Impact of Recent Bitcoin ETF Approvals on Crypto Markets and Traditional Finance

Marking a monumental milestone in its journey from an innovative peer-to-peer cash system to a global financial powerhouse, Bitcoin’s debut of exchange-traded funds (ETFs) since January 2024 heralds a new era in the entire financial landscape. This achievement underscores Bitcoin’s ascent to the 8th largest asset by market capitalization, measured in units equivalent to 1KG of Gold, and surpassing Silver in the financial hierarchy. This remarkable evolution reflects not only Bitcoin’s growing acceptance among mainstream investors but also highlights the need for a thorough examination of its wide-ranging implications. This article looks into the mechanics of Bitcoin ETFs, exploring their impact on Web3, price and volume dynamics, liquidity, and potential risks.

A Bitcoin ETF acts as a basket of Bitcoin shares that can be traded, mirroring the underlying asset’s price movements. Unlike futures-based ETFs approved earlier, these “spot” ETFs hold actual Bitcoin, offering investors convenient access without directly navigating cryptocurrency exchanges.

A Historical Journey: From Rejection to Recognition:

The road to Bitcoin ETFs was long and arduous. Several proposals faced rejection from the Securities and Exchange Commission (SEC) due to concerns about market manipulation and investor protection. However, a 2023 lawsuit by Grayscale, coupled with evolving regulatory landscapes and growing institutional interest, finally tipped the scales in favor of approval. This historical context underlines the significance of the SEC’s decision, not just for Bitcoin but for the entire crypto industry’s quest for mainstream recognition.

Price and Volume Rollercoaster:

The immediate impact of Bitcoin ETFs on price and volume was significant. The launch week saw record inflows and surging Bitcoin prices, reflecting newfound market confidence and accessibility. However, volatility remains a hallmark of the crypto market, and price fluctuations are to be expected. In the long term, ETFs could contribute to greater price stability by increasing institutional participation such as by BlackRock, Fidelity, and Valkyrie Funds, introducing a layer of professional management.

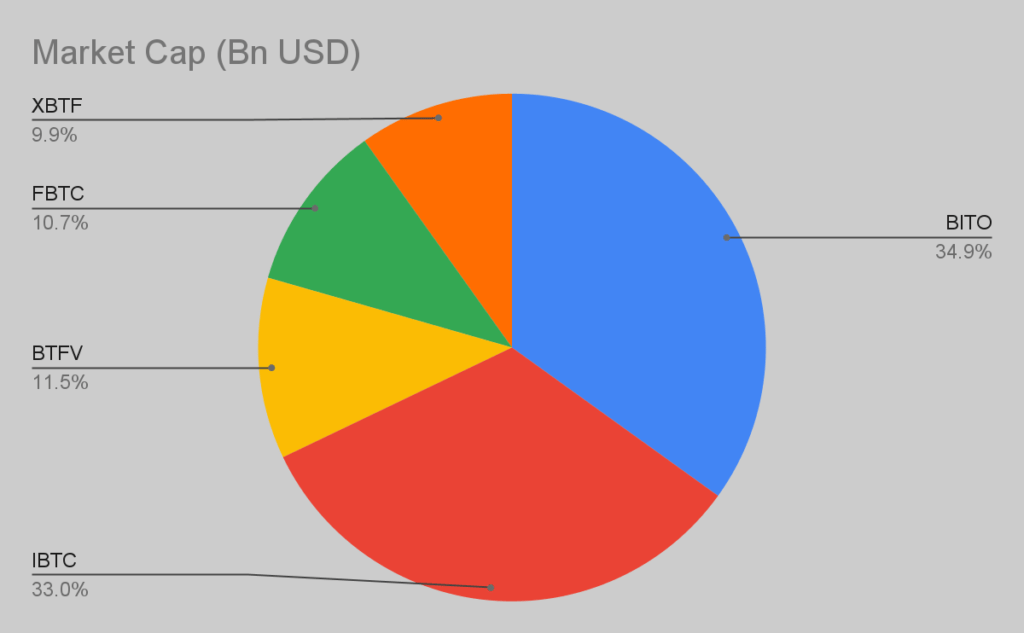

Figure 1: Top 5 Bitcoin ETFs by market capitalization:

