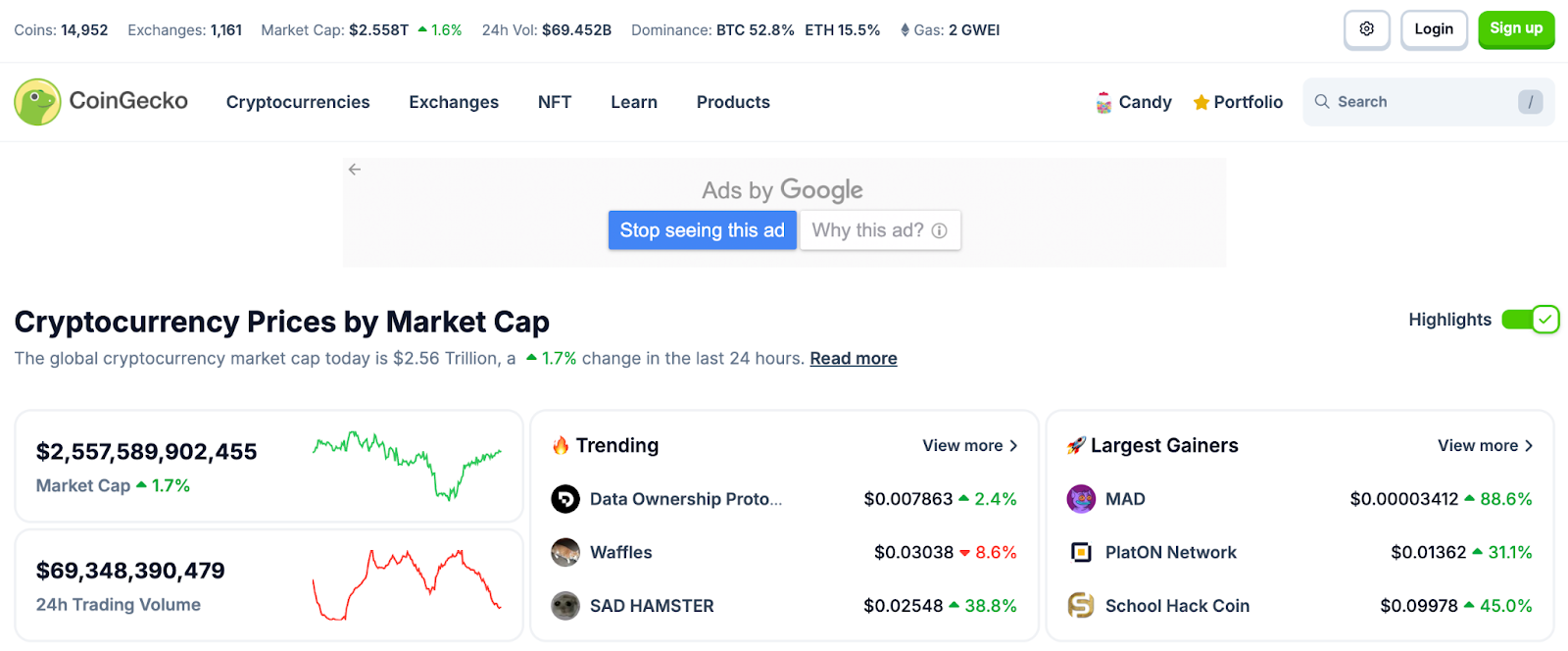

06- CoinGecko

CoinGecko is another powerful aggregation tool that allows users to monitor +11,000 projects and +600 exchanges. It is one of the largest aggregator tools and is popular amongst network operators. It is famous among both developers and traders for various reasons such as its largest number of tokens library, monitoring options, and massive educational guide section.

With CoinGecko, you can also track NFT’s floor prices. It also provides its API and products like exchanges, portfolio management and widget apps for traders to make the most out of the trading platform.

07- Cryptosignals

Cryptosignals is one unique trading platform that provides many tools for crypto signals. The tool also offers daily trading suggestions via Telegram. The tool in its entirety provides all the guidance for the traders to access the token trading. It also suggests to its users which pair they should buy or sell. The signal also tells the user what limit, take-profit, and stop-loss orders they should place. The tool also has a research section that provides the reasoning for trading suggestions. It also informs its users about every little difference in execution or settings that can lead to significant differences in performance and returns.

