Imagine a world where your spare computer power or that old unused cellphone tower could earn you money! DePIN is kind of like that. It’s a system where people like you and me can contribute physical stuff we have lying around – data storage space, processing power, even sensors or internet connectivity – to create a giant, shared network.

What is DePIN?

DePIN, or Decentralized Physical Infrastructure Network refers to a network where individuals contribute physical infrastructure resources such as data storage, computing power, energy grids, sensors, or connectivity. In return for their contributions, participants receive rewards, typically in the form of crypto tokens, based on the protocol’s incentive mechanism.

These networks leverage blockchain technology to facilitate peer-to-peer interactions and manage the allocation of resources in a decentralized manner. Unlike traditional centralized infrastructure models, DePINs aim to democratize access to and management of physical infrastructure, enabling a wide range of applications beyond the scope of Web3 and cryptocurrency.

While the term was introduced not too long ago, such infrastructure has been around for quite a while.

DePINs are designed to address real-world challenges associated with traditional infrastructure management, such as high entry barriers for new entrepreneurs, threats of centralization, and inefficiencies in resource utilization. By incentivizing individuals to share their resources and contribute to the network, DePINs can create self-sustaining ecosystems where the value of the network increases as more participants join and contribute.

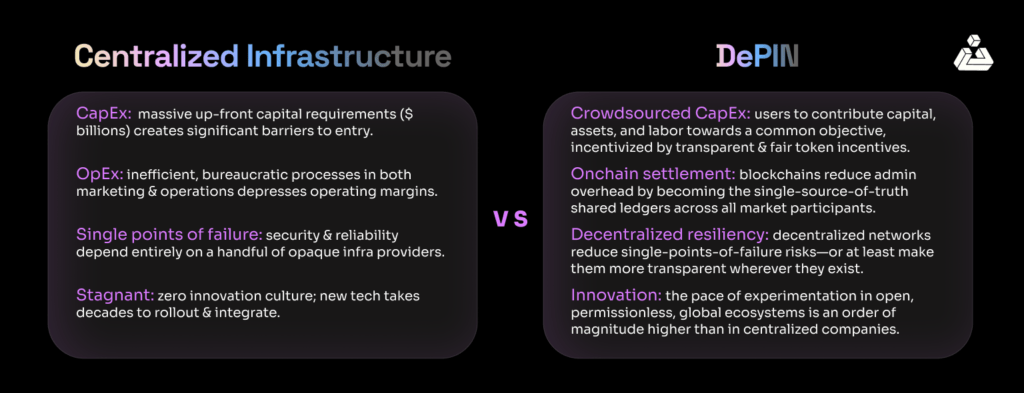

Centralized Infrastructures vs. DePIN

The key differences that set these two paradigms apart, exploring how DePINs upend the traditional model with a focus on efficiency, security, and the power of collective action is as follows.

How does DePIN work?

DePINs, or Decentralized Physical Infrastructure Networks, operate through blockchain technology, physical infrastructure, token rewards, and off-chain networks. Here’s a breakdown of how DePINs work:

- Blockchain Architecture: Blockchain technology serves as the backbone of DePINs. The network relies on blockchain architecture, including smart contracts, to execute preset rules, charge fees, and provide rewards. Smart contracts are self-executing contracts with the terms of the agreement directly written into code, ensuring transparency and automation of processes within the network.

- Physical Infrastructure Network: DePINs consist of physical components that facilitate the transmission of data, resources, or information within the network. These components include hardware devices such as switches, routers, networking equipment, sensors, energy grids, data storage facilities, and computing resources. Participants contribute these physical resources to the network in exchange for rewards.

- Token Rewards: Participants in DePINs receive crypto tokens as incentives for providing services or contributing resources to the network. The rewards vary based on the protocol’s incentive mechanism and may include factors such as the amount of resources contributed, the quality of service provided, and the demand for specific resources within the network.

- Off-Chain Network: In addition to on-chain transactions executed through the blockchain, DePINs may also involve off-chain networks for certain operations. Off-chain networks handle data transactions that occur outside the main blockchain network. Users may purchase required resources such as computing power, data storage, and connectivity from external service providers through off-chain transactions.