As of 13 February 2024, the top five Bitcoin ETFs are as follows:

- ProShares Bitcoin Strategy ETF (BITO): $12.4 billion

- iShares Bitcoin Trust (IBTC): $11.7 billion

- Valkyrie Bitcoin Strategy ETF (BTFV): $4.1 billion

- Fidelity Wise Origin Bitcoin Fund (FBTC): $3.8 billion

- VanEck Bitcoin Strategy ETF (XBTF): $3.5 billion

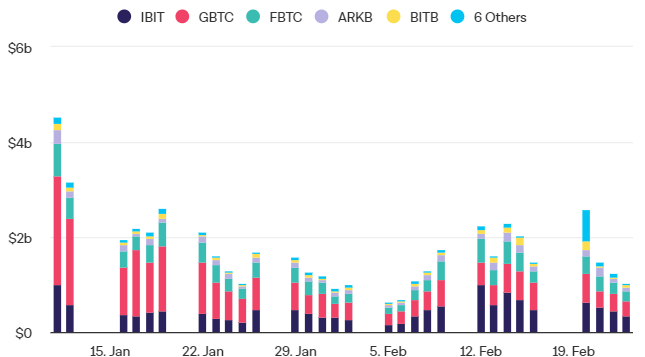

Figure 2. Bitcoin ETF Trading Volumes

Market Reaction:

While the long-term impact of Bitcoin ETFs on price trends is yet to be fully understood, here’s what we can observe based on the recent approval in January 2024:

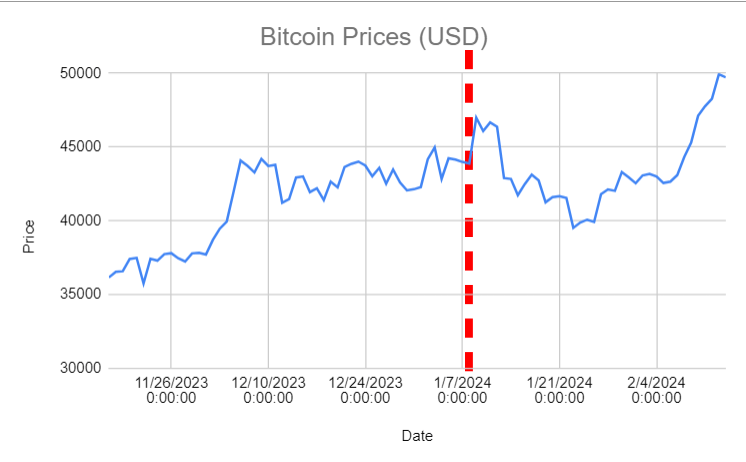

Figure 3. Bitcoin price for the last 90 days. Red line indicates SEC approval of Bitcoin ETFs

Upward Trend: In the months leading up to the approval, Bitcoin experienced a significant upward trend, rising nearly 60% from early October 2023. This was largely attributed to anticipation of ETF approval and increased institutional interest.

Volatility: The price remained volatile, with occasional corrections and pullbacks, reflecting general market sentiment and broader macroeconomic factors.

Initial Surge: Immediately following the approval, the price initially jumped, briefly touching $48,000, likely due to short-term buying fueled by excitement and speculation.

Correction and Stabilization: However, the price quickly corrected and settled around $45,000, suggesting that some investors had “bought the news” and realized profits. Prices have since fluctuated but remain within a similar range.

