“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

As the countdown to the quadrennial Bitcoin halving event begins, the sense of anticipation is immense among cryptocurrency enthusiasts and the Web3 community, especially with Bitcoin’s valuation already surpassing its previous all-time high by a notable 6.5%. This event is more than just a landmark occasion for the Bitcoin network; it carries significant implications for the broader Web3 industry as well. In light of the growing excitement, it becomes imperative to delve deeply into the nuances of this event, understanding its core essence, its critical importance, and the wide-ranging effects it may have on the Bitcoin network—including aspects like miner and token economics, network security, and the overarching Web3 ecosystem.

Let’s build some context to the Bitcoin network before diving into the halving process.

Context

Bitcoin operates on a blockchain, a decentralized network of nodes maintaining a complete history of transactions. Nodes validate transactions based on strict criteria, ensuring their legitimacy before adding them to the blockchain. The network’s security and stability improve as more nodes join.

Bitcoin mining draws a parallel to the extraction of precious metals such as gold, emphasizing the significant effort involved. It involves using computational power to process and validate transactions on the blockchain, rewarded with Bitcoin and transaction fees. This process uses a consensus mechanism called proof-of-work (PoW), where miners solve cryptographic puzzles to verify transactions and add new blocks to the blockchain, ensuring transaction integrity and network security. The mining process not only confirms transactions but also generates new Bitcoin, acting as an incentive for miners to secure the network.

With a brief overview of the network, we can now go on to explain the actual halving process.

Bitcoin Halving Explained

Bitcoin halving is a critical event that halves the reward received by miners for processing transactions and adding them to the blockchain. This event occurs approximately every 210,000 blocks, which roughly translates to every four years, based on the average time of 10 minutes taken to mine a single block. This process is an integral part of Bitcoin’s design to control inflation and ensure a steady, predictable release of new Bitcoins into circulation, contrasting with the more variable issuance rates of fiat currencies.

It’s crucial to clarify that Bitcoin halving does not reduce the existing supply of Bitcoin in circulation but rather decreases the rate at which new Bitcoins are introduced. With the total supply of Bitcoin capped at 21 million, halving events are a deliberate mechanism to diminish the flow of new coins, thereby inducing scarcity.

Economic Significance of Bitcoin Halving

Bitcoin halving plays a pivotal role in the network’s economic model by methodically reducing the rate at which new coins are introduced. This mechanism is akin to the practice of diamond or gold mining, where the discovery and extraction of the metals become progressively more challenging and less frequent. Just as the scarcity of these metals increases their value and desirability, each Bitcoin halving event heightens Bitcoin’s scarcity, potentially boosting its value. This process not only mirrors the gradual depletion of a finite resource but also instills a predictable economic structure that contrasts sharply with the often unpredictable nature of fiat currency inflation, where governments can increase money supply at will. The halving ensures that Bitcoin remains a disinflationary asset, akin to a precious resource whose availability diminishes over time, thereby fostering long-term value preservation within the digital realm.