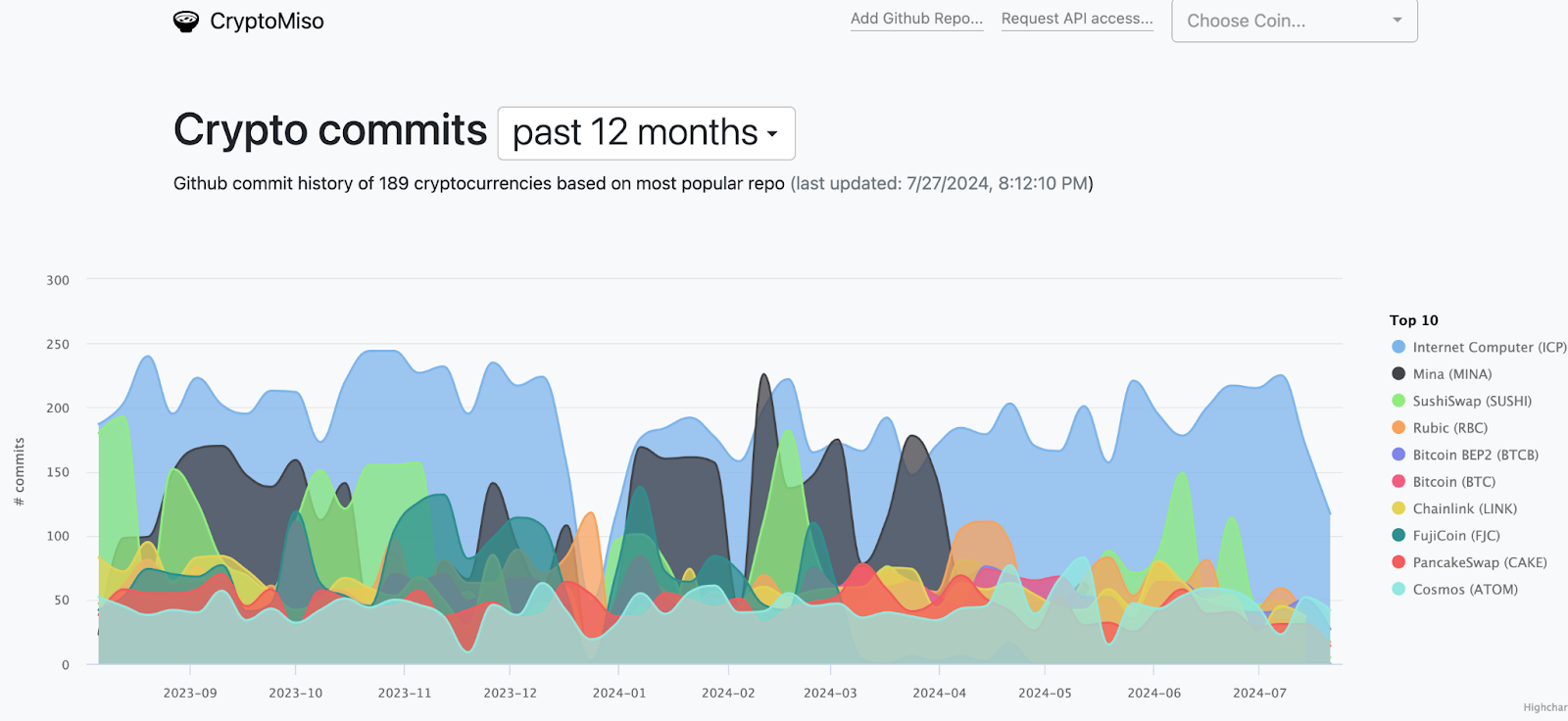

08- CryptoMiso

CryptoMiso is a tool that helps its users to determine the network activity to access the true value of assets. It does this by gathering the information of development activity of the project from their git repository. It also helps to avoid the chances of rugpull by monitoring the development activity which is a clear signal that a project is under work and has the interest of developers. You can observe the network activity over a custom time period and get valuable insights into the project.