The Risk Attitude:

The regulatory framework surrounding Bitcoin ETFs has instilled greater confidence in traditional market participants, reducing their perceived risk and collateral requirements associated with shorting Bitcoin. Bitcoin ETFs offer traditional investors a new asset class for diversification, potentially improving portfolio risk-adjusted returns and providing new hedging opportunities. To meet institutional demand, issuers of Bitcoin ETFs will likely acquire substantial Bitcoin positions, potentially impacting supply and demand dynamics significantly.

ETFs provide a familiar and regulated avenue for institutions to enter the crypto market, potentially leading to a substantial influx of capital. The arrival of spot Bitcoin ETFs eliminates the counterparty risk inherent in borrowing Bitcoin from unregulated lenders, the potential legal and operational risks associated with offshore exchanges, and the access barriers of commodities futures accounts, driving up Bitcoin prices as well as boosting the overall crypto ecosystem.

However, it’s worth considering that Bitcoin ETFs, despite claims of bringing stability, could actually intensify market volatility with the influx of institutional capital., especially during periods of high risk aversion. Potential spillover effects between crypto and traditional markets could pose systemic risks. Moreover, there is a potential for price discrepancy among the Bitcoin and Bitcoin ETFs. This discrepancy manifests as a premium or discount between the ETF price and the actual Bitcoin price. It arises because the ETF price reflects supply and demand within the ETF market, which might not perfectly align with the global Bitcoin market, especially during off-hours when Bitcoin ETF markets are closed.

While the arrival of Bitcoin exchange-traded funds (ETFs) has undoubtedly brought fresh capital and new participants to the Bitcoin options market, concerns linger about the potential for institutional dominance and market manipulation. However, Transparency requirements, market monitoring, diverse market participants, and various influencing factors still play a crucial role. Understanding these complexities and employing sound risk management strategies are essential for navigating the ever-evolving world of options trading.

In recent times, the fabricated announcement asserting the SEC’s approval of Bitcoin spot ETFs by hackers led to severe repercussions including an immediate surge in Bitcoin price, which briefly experienced a 4% increase as the market reacted positively to the perceived ETF approval. However, this triggered confusion among investors and analysts, fostering temporary uncertainty within the market. Swiftly, the SEC intervened to provide clarification, debunking the false announcement. Consequently, the price of Bitcoin corrected and stabilized around its previous levels, signifying the resolution of the incident and mitigating its long-term impact. This episode indicates the fragility of the cryptocurrency market as a whole and the extent of its fragility and susceptibility to manipulation.

The institutionalization of Bitcoin ETFs poses an imminent question given the philosophy of decentralization of finance and financial inclusion: Are we open to giving up the financial freedom and at what cost?

Extracting Insights: A Glimpse into the Future:

Bitcoin ETFs represent a pivotal turning point for Web3, the crypto industry as well as economic agents. Bitcoin can reach unbanked and underbanked populations, promoting financial inclusion and offering access to financial services that might not be readily available through traditional channels. As the dust settles and the market adjusts, one thing is clear: Bitcoin ETFs have opened a new chapter in the ongoing saga of digital transformation.

Retrospectively examining the launch of the SPDR Gold Shares ETF (GLD), the first U.S. spot gold ETF in 2004, offers valuable insights for Bitcoin ETFs. GLD garnered an impressive $1.9 billion (inflation-adjusted) within its first four weeks, skyrocketing to $4.8 billion by year-end. Similar trends are anticipated for Bitcoin ETFs.

As the cryptocurrency industry continues to intertwine with traditional financial mechanisms, the evolution towards more regulated and controlled traded funds, like Bitcoin ETFs, underscores a significant shift. This transition not only augments accessibility and regulatory oversight but also illuminates the path for responsible innovation and investment in the digital currency space.

At BlockApex, we recognize the significance of these developments and are committed to leading the charge in blockchain innovation and security. Our expertise in crafting secure, efficient blockchain solutions positions us as a key player in navigating the evolving landscape of digital finance.

Explore further Insights :

Cryptocurrency: Cutting-edge or Criminal?

The Collapse Of Blockchain Security

Achieving Security In Blockchain Part One: Outlining The Problem