-

Scarcity

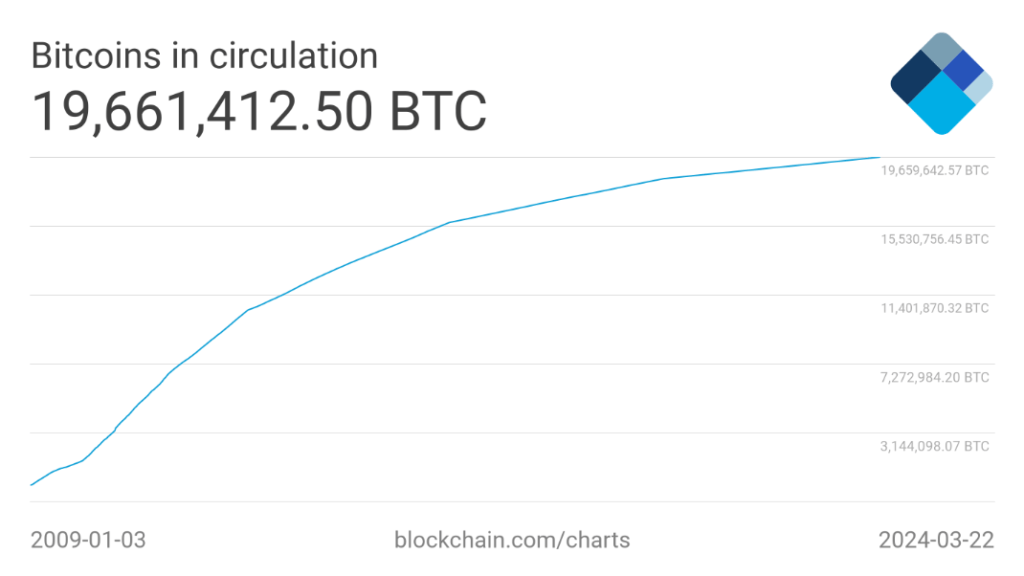

As of the current state, miners are rewarded 6.25 BTC for each block they mine. However, at the 840,000th block, this reward will decrease to 3.125 BTC, marking the next halving event. This adjustment in mining rewards is a fundamental aspect of Bitcoin’s economic model, designed to gradually reduce the supply of new coins entering the system until the maximum supply is reached. Below is a depiction of the circulating supply of Bitcoin since its creation.

https://www.blockchain.com/explorer/charts/total-bitcoins

It can be seen that the circulating supply represents a logarithmic curve that asymptotically approaches the maximum supply limit of 21 million coins. This shape is due to the halving events that occur approximately every four years, reducing the rate at which new Bitcoins are created and added to the circulating supply.

