Key Takeaways

- Liquidity levels in crypto markets can greatly influence token price volatility.

- Market sentiment, driven by news and social media, often causes short-term price fluctuations that are disconnected from a token’s fundamental value.

- Speculative demand frequently outweighs utility-based demand, with hype and investor behavior playing a key role in price spikes.

- External economic factors, such as interest rates and inflation, increasingly affect token prices as crypto markets mature and integrate with traditional finance.

- Long-term token stability relies on real-world adoption and use cases that go beyond speculation and deliver tangible value.

What Determines Token Price?

Cryptocurrency markets are known for their high volatility, with token prices often experiencing substantial fluctuations—sometimes moving by double-digit percentages within a few hours. But what drives these rapid price changes? Several factors contribute to determining a token’s price, including supply and demand dynamics, speculative trading, and market liquidity. In this article, we will explore the elements that influence token price changes and provide a deeper understanding of what drives these market shifts.

How is the Token Price Calculated?

In decentralized markets, token prices are calculated using Automated Market Makers (AMMs), which use algorithms to set prices based on the supply of tokens in a liquidity pool. This is different from traditional financial markets, where prices are set by matching buy and sell orders through a central limit order book managed by market makers. The most common formula used by AMMs is the constant product formula: x * y = k, where x and y are the quantities of two different tokens in the pool, and k is a constant.ll

When a user trades tokens, they change the balance of tokens in the pool. For example, buying Token A increases its price because the amount of Token A in the pool decreases, while selling Token A decreases its price. This formula ensures that token prices adjust automatically based on the current supply and demand, allowing for continuous price discovery without needing a centralized intermediary.

Don’t worry if the concept seems technical at first—we’ll explore it in more detail when we discuss the importance of liquidity in decentralized markets and delve into the secondary factors that can influence token prices. For now, it’s not necessary to have a deep understanding of Automated Market Makers (AMMs). Just keep in mind that token prices in these markets are determined algorithmically based on the token balances within a liquidity pool.

What are the Elements Influencing Token Price?

With a foundational understanding of how token prices are determined, let’s explore the key factors that drive changes in token prices:

-

Market Liquidity

Market liquidity is one of the most important factors influencing token price changes. Liquidity refers to how easily an asset can be bought or sold in the market without impacting its price. Higher liquidity means there are plenty of buyers and sellers in the market which means you are more likely to get a trade at the market price. Conversely, if there is low liquidity in the market the trade execution price may significantly differ from the market price.

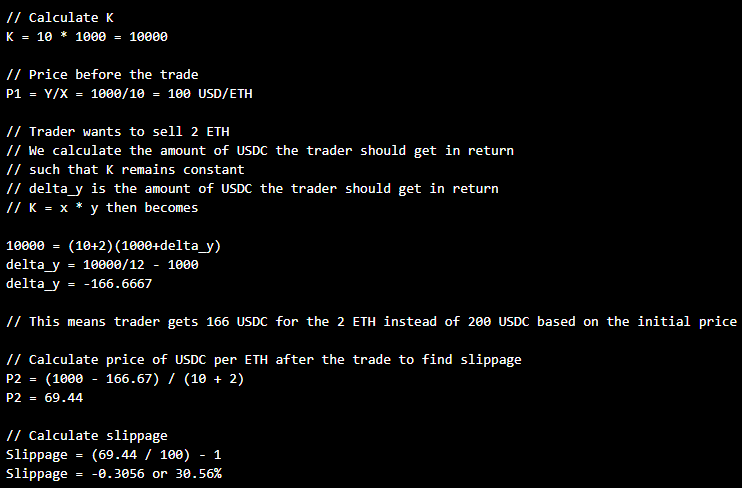

For instance, consider an ETH/USDC liquidity pool with 10 ETH and 1,000 USDC, which sets the price at 100 USDC per ETH. If a trader sells 2 ETH into this pool, they might expect to receive around 200 USDC (2 ETH x 100 USDC). However, due to the low liquidity relative to the size of the trade and how automated market makers (AMMs) operate, the execution price will be significantly lower. Instead of receiving 200 USDC, the trader will receive approximately 166 USDC, as the price drops to 69 USDC per ETH because of the pool’s liquidity constraints. This is what is known as slippage.

Liquidity is a fundamental challenge in crypto markets and a key driver of token price volatility. With lower liquidity, even a small amount of capital can cause large price swings, as demonstrated in the previous example. As a result, assessing market liquidity is crucial when it comes to evaluating the token price movements.

-

Market Supply and Demand

At the most basic level, the price of any asset, including tokens, is governed by the principles of supply and demand. These are the most critical factors influencing a token’s value.