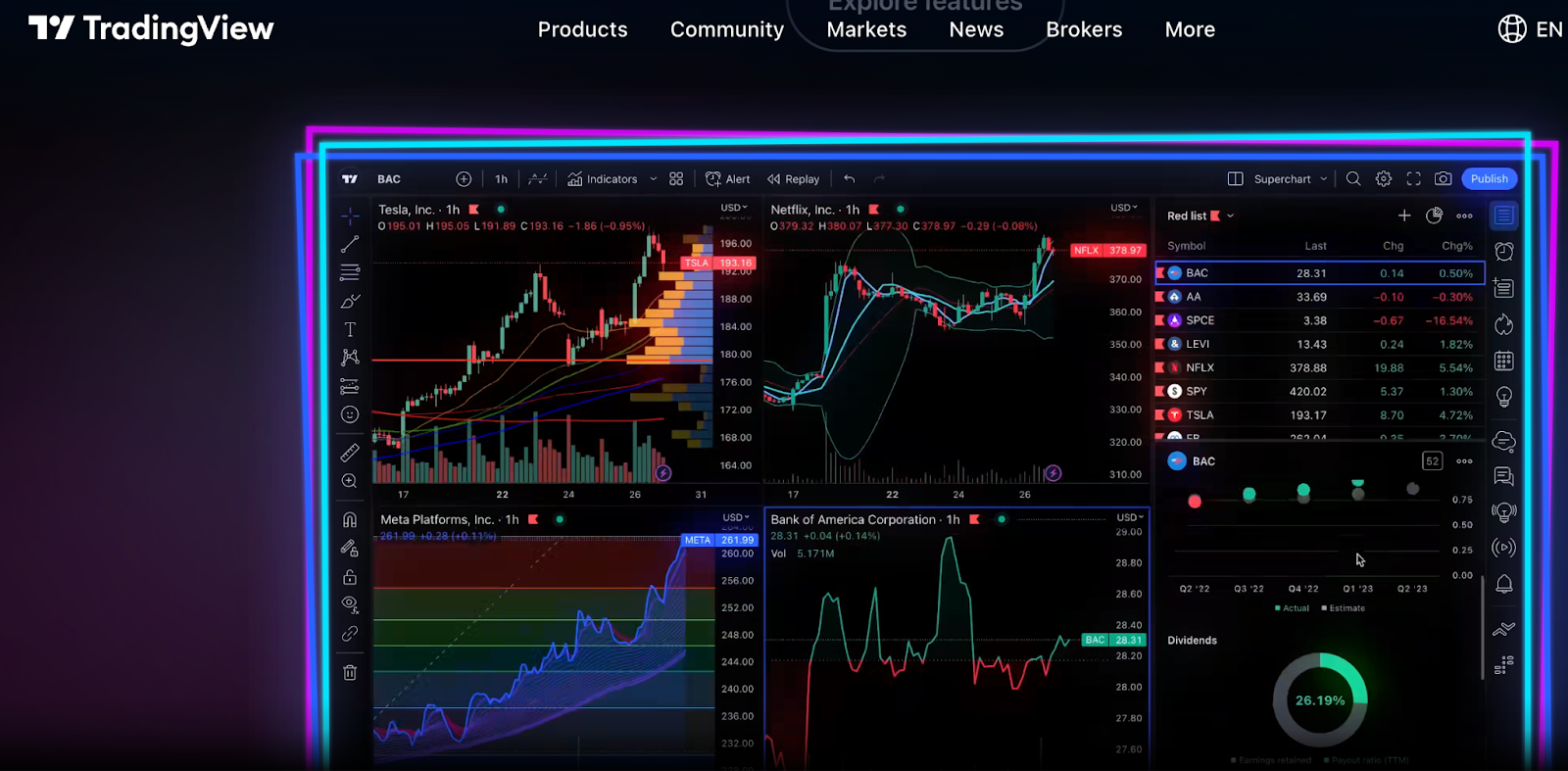

09- TradingView

TradingView is one of the top choices for analytics platforms to offer live trading charts for not just digital assets but also for stocks. The tool lets users simulate real market conditions in order to test their strategies. The tool has integrated around 100+ pre-built technical indicators to analyze the market trends of various exchanges and assets. It has a unique feature of backtracking all the trading history and making self-written strategies based on previous history. It has a charting feature that is free for both paid and non-paid users. Its free version is sufficient for the new traders and provides around five indicators per chart and 20 server-side alerts. TradingView also sends its users a snapshot of their trading activity.