-

Inflation protection

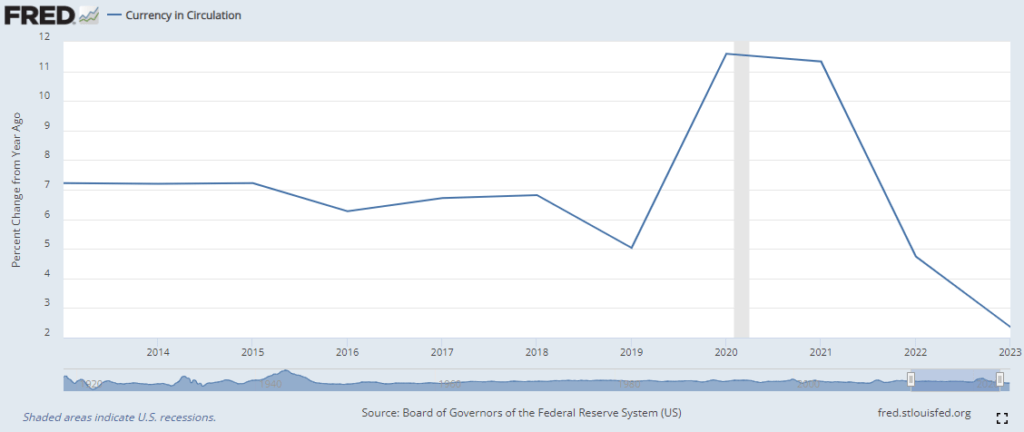

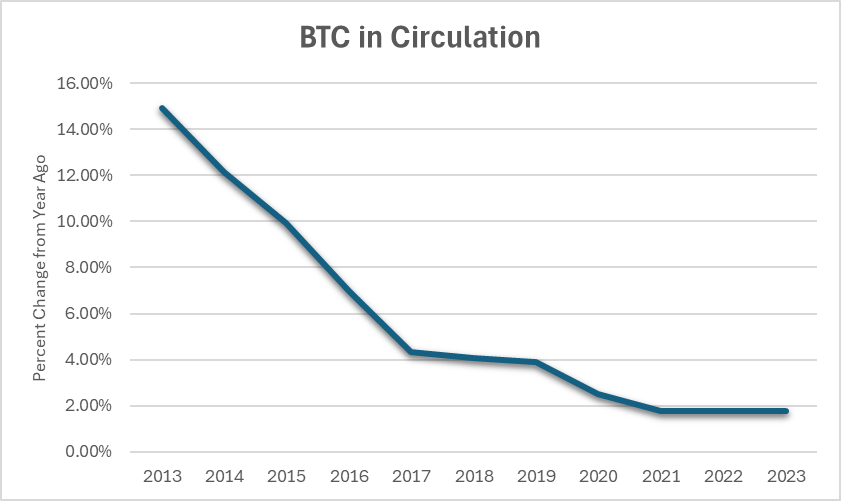

The fundamental concept behind the creation of Bitcoin was to establish a safeguard against inflation, particularly in response to central banks’ tendencies to excessively print US dollars, thereby expanding the money supply. The following figures illustrate the percentage change in the circulating supply of US dollars compared to the percentage change in circulating supply of Bitcoin respectively.

https://fred.stlouisfed.org/series/CURRCIR#0

Data taken from https://coinmarketcap.com/currencies/bitcoin/

It can be observed that the YoY inflation of the US Dollar over a decade is not consistent with an increase in circulating supply ranging from 2-12%. In contrast, the percent change of Bitcoin’s circulating supply is decreasing YoY and is currently around 1.75%. This comparison underscores Bitcoin’s design as a digital asset with a limited supply, contrasting with the potentially limitless nature of fiat currency production, which can lead to inflation and the erosion of purchasing power over time.

Implications of Bitcoin Halving

With a comprehensive grasp of the mechanics and significance of the Bitcoin halving event, it’s imperative to delve into its implications for key stakeholders, particularly Bitcoin holders. These stakeholders can generally be divided into two main categories: miners and BTC investors.

Miners play a vital role in ensuring the availability and security of the Bitcoin network, receiving BTC rewards in return for their efforts. For miners, the economic dynamics of both supply and price are crucial factors to consider when analyzing the impact of the Bitcoin halving. Conversely, BTC investors primarily view Bitcoin as a scarce asset and a hedge against inflation. For them, changes in price are typically the most significant metric.

While these economic factors are interconnected, we will examine each independently to elucidate the ramifications of the Bitcoin halving on both miner profitability and investor returns. This approach allows for a thorough understanding of how the halving event influences different aspects of the Bitcoin ecosystem, shaping the incentives and outcomes for miners and investors alike.

Impact on Miners

At a fundamental level, the reduction in block rewards following a Bitcoin halving event diminishes the incentive for miners to include new transactions in the blockchain. However, it concurrently enhances Bitcoin’s scarcity, potentially driving up its long-term value. To maintain profitability, miners rely on an increase in Bitcoin’s price exceeding the rate of reward reduction. In simpler terms, the price must double to sustain miners’ profitability at pre-halving levels. If the price doesn’t increase to desired levels, miners will find it difficult to stay competitive and be profitable due to the high costs of electricity and hardware.

This leads us to an important consideration: What are the implications if a substantial number of miners cease their operations? To address this question, it is essential to understand the concept of hash rate and network difficulty within the context of Bitcoin mining. The hash rate refers to the computational power contributed by miners to solve the cryptographic puzzle, known as the hash code, enabling them to append a new block to the blockchain. This rate is quantified by the number of guesses made per second. Essentially, a higher hash rate signifies increased computational activity within the blockchain network. Moreover, it translates to heightened network security, as a higher hash rate diminishes the likelihood of successful attacks on the network.

The Bitcoin network also employs the hash rate to compute mining difficulty, a pivotal parameter that undergoes automatic adjustment approximately every 2,016 blocks. This adjustment, either upwards or downwards, is contingent upon the collective hashpower contributed by participants within the mining network.

Now back to the discussion.