DePIN Insights

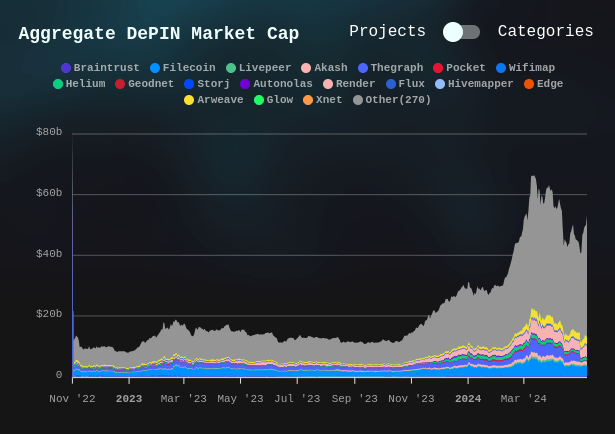

The DEPIN market has seen significant growth in 2024. According todepin.ninja analytics, the total market capitalization of DEPIN projects surpassed $44 billion in March. This suggests that there is growing interest in DEPIN solutions, which aim to address privacy concerns in blockchain networks.

Source: depin.ninja analytics

DePIN is showing promise for the future but still occupying a relatively small space compared to established areas. Here’s a breakdown according to Messari and Depin.ninja

- Market Size and Growth: As of 2023, the DePIN ecosystem encompassed over 650 projects with a combined market capitalization of $35 billion, spanning various sectors like computing, AI, and wireless. Experts estimate the potential market size to reach a staggering $3.5 trillion by 2028, reflecting a potential growth of over 243 times in the near-to-medium term.

- Project Distribution: A significant portion of DePIN projects focus on computing (250), AI (200), and storage solutions. This aligns with the presence of established players like FIL, RNDR, and AKT among the top DePIN tokens listed on CoinMarketCap.

- Tokenization and Market Share: While many DePIN projects have issued their own tokens, their collective market cap of $33 billion remains modest compared to other crypto sectors like DeFi or NFTs. Additionally, compared to the traditional IoT landscape, DePIN has fewer projects exceeding $100 million in market cap, highlighting its current stage of development.

As of February, research conducted by Crypto.com revealed that the collective market capitalization of all DePIN tokens surpassed $25 billion. Predominantly, computing, storage, and artificial intelligence sectors constituted the largest share of this market capitalization.

Why DePIN is even needed in the first place?

The tech landscape is dominated by a handful of powerful companies. These giants control vast amounts of hardware infrastructure, creating bottlenecks and limitations for users. DePINs emerge as a revolutionary force, fostering open markets for this very infrastructure.

Imagine a world where anyone can access high-performance computing power without begging at the feet of tech giants. DePINs make this a reality. By decentralizing hardware infrastructure, DePINs create a level playing field, empowering users:

- No More Gatekeepers: DePINs eliminate the risk of censorship or service shutdowns at the whim of a central authority. Users control their data and access to resources, fostering a more democratic and censorship-resistant online environment.

- Power to the People: Remember the struggle to get a decent GPU in 2023? DePINs empower individuals and small businesses by creating open marketplaces for hardware resources. No longer will big corporations monopolize access to crucial technology.

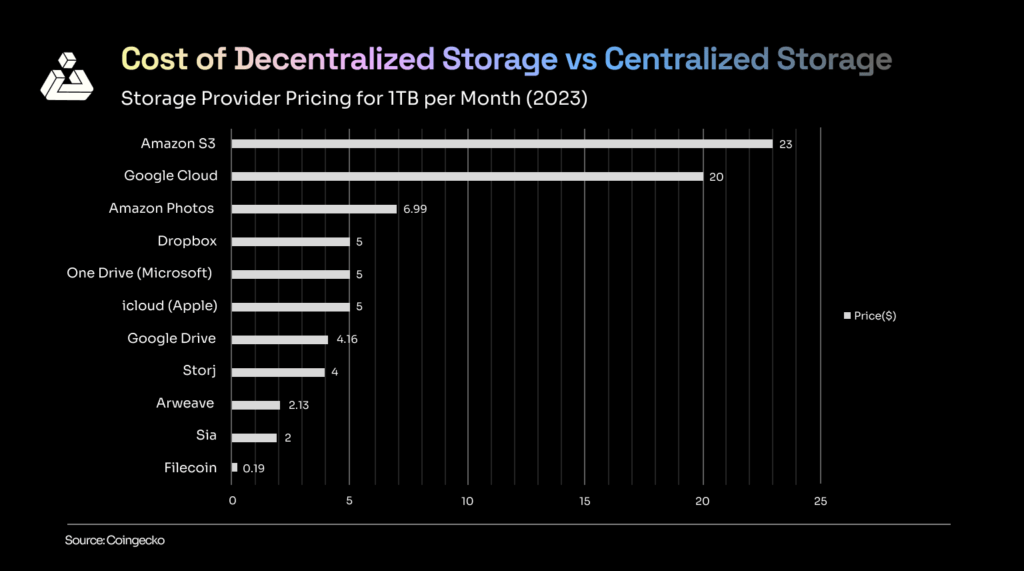

- A Sharing Economy for Hardware: DePINs foster a sharing economy where underutilized hardware can be rented out, maximizing resource utilization and potentially lowering overall costs for everyone involved.