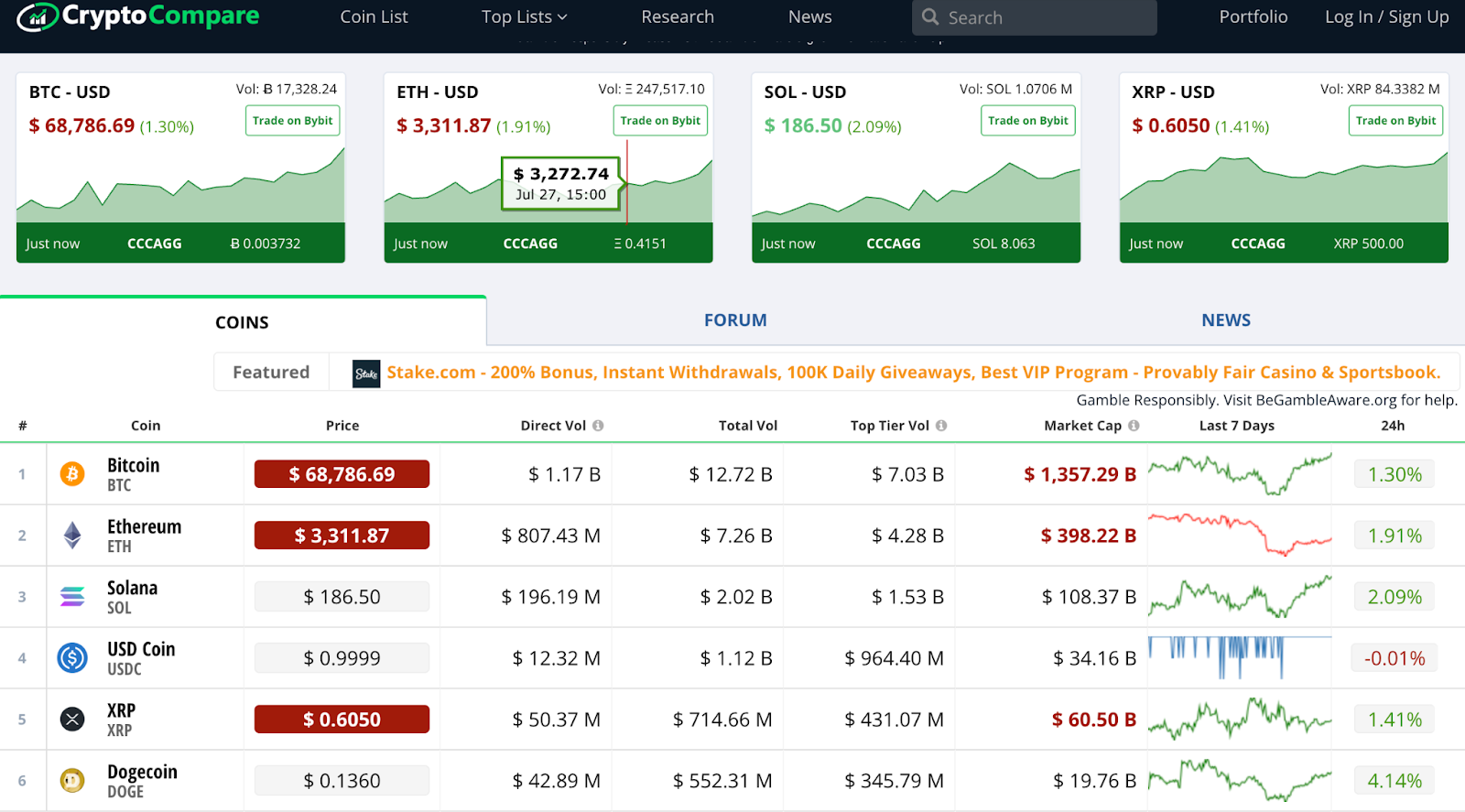

10- CryptoCompare

At last we present another cool analysis tool which is CryptoCompare. This is a tool that helps to streamline the comparison of different blockchain networks. It offers side by side charting of networks which helps to compare the various networks at once based on similar attributes. It tracks different coins and their momentum by tracking the live market activity. You can use this tool with other helpful options such as CryptoMist, to gain full transparency on projects quickly.