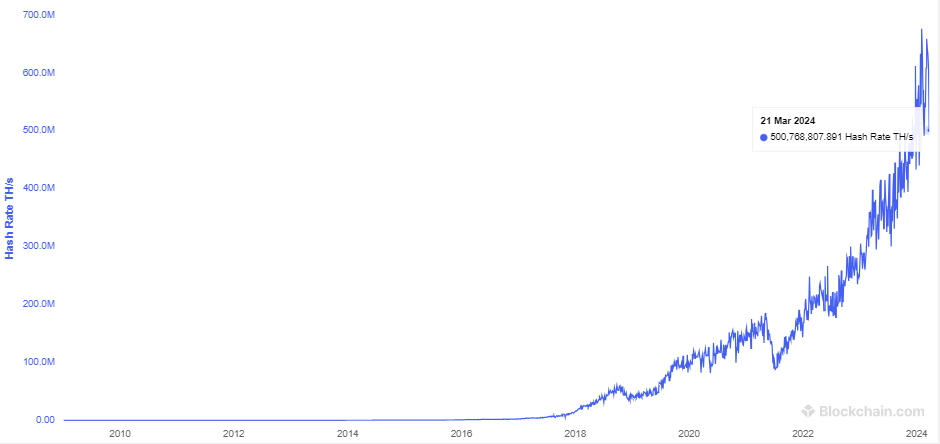

While the discontinuation of mining operations by a significant number of miners could theoretically pose an elevated security risk to the network, historical data presents a different picture. Despite the potential concerns, empirical evidence indicates that Bitcoin’s hash rate has continued to increase over time, irrespective of halving events.

https://www.blockchain.com/explorer/charts/hash-rate

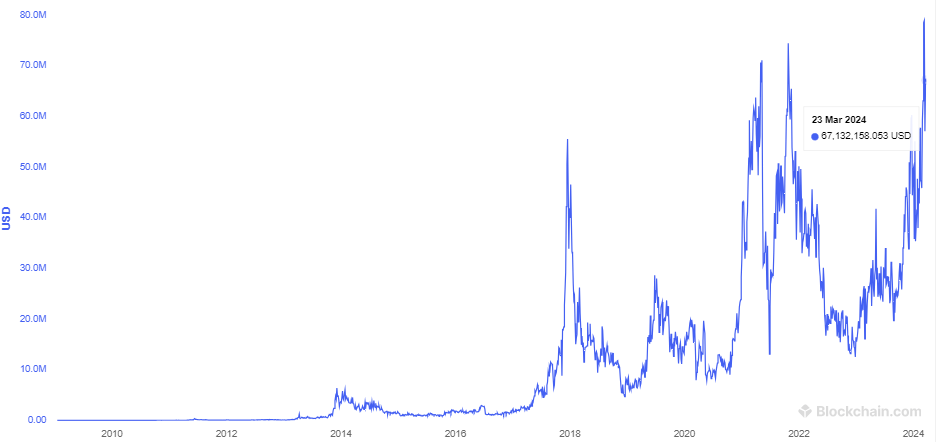

Likewise, mining revenue, encompassing both transaction fees and block rewards, has exhibited a consistent upward trend. While halving events have led to temporary reductions in miner revenue, evidenced by the troughs observed in 2016 and 2020, subsequent periods have seen larger peaks. This pattern suggests that, historically, fluctuations in Bitcoin’s price have compensated miners for the reduction in block rewards in due course.

https://www.blockchain.com/explorer/charts/miners-revenue

However there is no denying the fact that as the value of Bitcoin continues to ascend, the halving event prompts a need for heightened efficiency, intensified competition, and strategic resource allocation within the mining sector. Analysts foresee that prominent mining pools boasting low production costs and minimal debt are poised to emerge as the primary beneficiaries of capacity expansion. Such entities are expected to possess the resilience necessary to navigate potential Bitcoin price volatility and mitigate the impact of cost escalations stemming from the forthcoming Bitcoin halving in 2024.