Demand reflects the willingness of buyers to purchase a token. Various indicators can serve as proxies for token demand depending on its use case. For example, transaction volume is a proxy for the demand for Ethereum (ETH) since people use ETH to pay for gas fees in transactions. When demand for a token increases, with all other factors remaining constant, its price tends to rise.

Supply represents the total amount of tokens available in the market and how this quantity changes over time (i.e., issuance rate, burning mechanisms). If the supply of a token increases while demand remains constant, the price is likely to decrease. Conversely, if the supply decreases or remains limited and demand is high, the price tends to increase.

Fixed supply vs inflationary supply curves

For a deeper understanding of how supply and demand impact token price fluctuations, explore our guide on analyzing supply and demand in tokenomics.

-

Growing Crypto Adoption & Use Cases

The growing adoption of cryptocurrencies and the expansion of their use cases act as strong catalysts for rising token prices. As Web3 projects continue to solve real-world problems, the demand for these projects—and their respective tokens—naturally increases. For example, if Bitcoin were to be widely adopted as a global payment method, demand for the asset would increase, driving its price upward. Similarly, tokens that power decentralized applications (dApps), enable financial transactions, or provide access to decentralized networks will see increased demand as these technologies become more integrated into mainstream use. The more practical and widespread the use cases, the stronger the demand, ultimately boosting token values.

-

Market Sentiment

Market sentiment plays a pivotal role in influencing token price changes. It reflects the reaction of investors to various factors such as news, project milestone achievements, regulatory updates, all of which can significantly impact price volatility and trading behaviors.

Positive sentiment can drive token prices upward as it often leads to increased buying pressure. Factors like favorable media coverage, endorsements from key influencers, or bullish market conditions can create a sense of optimism, prompting investors to purchase tokens in anticipation of future price gains. This increased demand pushes prices higher, even in cases where token fundamentals or utility-based demand remain unchanged.

Conversely, negative sentiment can lead to rapid declines in token prices. Regulatory crackdowns, adverse news, security exploits or overall market downturns can trigger fear and uncertainty among investors. As a result, many may rush to sell their tokens to minimize potential losses, causing a surge in supply and a corresponding drop in price. Even tokens with strong utility and well-designed tokenomics can experience significant price drops if negative sentiment prevails.

-

External Economic Factors

Macroeconomic conditions in traditional markets—such as interest rates, inflation, and geopolitical events—can significantly influence cryptocurrency prices. For instance, during periods of traditional market instability, such as when interest rates decrease, investors may shift capital into cryptocurrencies, driving token prices higher. Conversely, when interest rates rise, capital often flows back into traditional financial channels, reducing demand for digital assets. Similarly, during negative economic conditions or financial crises, investors tend to sell off riskier assets like cryptocurrencies in favor of more liquid holdings such as cash or T-bills.

The influence of traditional economic factors on cryptocurrency prices is largely due to the nascent state of the crypto market and the limited real-world adoption of blockchain technology. Much of the investment in the space is driven by speculation, with short-term investors looking to capitalize on price volatility rather than long-term utility. While the approval of Bitcoin and Ethereum exchange-traded funds (ETFs) has introduced new capital into the ecosystem, these vehicles primarily serve as speculative investment tools rather than guarantees of widespread adoption.

In addition, the yield market, whether in traditional finance or DeFi, is highly competitive, with investors quickly switching between platforms for better returns. To retain capital long-term, widespread adoption must be paired with real-world use cases. This ensures that capital remains “sticky” in decentralized markets, as users will be driven by practical value rather than just speculative gains.

-

Protocol Upgrades & Partnerships

The development of new features, technology upgrades (e.g., protocol improvements), or strategic partnerships can significantly influence token prices. For instance, upgrades that improve scalability or security often generate positive sentiment and drive demand. Recently Jupiter’s proposal to burn 30% of the total supply was taken positively by the market with the token price pumping by 28%.

Conclusion

To sum it all up, in the current space, market liquidity, and sentiment are two key drivers of token price changes, often overshadowing a project’s real-world value. Take Chainlink’s LINK token, for example—despite its critical role in powering decentralized applications, its price may not always reflect this utility. This could be due to the impact of speculative demand, market sentiment, and liquidity, which often outweigh the project’s actual contributions.

However, as crypto adoption grows and projects solve real-world problems, the value of tokens will increasingly mirror their true utility. Navigating this fast-paced market requires not just understanding the numbers but staying tuned to the waves of innovation, technology upgrades, and investor sentiment.

If you’re interested in understanding how market sentiment, liquidity, and tokenomics influence your project’s token price, reach out to us at BlockApex for a comprehensive tokenomics audit. Our experts can help you optimize your token’s performance in the market.