Top 4 DePIN projects

Several examples of DePINs, or Decentralized Physical Infrastructure Networks, exist across various industries. According to CoinGecko, we will have a brief look at the top 5 DePIN projects.

1- Render (RNDR)

The Render Network is the first decentralized GPU rendering platform, empowering artists to scale GPU rendering work on-demand to high-performance GPU Nodes around the world. Here’s how it reimagines GPU rendering through a DePIN lens:

- Decentralized Marketplace: Render cuts out the middleman by creating a peer-to-peer network. Artists (“Creators”) can access high-performance GPUs directly from individuals with unused hardware (“Node Operators”).

- Empowering Users: Creators gain the ability to scale their rendering needs on-demand, tapping into a global pool of resources. This eliminates dependence on centralized cloud services and potentially reduces costs significantly.

- Tokenized Incentive: RNDR tokens incentivize participation. Node Operators earn tokens for contributing their idle GPUs to the network and completing rendering jobs.

- Open and Accessible: Anyone with a compatible GPU can join the network, democratizing access to high-performance computing power for artists and creators.

2- Filecoin (FIL)

Filecoin is a peer-to-peer decentralized storage network. It facilitates an open market so that a single company won’t control the available storage and its price. In Filecoin, users pay storage miners to store and retrieve their files. Here’s how it works:

- Decentralized Network: Filecoin eliminates reliance on centralized cloud storage providers. Instead, it utilizes a peer-to-peer network where users (“Storage Providers”) rent out their unused storage space.

- Algorithmic Market: Filecoin leverages an algorithmic market to determine storage costs. Users (“Clients”) can store their data at competitive prices based on supply and demand for storage within the network.

- Cryptographic Security: Filecoin prioritizes data security through built-in cryptography. This ensures reliable and tamper-proof storage of your valuable information.

- Incentivized Storage: Storage Providers are incentivized to participate by earning FIL tokens for contributing their storage space and upholding network protocols.

3- Arweave (AR)

Arweave is a decentralized storage network that seeks to offer a platform for the indefinite storage of data. Arweave stands out as a DePIN (Decentralized Physical Infrastructure Network) with a unique focus: permanent and secure data storage. Here’s how it leverages DePIN principles:

- Decentralized Network: Arweave eliminates reliance on centralized storage providers. Instead, it utilizes a peer-to-peer network where users (“Storage Providers”) contribute storage space to the “permaweb.”

- Permanent Storage: Data stored on Arweave is designed to last forever, utilizing a novel “blockweave” technology that ensures data persistence.

- Cost-Effective: Arweave aims to offer this permanent storage at a one-time fee, potentially reducing long-term storage costs compared to traditional solutions.

- Censorship Resistance: Arweave prioritizes data integrity and immutability. Once data is stored, it cannot be altered or deleted, creating a censorship-resistant environment.

4- Theta Network (THETA)

Theta Network is a peer-to-peer blockchain protocol that provides decentralized data storage, content delivery, and computing services. Here’s how it resonates with DePIN principles.

- Decentralized Network: Theta aims to move away from centralized content delivery networks (CDNs) by utilizing a peer-to-peer network. Users (“Edge Nodes”) contribute their storage and bandwidth resources to distribute video content.

- Content Delivery Efficiency: Theta’s edge network infrastructure potentially improves video delivery efficiency by reducing reliance on centralized servers. This could lead to faster streaming and lower costs for both content creators and viewers.

- Tokenized Incentives: THETA tokens incentivize user participation. Edge Nodes earn tokens for contributing their resources to the network, while content creators can potentially benefit from a fairer revenue sharing model through staking mechanisms.

- Open Ecosystem: Theta aims to create a more open and user-centric content delivery ecosystem by empowering individuals to contribute resources and potentially earn rewards.