https://www.blockchain.com/explorer/charts/miners-revenue

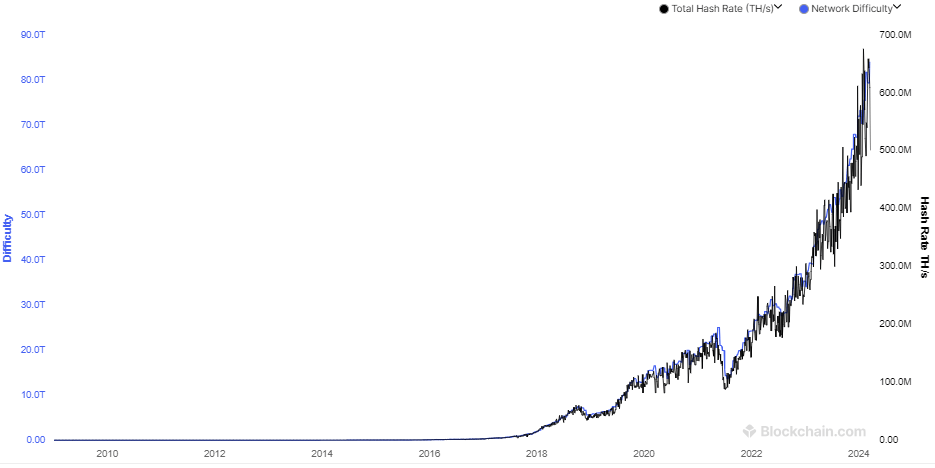

The graph illustrating the Bitcoin network’s complexity reveals a significant rise in competition over time. This increased competition makes it challenging for new entrants to participate in mining activities. It indicates a shift towards a more professionalized mining landscape, requiring newcomers to navigate higher entry barriers and adopt strategic approaches to succeed.

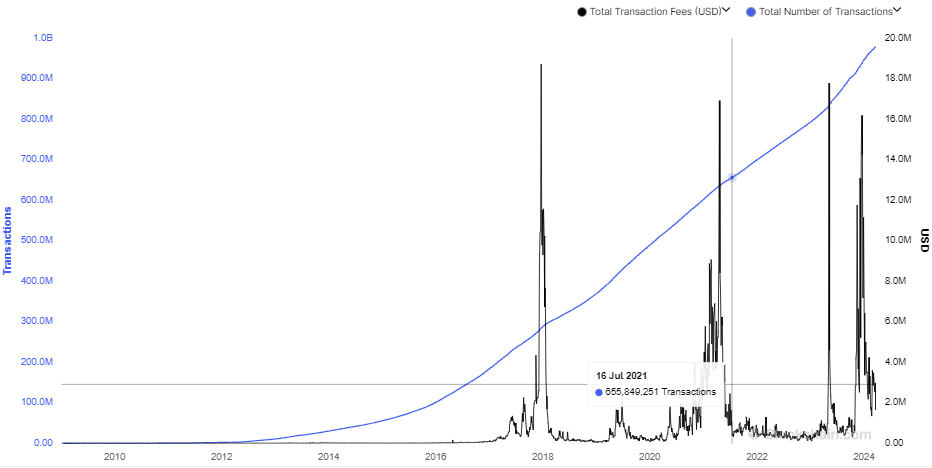

Impact on network congestion and transaction fees

The reduction in mining rewards prompts miners to engage in more aggressive competition to validate transactions, as transaction fees become a more significant source of revenue. However, this heightened competition can result in network congestion. Miners prioritize transactions with higher fees to offset the reduced subsidy from BTC rewards. This, along with increased activity during halving events, leads to a surge in the number of transactions. Consequently, the market-driven response to rising transaction fees during periods of high demand may prompt users to explore alternative blockchains offering advantages such as lower fees, faster transactions, or improved cross-chain compatibility.

