In June 2016, a malicious hacker was able to hack into the DAO protocol on Ethereum’s blockchain. They stole over $50 million worth of funds. In an attempt to rectify this massive loss, the Ethereum community initiated a hard fork. This hard fork would return the hack funds and restore users’ lost ETH. As a result, the division of the Ethereum blockchain into two resulted from the community’s choice: those who chose not to upgrade became part of a parallel network known as “Ethereum Classic,” while those who upgraded continued as “Ethereum.”

Five years later, we are witnessing history repeat itself as the Ethereum community churns out another London hard fork. This time, on purpose. The London Hard Fork as it is termed contains five Ethereum Improvement Proposals (EIP). These EIPs will have a big impact on the role of miners in the network. This will also give some exciting improvements related to gas fees and transaction rates.

Both hard forks are milestones in the Ethereum world. They will guarantee lasting impacts on the blockchain as we know it. Before we start comparing the two, let’s unpack some blockchain basics.

What is a Hard Fork?

Ethereum is a platform built on blockchain technology. It relies on a vast network of individual users all working together to verify new additions to the blockchain. The rules followed by users determine the validity of blocks and transactions on the network. Once added to the blockchain, a block becomes immutable and can never be altered.

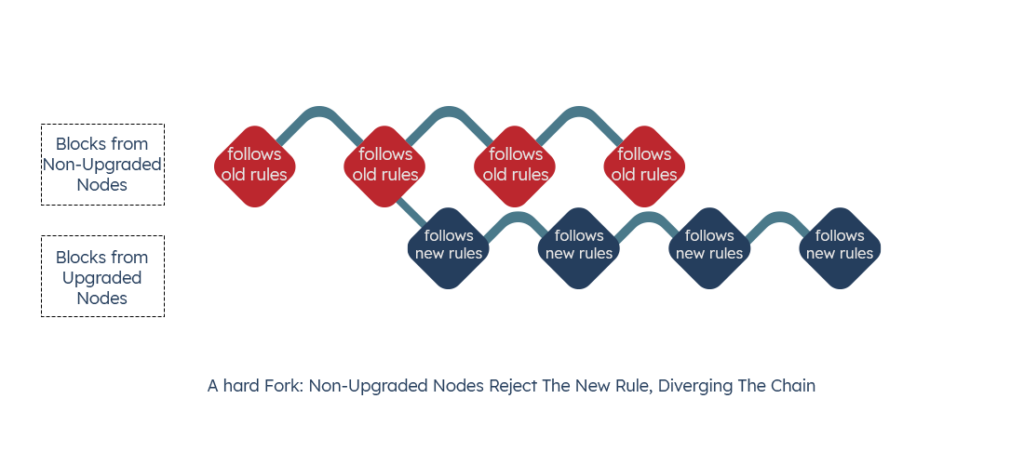

But what happens when these rules are changed? Each block will need to upgrade to the new set of rules introduced to keep the blockchain system functioning. With such a huge network, convincing each node to agree to this is an incredibly difficult task, and in most cases attempting to do so results in a hard fork.

A hard fork involves a radical change to the protocol of a blockchain network. This causes the blockchain to split into two. In the same way as a path on the road splits into two forks; a hard fork may result in a permanent divergence in the blockchain, with nodes following one of the two versions. Both may now function independently, adding to their chain using the rules they see fit.

Revisiting the Birth of Ethereum Classic

By 2016, the Ethereum network was steadily growing, hosting dapps of all kinds on the blockchain. Adding to the excitement surrounding this new technology, an application known as the Decentralized Autonomous Organization, or DAO, emerged. The DAO aimed to fund startups and emerging projects on the network, while also functioning as a tool for taking all the important decisions regarding Ethereum’s future. To participate in the DAO, members had to simply invest their ETH to obtain DAO tokens. This investment benefited them later when the projects they were funding became successful.

All this had the community very excited, and the funds collected by DAO grew to over $150 million in just one month. Shortly afterward, however, the discovery of a serious bug in the Ethereum smart contracts allowed users to bypass rules set by the DAO using an endless recursive call. Exploiting this vulnerability, an attacker drained $50 million from the DAO funds, invested by the community, into his own personal account.

Ethereum developers now needed to figure out a way to return these stolen investments made by members of the community back to them. After much chaos and confusion, the community made the controversial decision to execute a hard fork. This hard fork rolled back the network to its state before the DAO hack, reverting all transactions so that funds could be returned to their owners.

The decision to hard fork sparked a heated debate on the Ethereum network, with many arguing that it contradicted the blockchain technology’s core attribute of immutability. Those who refused to upgrade became a part of Ethereum Classic, while those who did formed Ethereum. The two platforms now function independently, recording their own transactions and updates to their networks. The key differences between them lie in the consensus algorithms used, with Ethereum Classic sticking to POW (proof-of-work) while Ethereum moves toward POS (proof-of-stake). Ethereum Classic also established its ETC cryptocurrency to have a max hard cap at 210 million, while ETH crypto remains unlimited.