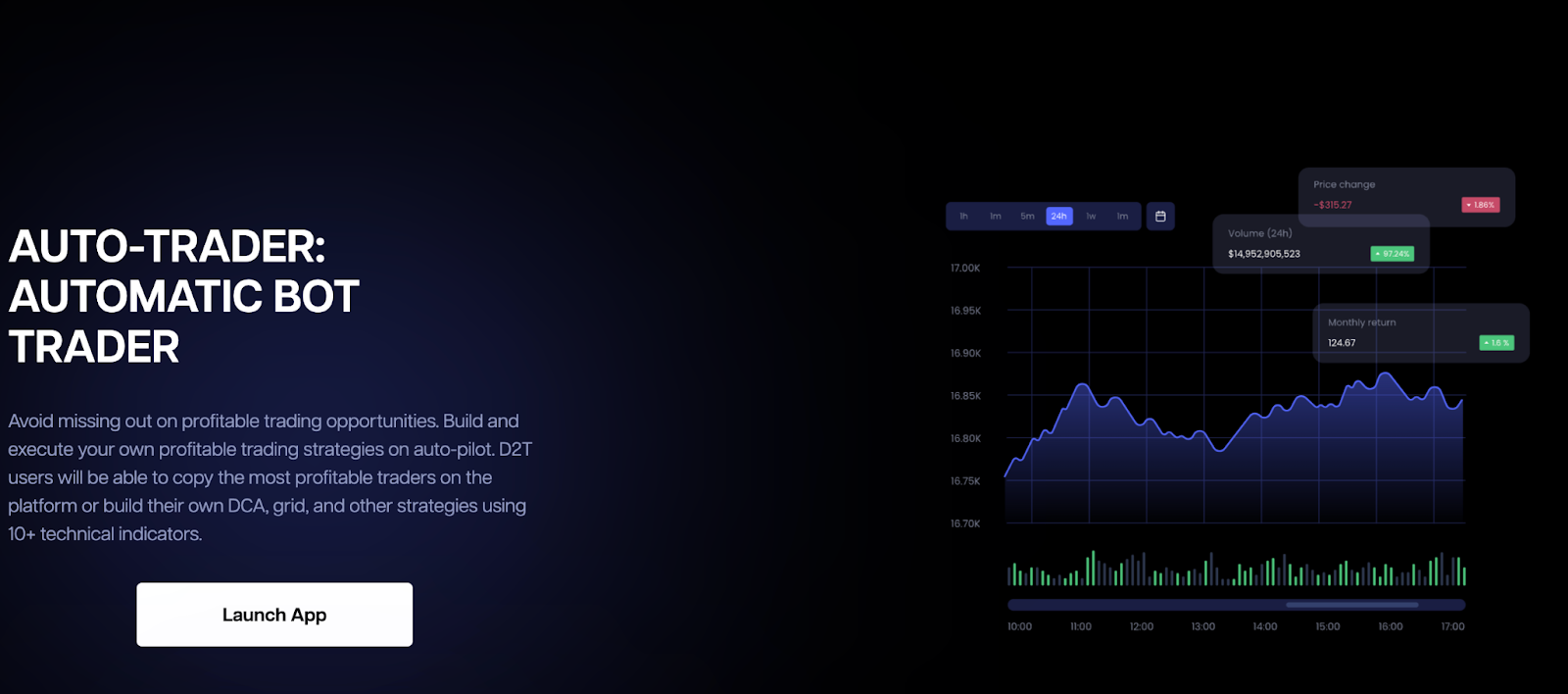

Trading Bots

Apart from trading and analysis tools, traders can also use trading bots for short-term trading. This is an automated trading method where users don’t need to watch the market activity; rather, whenever their desired condition for a certain asset matches, the bot itself executes the relevant action. There are many bots available that let you trade but they are mostly limited to network activity.

Final Thoughts

These tools offer valuable insights and can significantly reduce the risk of capital loss, but they should complement a well-rounded investment strategy. Always remember that no tool can guarantee absolute accuracy in market predictions.