https://www.blockchain.com/explorer/charts/market-price

Impact on Price

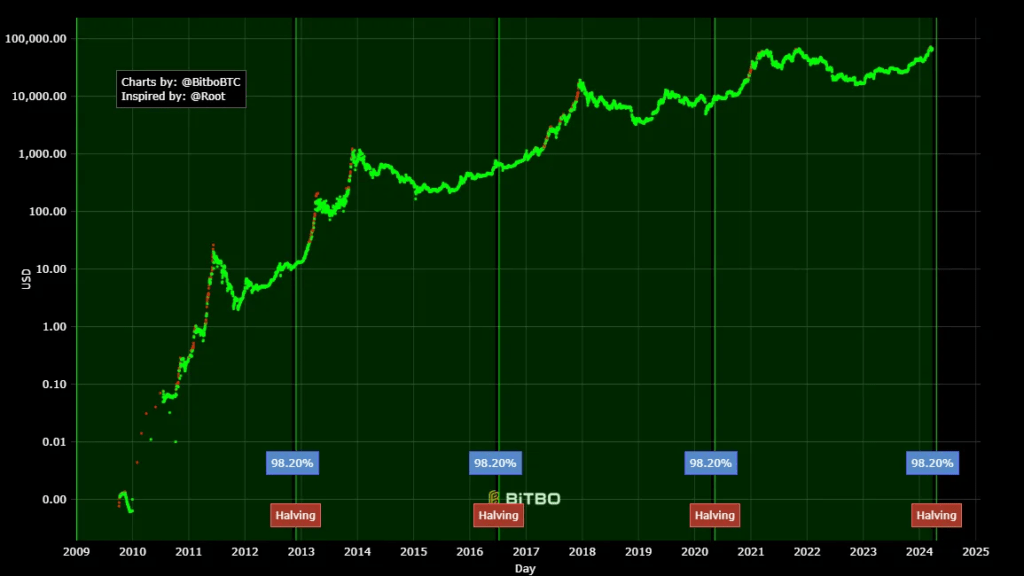

Amidst the intricate interplay of macroeconomic forces and market sentiment, Bitcoin’s price dynamics have often been marked by notable volatility, especially surrounding its halving events. Historically, these halvings have heralded significant bull runs in Bitcoin’s value. The general trend can be seen from the following graph.

https://charts.bitbo.io/halving-progress/

The percentage represents the time elapsed since the previous halving event (98.2% of the 210,000 blocks have been mined), with the green line marking the occurrence of actual halving events. The small gap preceding the green lines illustrates the price movement of Bitcoin during the remaining 1.8% of blocks, using the current halving remaining time as a reference point.

Following the first two halvings, Bitcoin witnessed exponential growth. Notably, after the inaugural halving in November 2012, Bitcoin’s value surged from $12 to around $1,150 by December 2013.

Similarly, the 2016 halving foreshadowed Bitcoin’s meteoric rise in 2017, culminating in a near $20,000 valuation. The most recent halving in May 2020 saw Bitcoin reaching new all-time highs above $64,000 within just nine months, before experiencing a subsequent correction.

As the 2024 halving event looms on the horizon, Bitcoin has surged past its previous all-time highs, surpassing $73,000 and demonstrating remarkable resilience. With the anticipation surrounding the upcoming halving event and the inflow of investments through ETFs, Bitcoin’s trajectory seems poised to ascend even further.

In the lead-up to halving events, speculation in Bitcoin markets intensifies significantly. Traders anticipate the impending supply shock and its potential positive impact on prices, driving up demand and prices in the process. This pre-halving frenzy often creates unsustainable rallies, followed by corrections before the halving takes place.

The period following the halving event is crucial as it determines whether the anticipated appreciation materializes. This hinges on whether adoption accelerates post-halving, absorbing the reduced selling pressure from miners. Should adoption falter, the euphoric rallies preceding the halving could collapse. Conversely, sustained or growing demand combined with reduced supply can lead to disinflationary pressure and appreciating valuations, representing the optimal scenario according to economists.

Conclusion

In conclusion, the Bitcoin halving event represents a critical juncture in the cryptocurrency landscape, influencing economic dynamics and market sentiment. With its meticulous control over inflation and fostering of scarcity, the halving underscores Bitcoin’s unique value proposition. As stakeholders navigate the challenges and opportunities presented by reduced mining rewards and heightened price volatility, it’s essential to approach the halving with a nuanced understanding of its implications. Ultimately, the halving symbolizes Bitcoin’s resilience and enduring appeal, driving forward the principles of decentralization and financial sovereignty.