The DePIN Economic Flywheel

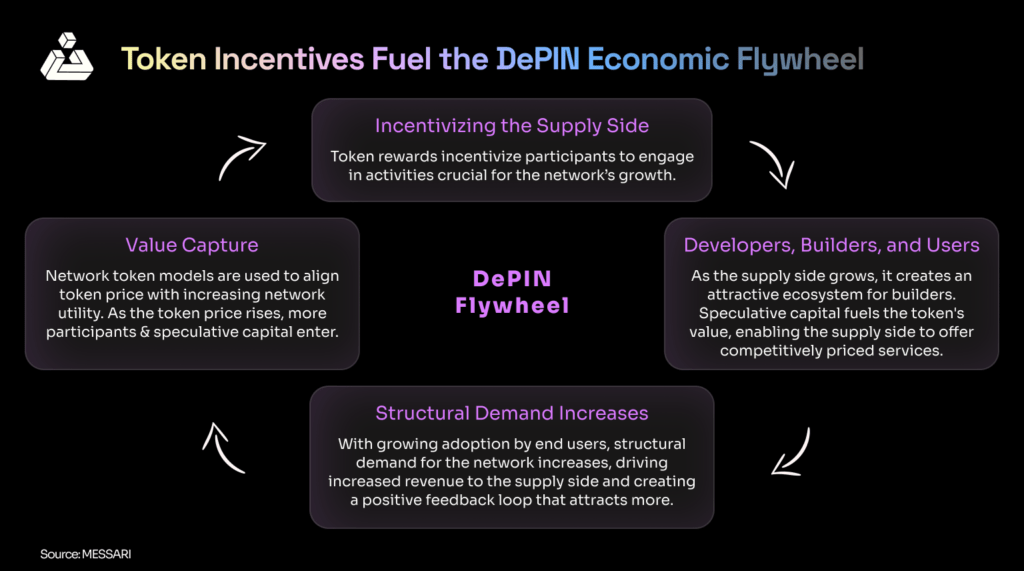

The DePIN economic flywheel characterizes a cyclical process fueled by token incentives. It attracts participants to contribute physical resources to the network by rewarding them with tokens. As the supply side grows, it creates an attractive ecosystem for developers, builders, and users.

This DePIN economic flywheel thrives on a four-step cycle

1- Incentivizing Supply-Side Participants

The first step revolves around incentivizing supply side participants. This involves attracting individuals and entities to contribute physical resources (Wi-Fi hotspots, data storage) to the network by rewarding them with native tokens. These tokens hold value within the ecosystem, allowing for governance, staking, and payment for services.

2- Attracting Devs, Builders, & End Users

With a growing pool of resources, the network becomes fertile ground for attracting developers and end-users. This robust infrastructure entices developers to create innovative applications and services. As these applications flourish, they attract a critical mass of end-users. The more users rely on the DePIN network, the more valuable it becomes, creating a positive feedback loop that fuels further development and adoption.

3- Increasing Structural Demand

The flywheel doesn’t stop at attracting users. The next stage focuses on increasing structural demand for the network’s services. This might involve offering functionalities that traditional infrastructure struggles to provide, like secure data storage. Additionally, integrating DePIN services with existing platforms and fostering a strong developer community can further solidify its value and ensure long-term growth.

4- Value Capture

Finally, the flywheel culminates in value capture. As the DePIN network attracts more users and experiences significant growth, the value of its native token naturally increases. This token represents access to a valuable and ever-expanding infrastructure. Value capture mechanisms allow participants to reap the benefits of this growth by selling tokens, earning rewards through ongoing contribution, or using them to pay for services within the DePIN ecosystem itself.

This cyclical process ensures the DePIN network’s continued growth and fuels its potential to revolutionize how we interact with infrastructure in the future.

To Conclude

The exploration of DePINs offers a compelling vision for a more decentralized, democratic, and efficient approach to managing physical infrastructure resources. By leveraging blockchain technology and incentivizing participation, DePINs have the potential to reshape industries and empower individuals in unprecedented ways. However, their success will depend on overcoming challenges and gaining widespread adoption in the years to come.

Disclaimer: This content does not constitute investment advice or financial planning. Please consult a qualified professional before making any investment or financial decision.

Read More:

Ethereum Dencun Upgrade: Everything You Need To Know

EigenLayer: ETH Staking And How It Works

Bitcoin Runes: Cryptocurrency’s New Vanguard Or Digital Ruin?