What to Expect From London Hard Fork?

The London hard fork plans to introduce 5 major changes to the Ethereum network, with each decision outlined as an EIP, or Ethereum Improvement Proposal. These EIPs will act as a gateway towards Ethereum 2.0, which will eventually shift the Ethereum network towards proof-of-stake.

Some of the proposals introduced by the London Hard Fork were met with approval while others brewed controversy among the users part of the Ethereum community. Let us discuss each of the changes along with their intended impact and current reaction.

EIP-1559: Fee market change for ETH 1.0 chain

Traditionally, adding a transaction to a block follows an auction-style system, where a transaction is more likely to be added quickly if it has a higher transaction fee. This method has proven to be highly inefficient, often resulting in fee overpayment.

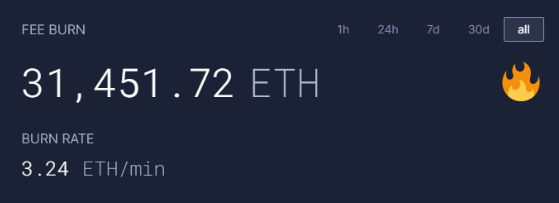

The EIP-1559 combats this problem by introducing an algorithm which automatically calculates the base fee for a block depending on network demand. Instead of going to miners, the system “burns” this base fee, removing it entirely from circulation. The network can also increase the size of a block depending on congestion, allowing more transactions to occur simultaneously.

These changes aim to improve or eliminate previous inefficient tactics that were a part of the Ethereum network. By burning base fees in every transaction, the supply of Ethereum will dwindle leading to an increase in demand and subsequent expected rise in price. However, this change means miners will earn fewer rewards in the short term, as the system now burns the fee that previously went to them, forcing them to depend more on block rewards and transaction tips.

EIP-3198: BASEFEE opcode

This proposal builds on the base fee feature introduced in EIP 1559. EIP-3198 will return the value of the base fee of the current block. This will enable smart contracts to obtain this value instantly. Developers can also use this feature to obtain the base fee for use in their decentralized apps.

EIP-3529: Reduction in refunds

Previously, users were able to refund their gas after deleting or reducing smart contracts and addresses on Ethereum. However, this became a loophole to exploit for some users. Sometimes, user would join the network when prices were low and then wait until they were high again to delete their smart contracts, obtaining an overall profit. EIP-3529 will lower the refunds to make exploits like these no longer viable.

EIP-3541: Reject new contracts starting with the 0xEF byte

EIP-3541 aims to set up future changes to the network by establishing a rule to reject new contracts that start with the 0xEF byte. Although this won’t have any immediate impact on the network, it may be a crucial step for the future.

EIP-3554: Difficulty Bomb Delay to December 1st 2021

Ethereum has a built-in difficulty time bomb. Difficulty time bomb works to increase the difficulty of mining on Ethereum as time goes by. The purpose of this time bomb is to have the network eventually reach a point where mining on Ethereum 1.0 using proof-of-work becomes difficult. So, users are naturally drawn towards shifting to Ethereum 2.0 which is built on proof-of-stake.

In order to control the progress of this time bomb, the authors of this proposal introduced a difficulty bomb delay in the shape of EIP-3554.

What Does This Mean for Ethereum’s Future?

As of August 8th, 2021, the price of ETH has gone up to $3,048.50,. This is an increase of almost 12 percent from what it was before the London hard fork took place. An astonishing number of ETH have also been burned since the upgrade. Burned Eth reached a value of 13,564.9 ETH burned in just four days.

The successful upgrade of the London Hard Fork is a big difference from the fork that took place back in 2016. It shows the willingness of users in moving towards the proof-of-stake model. Why? to improve Ethereum as a platform and ETH as a cryptocurrency in the years to come.

In stark contrast to this, Ethereum Classic is holding on to its roots, comfortable with continuing to use proof-of-work as its underlying scheme.

The forging of Ethereum Classic is not necessarily a sign of failure, however. As the network continues to grow and expand, divergence may be inevitable. Ethereum Classic’s Cooperative Executive Director Bob Summerwill welcomes this change, going on to give his view of Ethereum’s possible future.

“You had Unix and then you had Linux and then you had iOS and all of these different families of related operating systems and related kernels,” Summerwill said in an interview. “I think it’s likely that you’re going to have something quite similar on the Ethereum side – that you’re going to have many many Ethereum-flavored solutions compatible to varying degrees.”

REFERENCES

https://eips.ethereum.org/

https://blog.ethereum.org/2021/07/15/london-mainnet-announcement/

https://www.coindesk.com/hard-fork-sets-stage-for-ethereum-classics-second-major-departure-from-ethereum

Also Read:

NFTs Explained: A Security Perspective

Zero-Knowledge Proofs: A Security Perspective